Why AI M&A Multiples Look Low and Why That’s Rational for Startup Valuation

By Lior Ronen | Founder, Finro Financial Consulting

AI acquisition multiples often look disappointing when viewed next to private round headlines.

Founders see late-stage valuations quoted at 30x, 50x, or higher, then look at acquisition outcomes clearing at materially lower levels and assume something went wrong. In most cases, nothing did. The numbers are performing exactly as intended.

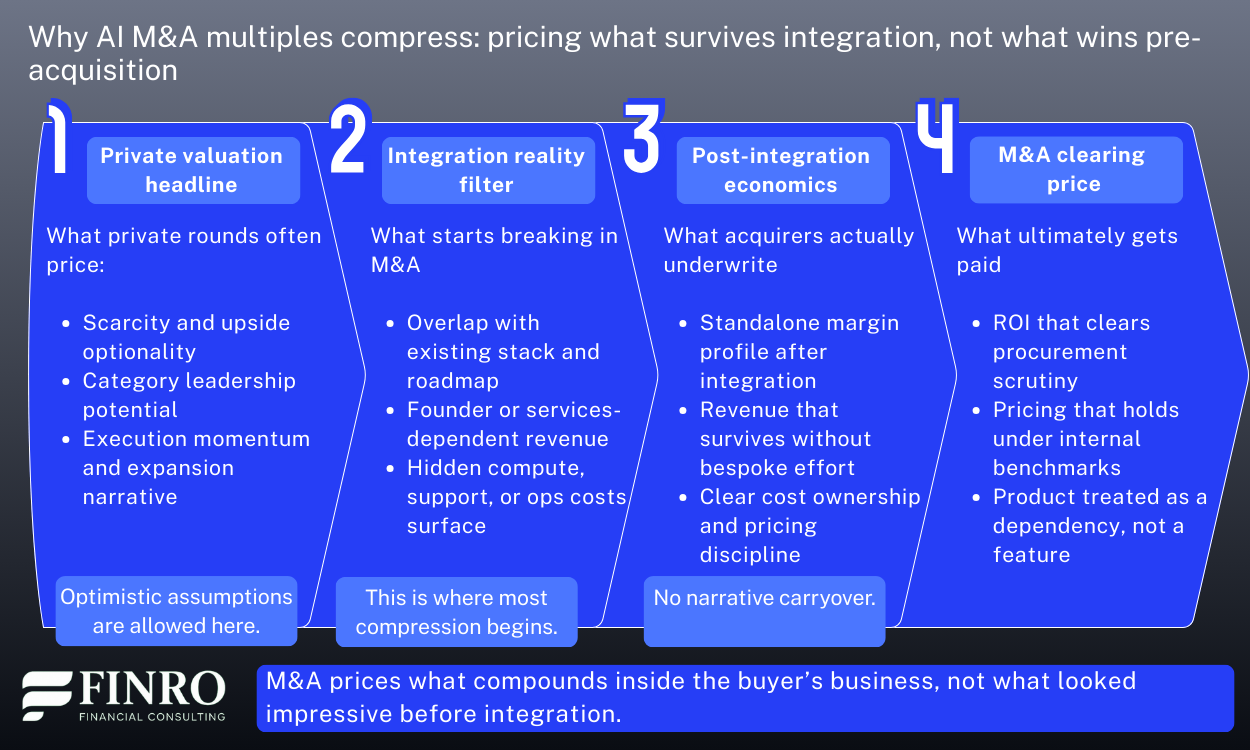

M&A is not pricing vision or optionality. It prices what a buyer can integrate, operate, and earn a return on.

That distinction matters more in AI than in most markets. AI businesses often show strong top-line growth while still relying on compute subsidies, fragile pricing, or heavy implementation effort. Private markets can bridge that gap by betting on future scale, category leadership, or strategic control. Strategic buyers cannot.

When an acquirer evaluates an AI company, the question is not “How big could this be?” It is “What does this do to our P&L, margin profile, and operating complexity once it is inside our organization?”

That shift in lens is why AI M&A multiples tend to clear at a lower multiple than private markets, and why that outcome is rational rather than punitive.

This article explains how M&A pricing actually works in AI, what buyers are underwriting that founders often overlook, and why acquisition multiples are often the most honest signal in the valuation stack when you are thinking about startup valuation, AI valuation, and AI multiples.

AI M&A multiples look low because they price operational reality, not upside. Acquirers value what can be integrated quickly, run at normalized margins, and improve P&L once compute costs, services load, and support are fully absorbed. Core AI assets clear higher outcomes when they are embedded dependencies with improving cost curves, while applied AI holds up only when revenue is contracted, renewal-driven, and operationally repeatable. Private rounds can price future dominance and optionality, but M&A collapses that future into today’s economics. The result is not skepticism toward AI, but disciplined pricing of what survives integration, scale, and accountability.

Why AI M&A multiples feel low compared to private rounds?

M&A is where valuation narratives meet operational reality. Buyers underwrite integration risk, margin durability, and time-to-value, not upside optionality. That is why acquisition multiples consistently sit below late-stage private marks, even for strong AI assets.

You can see this clearly in Core AI.

LLM Vendors remain among the highest-priced assets in the stack, but even here, M&A clears meaningfully below private rounds. In Q1 2026, LLM Vendor M&A averages sit around the mid-50x EV/Revenue range, versus ~80x in private rounds, reflecting confidence in strategic importance but discipline around integration and cost structure.

Infrastructure shows a similar pattern, with tighter compression. AI infrastructure and tooling assets clear M&A at roughly mid-20x EV/Revenue, compared to low-30x private marks. The premium holds when the product is already embedded in enterprise workflows or developer stacks, but drops quickly when buyers expect bundling or pricing pressure post-acquisition.

Where differentiation is weaker, compression is sharper.

Computer Vision is a good example. Despite strong technical capabilities, the segment clears M&A at roughly ~12x EV/Revenue overall, with public comps closer to ~10x. Buyers treat these assets as features that improve existing platforms, not standalone growth engines.

Applied AI shows the same logic from a different angle.

Enterprise workflow leaders in Legal, HR, and writing still clear healthy acquisition pricing when revenue is contracted and renewal-driven. But most Applied AI M&A sits firmly below private peaks, often in the low- to mid-teens EV/Revenue, because acquirers price execution risk, services drag, and post-deal margin normalization explicitly.

The pattern is consistent across the dataset:

Private markets price what a company could become.

M&A prices what a buyer can integrate, scale, and earn from.

That is why acquisition outcomes often look “low” relative to headline private multiples, even when the deal makes strategic sense. It is not a discount on AI. It is the cost of certainty.

What buyers actually price in AI acquisitions?

Once valuation moves from private rounds to M&A, the question changes. Buyers are not pricing upside. They are pricing what the business looks like once it is fully integrated and accountable.

Integration effort is the first filter. AI assets that plug cleanly into existing platforms or workflows clear better outcomes. This is why Core AI infrastructure and developer tooling tend to outperform highly customized agent or workflow products in M&A.

Margins are the next reset. Many AI companies show strong gross margins under preferential compute or early optimization. Acquirers reprice assuming normalized cloud costs and internal support overhead. You see this clearly in LLM Vendors. In Q1 2026, private marks average close to ~80x EV/Revenue, while M&A clears closer to the mid-50x range. The gap reflects margin realism, not loss of strategic value.

Compute volatility is priced as risk. Buyers discount businesses where margins swing with usage or inference volume. Infrastructure assets with clearer cost controls hold up better, which is why AI infrastructure clears roughly mid-20x EV/Revenue in M&A versus low-30x private marks.

Services drag compresses Applied AI faster. Enterprise workflow leaders in Legal, HR, and writing still clear healthy acquisition pricing when revenue is contracted and renews operationally. Products that require heavy implementation or bespoke tuning tend to clear in the low- to mid-teens EV/Revenue, even after much higher private rounds.

Time to synergy is the final check. Strategic value only matters if it shows up quickly. Assets that can be embedded, bundled, or sold through existing channels clear higher multiples. Computer Vision shows the opposite pattern. Despite strong technology, M&A averages land around ~12x EV/Revenue because buyers treat these assets as features, not standalone growth engines.

The pattern is consistent.

Private markets price what a company could become.

M&A prices what it will do to margins, complexity, and returns on day one.

That is why AI M&A multiples often look lower than private headlines. It is not skepticism about AI. It is the cost of certainty.

M&A revenue multiples by AI niche: where buyers still pay up and where they do not?

The previous sections explained why AI M&A multiples look lower than private rounds and what buyers are actually pricing when they acquire an AI company. The next step is to see how that logic plays out across individual AI niches.

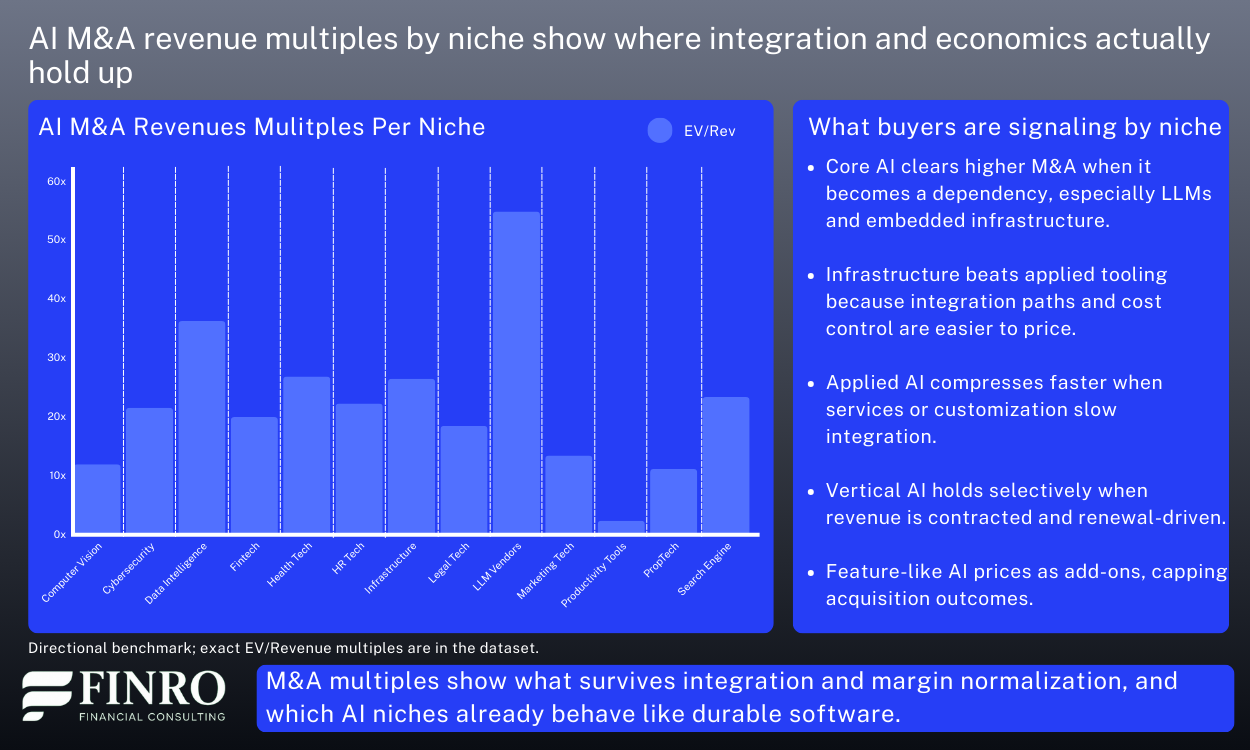

When you break M&A outcomes down by segment, the dispersion becomes easier to explain. Buyers are not applying a single “AI discount.” They are pricing each niche based on integration risk, margin durability, and how directly the asset improves an existing business.

Core AI niches still clear the highest acquisition multiples, but with discipline.

LLM Vendors sit at the top of the M&A stack in Q1 2026, with average acquisition multiples in the mid-50x EV/Revenue range. Buyers are paying for strategic control and platform leverage, but still well below private marks near ~80x because compute costs and margin normalization are fully priced in.

AI Infrastructure and developer tooling clear the next tier. M&A outcomes cluster around the mid-20x EV/Revenue range, compared with low-30x private rounds. These assets hold up when they are already embedded in developer workflows or enterprise stacks, and compress quickly when they look easy to replicate or bundle.

Computer Vision shows sharper compression. Despite strong technical capability, M&A multiples average around ~12x EV/Revenue, with public comps often closer to ~10x. Buyers treat these assets as features that enhance existing platforms, not standalone growth engines, which caps acquisition pricing.

Applied AI clears lower multiples overall, but with meaningful variation by workflow.

Enterprise-oriented Applied AI niches such as Legal Tech, HR Tech, and productivity tools tend to clear acquisition multiples in the low- to mid-teens EV/Revenue when revenue is contracted and renewal-driven. Buyers pay for operational leverage and cost savings that show up quickly post-acquisition.

In contrast, Applied AI categories with heavier implementation effort or bespoke tuning compress faster. Marketing Tech, Sales Ops, and agent-heavy automation tools often clear below private expectations because acquirers explicitly price services drag, support load, and slower time to synergy.

The takeaway is structural, not cyclical.

M&A multiples are highest where AI assets reduce complexity for the buyer and lowest where they add it. Core infrastructure clears premiums when it becomes a dependency. Applied AI clears premiums when it behaves like software, not services.

Seen this way, niche-level M&A pricing is not conservative. It is precise. It reflects where AI already functions as an integrated economic asset rather than a promising standalone product.

What This Means for Startup Valuation and AI Multiples?

The sections above show why AI M&A multiples look lower than private rounds and what buyers actually price once a company moves from narrative to integration. Taken together, the signal is clear: AI valuation is not compressing randomly. It is getting more precise.

Most confusion comes from mixing lenses. Private rounds price future optionality. Public comps price defensibility today. M&A prices what survives integration, margin normalization, and operating reality. Those are different questions, so the answers look different.

Once that separation is clear, the spread across AI multiples becomes rational. M&A outcomes effectively define the valuation floor. Private premiums sit above that floor only when scarcity, durability, and execution still feel credible.

The Core vs. Applied split sharpens this further. Core AI earns premiums when it becomes infrastructure others depend on. Applied AI holds value when revenue renews operationally and expands without services drag. When those conditions fail, compression shows up first in M&A pricing.

The takeaway is simple. There is no single “AI multiple.” Valuation depends on where a company sits in the stack, how replaceable it is, and which market lens it clears.

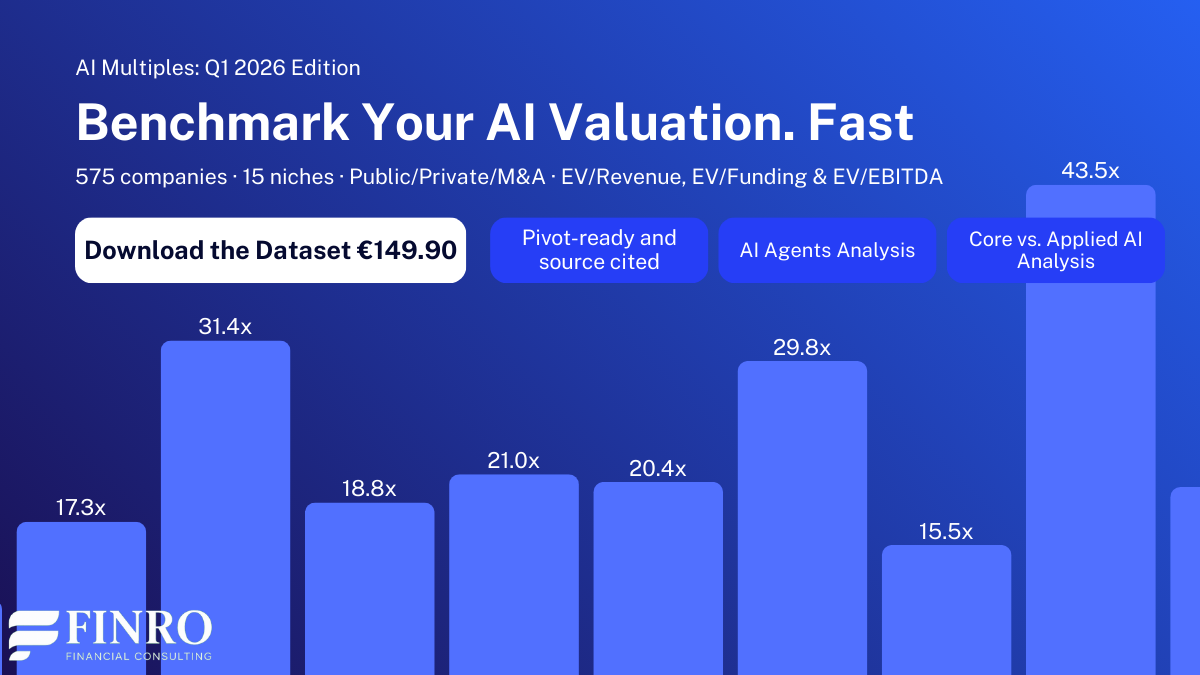

For readers who want to explore this in detail, the full dataset breaks down public, private, and M&A multiples across AI niches, Core vs. Applied layers, and agent-heavy segments to support deeper benchmarking and research.

Summary

AI valuation in Q1 2026 is not about sentiment shifts or cooling enthusiasm. It is about how precisely the market is separating risk, durability, and monetization.

Private rounds, public comps, and M&A are answering different questions. Private markets price optionality and scarcity. Public markets enforce defensibility and unit economics. M&A pricing reflects what survives integration, margin normalization, and operating reality.

That separation becomes clearest when the AI market is viewed through the Core versus Applied lens. Core AI can still command premium multiples when it becomes infrastructure others depend on and when cost curves show credible improvement. Applied AI holds value when it is embedded in workflows, tied to budgets, and renews like operations rather than experimentation.

M&A outcomes anchor the valuation stack. They define the economic floor beneath AI narratives and expose where differentiation is durable versus where it compresses under real-world constraints.

The result is not a single AI multiple, but a structured range shaped by position in the stack, replaceability, and execution certainty. Understanding that structure is now essential for startup valuation, AI valuation, and interpreting AI multiples across funding and exit scenarios.

Key Takeaways

AI M&A multiples look lower because buyers price integration, margin normalization, and operating reality rather than future optionality.

Acquirers value AI assets that embed cleanly into existing products, workflows, and sales motions with minimal operational friction.

Compute volatility and margin uncertainty compress M&A pricing, even for technically strong AI businesses.

Core AI clears higher M&A multiples when it becomes a dependency; feature-like AI is priced as an add-on.

AI M&A pricing is the most disciplined valuation signal because it reflects what survives integration, accountability, and real P&L impact.

Answers to The Most Asked Questions

-

AI M&A prices integration risk, margin normalization, and time-to-synergy, while private rounds price future optionality, category leadership, and upside that may never fully materialize.

-

No. Buyers are pragmatic. They value AI that improves margins and operations post-acquisition, not technical promise that fails to translate into integrated, scalable economics.

-

Core AI segments like LLM platforms and infrastructure clear higher M&A multiples when they are embedded dependencies with defensible economics and predictable integration paths.

-

Acquirers focus on integration effort, ongoing compute costs, services drag, and operational impact, while private investors underwrite growth narratives and long-term strategic upside.

-

Both matter. Private comps reflect fundraising potential, while M&A multiples reveal what the business is worth once uncertainty collapses into operating reality.