AI Startup Valuations Enter a New Phase: Efficiency Defines Value

By Lior Ronen | Founder, Finro Financial Consulting

In 2025, pricing an AI company feels less like running a formula and more like reading a market pulse.

Valuation is no longer about one perfect multiple; it’s about how well a company turns innovation into retention, recurring revenue, and real traction.

The flow of capital tells the same story. Money hasn’t disappeared from AI, it’s become smarter. Investors still back bold ideas, but they now look for proof before price.

The biggest rounds go to teams that already show scale, customer stickiness, and operating discipline, while early-stage founders face longer due diligence cycles and tougher negotiations.

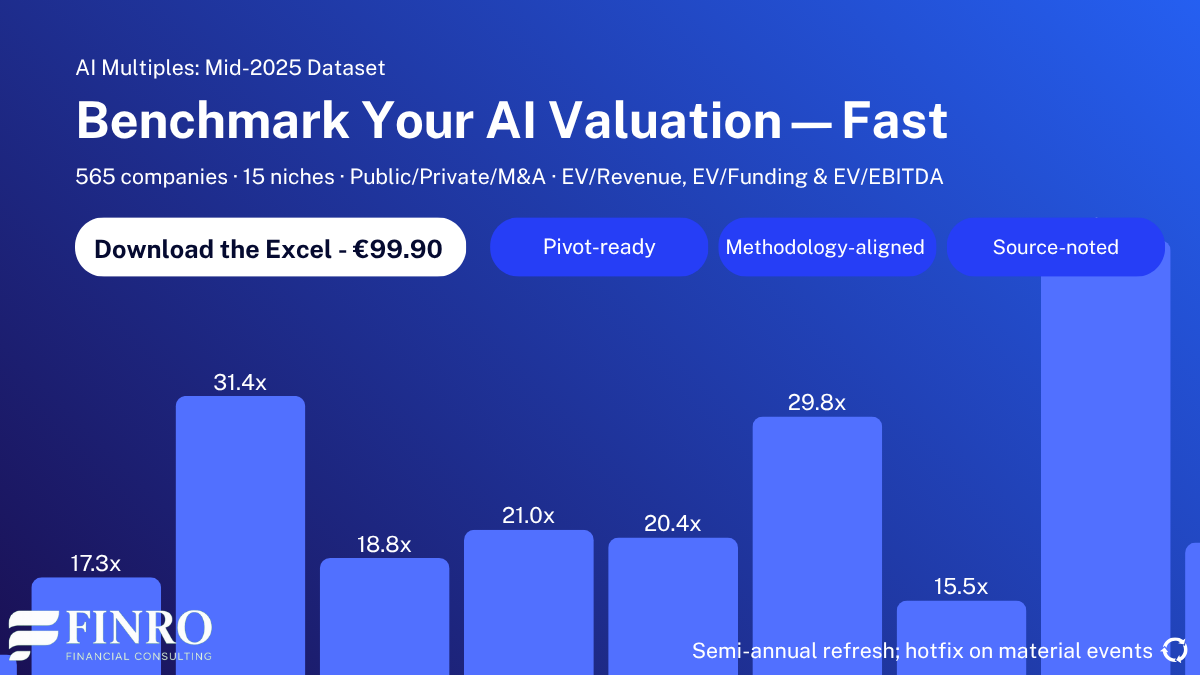

This analysis draws on Finro’s Q4 2025 AI valuation dataset, covering 565 companies across public, private, and M&A transactions. It tracks how AI valuation logic is shifting:

Which niches consistently trade at higher revenue multiples, how pricing evolves across funding stages, and what characteristics separate companies that sustain value from those that fade once the hype settles.

For founders and investors alike, this is a useful compass.

It shows where the market is still paying for promise, where it’s demanding performance, and how the balance between the two keeps redefining what “value” means in AI.

The current AI funding landscape shows a clear transition toward efficiency and proof-driven growth. Investors continue to deploy significant capital but concentrate on later-stage companies that demonstrate scalability, retention, and durable business models. Early rounds still attract interest, yet valuations increasingly depend on measurable traction rather than vision alone. Multiples remain high, especially in infrastructure and enterprise-oriented niches, reflecting a market that values operational predictability over hype. This shift signals a more disciplined phase for AI investing, where lasting value is built through defensibility, efficiency, and capital discipline.

Where the Money Flows: Stage Distribution and Investment Priorities

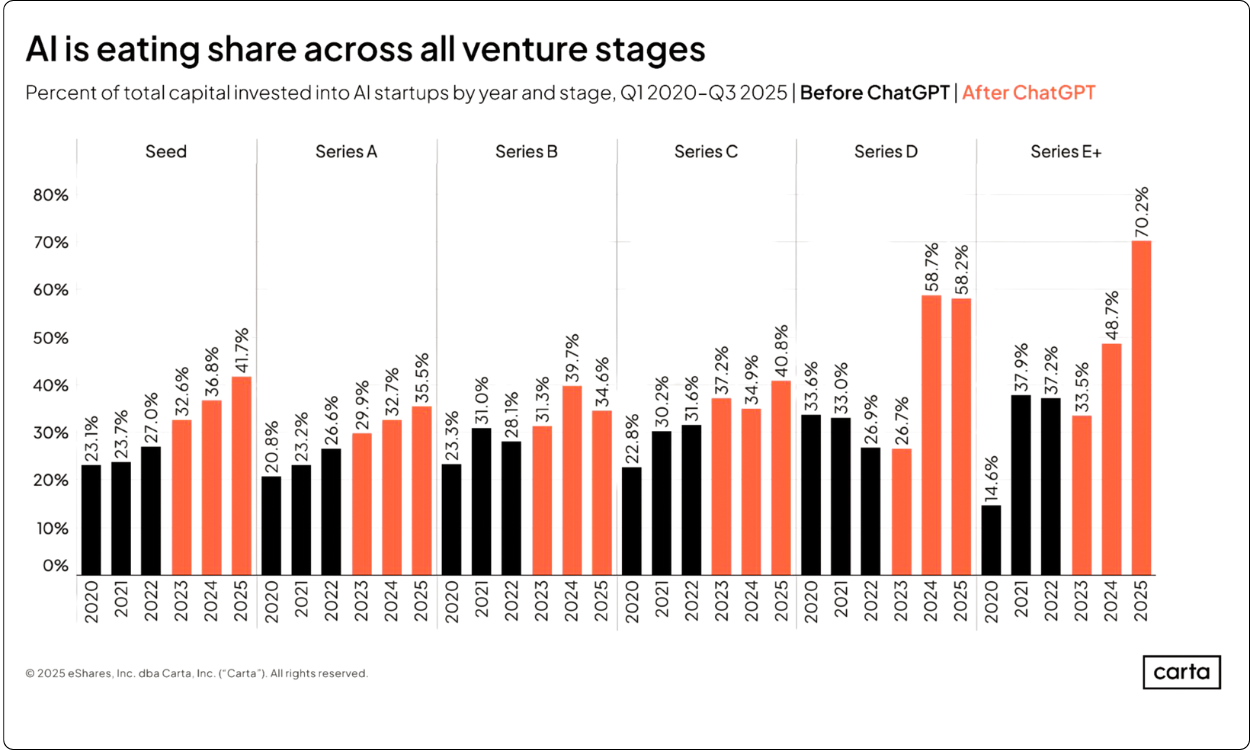

That shift in investor mindset shows up clearly in the data. Funding is still strong, but it’s no longer spread evenly. The center of gravity has moved toward companies that have real traction and measurable retention.

AI startups are still attracting massive amounts of capital, but where that money goes has changed. Most new funding now flows into later-stage companies that are already proving scalability, retention, and defensibility.

The middle of the market, particularly Series B and C rounds, captures a disproportionate share of total investment, while early stages are starting to feel the squeeze.

This tells us more than just where the money lands; it shows how investors are pricing risk. Early rounds that once cleared easily on potential now face deeper scrutiny, tighter terms, and valuations that reflect operational proof.

The appetite for early-stage risk hasn’t vanished, but it’s become selective and focused on founders who can show traction, not just vision.

At the top of the curve, the largest checks go to companies that already operate at scale or build critical infrastructure. Series D and beyond rounds absorb the bulk of AI capital, not because they promise faster growth, but because they’ve shown they can sustain it.

The narrative has shifted from “how fast can you grow” to “how efficiently can you scale.”

Across Finro’s Q4 2025 AI valuation dataset, covering 565 companies, the same trend appears. Early-stage multiples often exceed 20x revenue but drop sharply once a startup transitions from narrative to execution.

Late-stage AI startups, particularly those beyond Series C, trade between 21x and 28x revenue, reflecting maturity, predictable growth, and investor confidence in scalable business models.

It’s a healthy reset.

The market is learning to price substance over speed, rewarding startups that can convert capital into durable enterprise value.

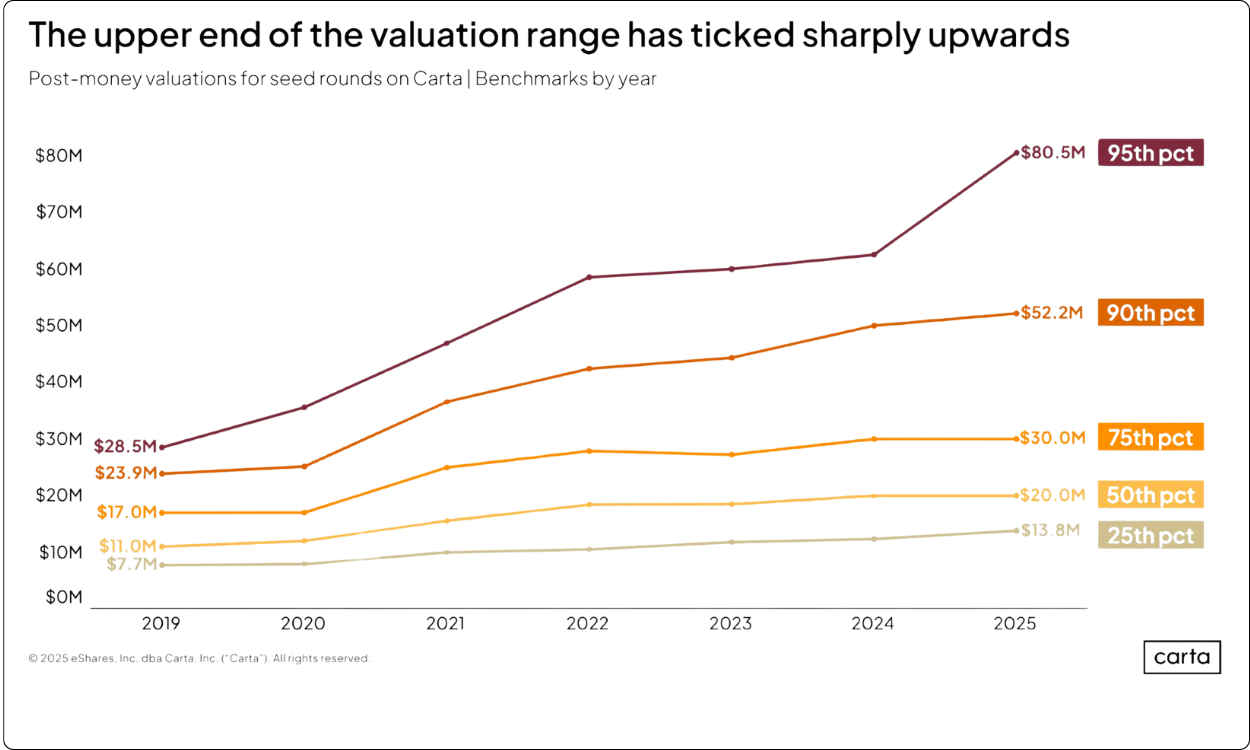

Valuations rise fast, then flatten

The valuation curve for AI startups has started to resemble a plateau rather than a climb.

In the early years of the boom, each new funding round reset expectations upward. But as investors learned to price traction rather than just vision, the market changed.

Recent data shows that while early-stage rounds remain inflated, the steep escalation that once defined AI valuations has begun to level out.

The median post-money valuation for Seed-stage companies has roughly tripled since 2019, but the pace slows noticeably beyond Series A. The market is still rewarding proof of concept, not promise alone.

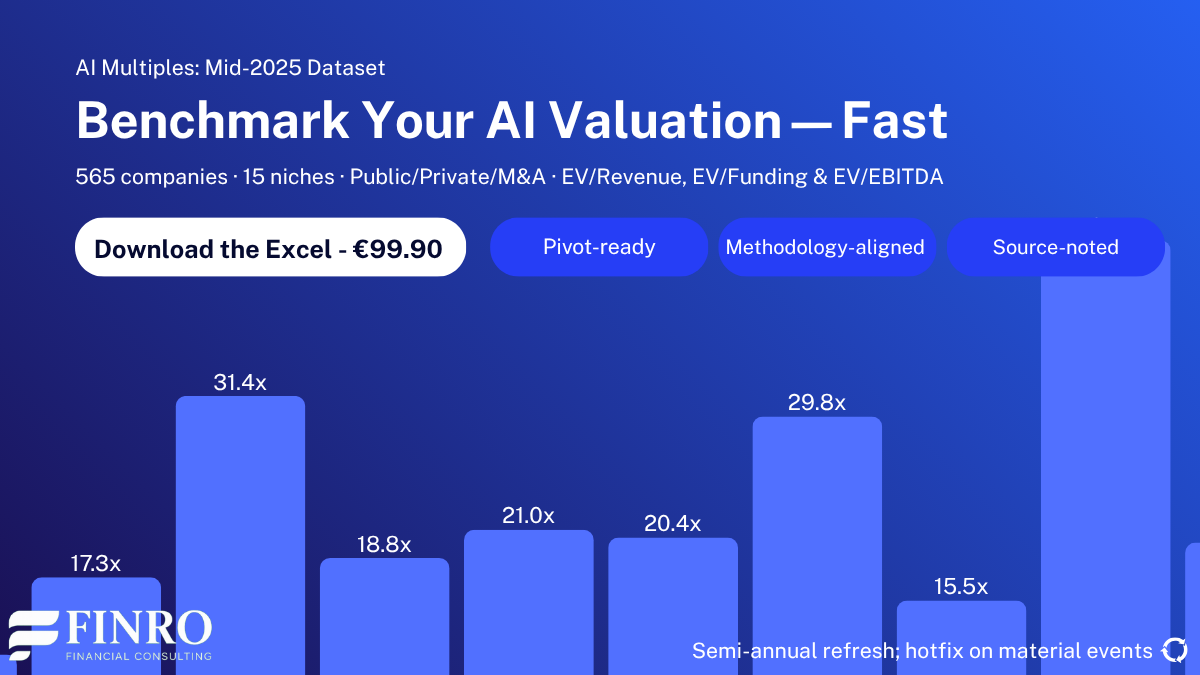

Across Finro’s Q4 2025 dataset of 565 AI companies, this pattern is clear. Seed-stage startups trade at ~19.6x revenue on average, Series A climbs to ~31.9x, and Series B peaks near 32.8x, but from that point forward, multiples fall steadily.

Series C rounds average ~27.9x, Series D ~21.6x, and even elite late-stage firms hover around ~28.1x. The compression isn’t a sign of weakness; it’s proof that investors are finally pricing maturity instead of momentum.

The story behind those numbers is structural. Founders who can demonstrate efficiency, retention, and customer-led growth are still seeing premium valuations.

Those chasing expansion for its own sake face longer diligence cycles and sharper scrutiny. What was once rewarded as potential is now measured as performance, and that’s a much healthier market.

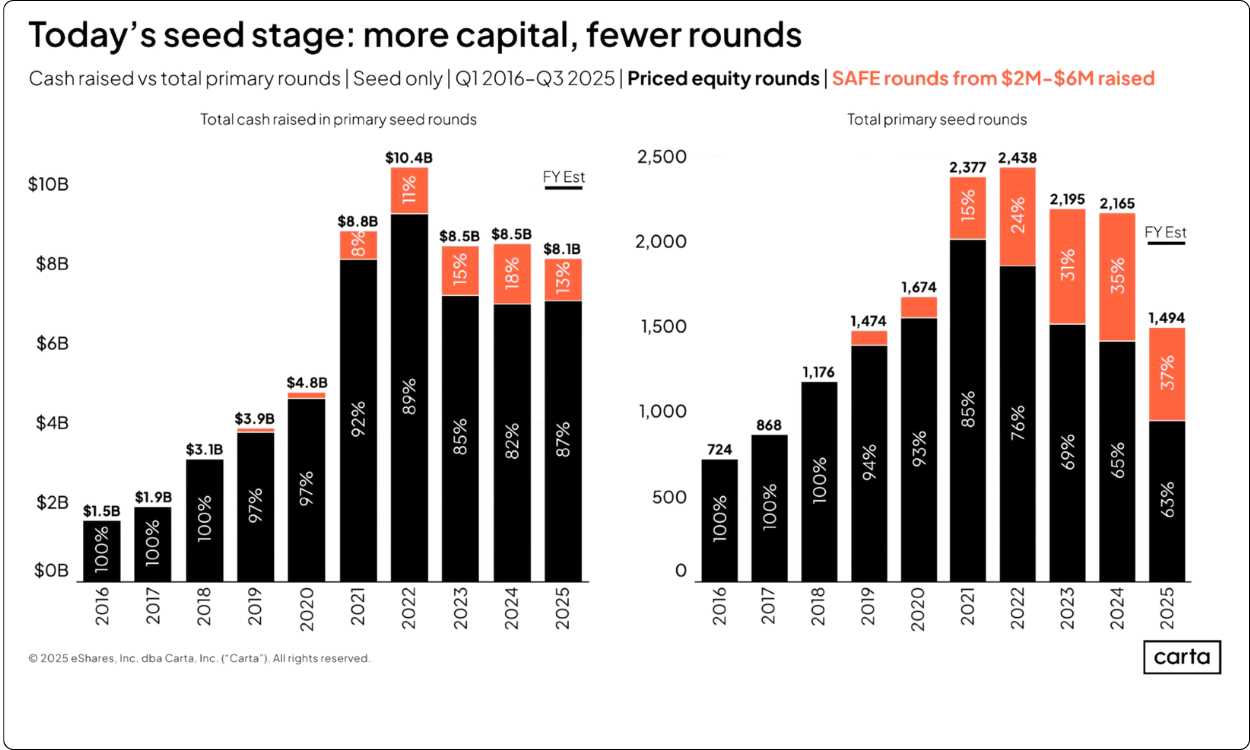

The age of efficiency

After years of chasing scale at any cost, AI startups are learning to grow with discipline. The conversation has shifted from how much capital a team can raise to how effectively that capital is used.

Investors are no longer impressed by burn rates that outpace revenue growth. They are rewarding companies that can turn limited resources into durable value.

This shift is measurable on both sides of the equation.

Finro’s Q4 2025 AI dataset shows that efficiency is now the strongest predictor of valuation resilience. Startups generating five to seven dollars of enterprise value for every dollar raised consistently trade at higher revenue multiples.

In contrast, those relying heavily on external funding often fall below three times EV/Funding, showing that investors now discount growth driven purely by capital.

The same pattern appears in how startups operate. Teams are hiring later, running leaner, and extending their cash runways. In 2021, founders were raising to accelerate; in 2025, they are raising to optimize.

Companies that once built headcount around future growth projections are now aligning costs to actual performance. The leaner models aren’t a sign of constraint. They’re a deliberate move toward sustainability.

This new mindset has redefined what a “strong” round looks like. Instead of aggressive capital injections, investors are favoring measured rounds that fund specific milestones: customer expansion, margin improvement, or infrastructure scaling. The best-performing AI startups raise less frequently but achieve more with each raise, compounding credibility along the way.

It’s a quiet but powerful shift. The startups that learn to treat efficiency as a strategy, not a restraint, are the ones holding their multiples even as the broader market recalibrates.

Where premiums concentrate?

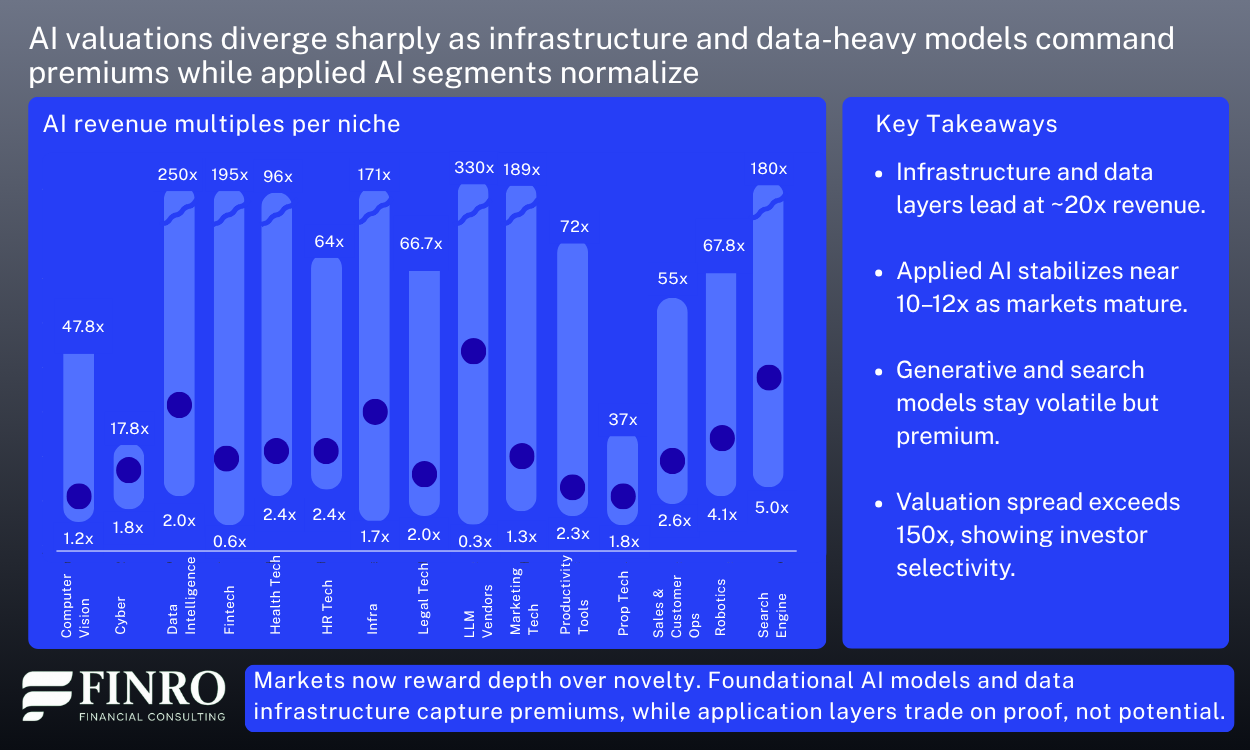

Not all AI startups are valued equally. Beneath the averages lies a clear hierarchy — one that mirrors where investors see durable value. The top tiers of the market belong to companies building the infrastructure and intelligence layers of AI, not those applying it narrowly.

Finro’s Q4 2025 dataset shows that AI Infrastructure & Platforms lead the pack with average revenue multiples above 20x, followed closely by Data Intelligence and Generative AI, both in the 17–18x range.

These categories benefit from recurring enterprise contracts, high switching costs, and strong integration depth. Investors treat them as the “rails” of the ecosystem — the products that other AI tools depend on to run.

By contrast, applied verticals such as HRTech, PropTech, and EdTech trade closer to 10–12x, reflecting more traditional SaaS dynamics. Their growth is steady, but their pricing power is narrower and customer stickiness more limited. In these segments, valuation upside comes from execution and market leadership rather than macro tailwinds.

The M&A market reinforces the same logic. Buyers are paying premiums for data-heavy businesses with defensible IP and ecosystem lock-in, rather than for standalone tools. The valuation gap between the “infrastructure” and “application” layers isn’t just about multiples, it’s about leverage, integration, and defensibility.

For founders, the takeaway is simple: the market rewards what it can’t easily replace. In AI, that means building into the workflow, owning the data, and embedding deeply into the value chain.

Why download the dataset?

The past sections showed how the AI investment landscape is maturing. Funding is still abundant, but investors now price proof, not potential.

Multiples compress as companies scale, efficiency outperforms speed, and value concentrates in models that convert capital into durable enterprise outcomes.

But to really understand what’s driving those patterns, you need to see the data itself.

Finro’s AI Valuation Multiples Database (Q4 2025) captures the full picture with 565 AI companies across 15 nichesand three categories: public, private, and M&A. Each company record includes valuation, revenue, funding, and calculated metrics like EV/Revenue and EV/Funding, allowing you to explore where the market rewards growth, where it discounts risk, and how pricing logic evolves by stage.

For founders, it’s a way to benchmark your numbers against peers and understand what investors actually reward in your segment. For investors and advisors, it’s a structured dataset that helps validate pricing assumptions, assess sentiment, and identify outliers worth a closer look.

It’s the same dataset behind Finro’s quarterly valuation analyses and the foundation for every chart, multiple, and insight featured above.

And unlike most reports, this is not a summary. It is a working tool built for exploration.

You can download the full dataset for €99.90. It is a digital product designed for people who want to analyze valuation trends, not just read about them.

Summary

AI startup valuations are no longer driven by optimism alone.

The data shows a market that rewards structure over story, efficiency over expansion, and retention over reach. Growth is still valued, but only when it comes with evidence of scalability and control.

Funding continues to flow, but differently. Later rounds capture the majority of new capital, early rounds have become more selective, and valuation gaps across stages are narrowing.

Multiples at the top remain healthy, but they are now earned rather than assumed.

Across the 565 companies analyzed in Finro’s Q4 2025 dataset, a consistent pattern emerges.

Startups that convert each dollar of funding into measurable enterprise value hold their multiples longer.

Those that depend on burn to sustain growth see faster compression as they scale.

The message is simple: the market has matured. AI startups that build strong fundamentals early, retention, efficiency, and defensibility are the ones that preserve value over time.

Key Takeways

Investors now price structure over story, valuing retention, defensibility, and efficient scaling across AI startups.

Late-stage funding dominates as capital shifts toward proof of traction and sustainable growth.

Early rounds face selective funding and tighter valuations tied to measurable progress.

Capital efficiency and EV/Funding ratios strongly predict valuation durability.

Infrastructure and enterprise AI niches sustain premium multiples driven by recurring contracts and entrenched adoption.

Answers to The Most Asked Questions

-

AI startup valuation depends on proven traction, capital efficiency, and defensibility. Investors reward measurable scalability over hype-driven projections or early-stage momentum.

-

Across Finro’s Q4 2025 dataset, AI startups trade between 8x–20x revenue, depending on niche, maturity, and business model stability.

-

Infrastructure, enterprise AI, and data intelligence lead the market with 18x–22x revenue multiples due to recurring demand and deep integration.

-

Early-stage rounds face tighter diligence and higher proof expectations. Investors fund founders who can show retention, market traction, and efficient use of capital.

-

Retention, operational leverage, and EV/Funding ratios define durability. Startups that convert each dollar raised into sustained enterprise value maintain stronger multiples over time.