What Is Gross Margin and Why It Matters for Startups?

By Lior Ronen | Founder, Finro Financial Consulting

Gross margin is one of the simplest numbers in a startup’s financial model, and one of the most misunderstood. Founders often track revenue growth or burn, but overlook the metric that actually shows whether the business scales efficiently: what’s left after serving the customer.

Gross margin tells you how much value your company keeps after delivering its product or service.

It answers a fundamental question investors always ask: can your model grow profitably, or does every new user come with a proportional increase in cost?

A business with a strong gross margin doesn’t just grow faster. It grows smarter, keeping more of each additional dollar as it scales. Understanding gross margin isn’t about accounting precision. It’s about understanding scalability, defensibility, and long-term potential.

In this article, we’ll explain what gross margin really measures, how to calculate it, what healthy margins look like for different startup models, and how founders can improve theirs to build a stronger, more fundable business.

The strength of a startup lies in how much value it can create without matching that growth in cost. Gross margin reflects that ability — it’s the proof of efficiency, pricing power, and product strength. When startups expand gross margin, they turn growth into leverage: less dependency on funding, more control over reinvestment, and a business model that scales on its own momentum.

What Is Gross Margin?

Gross margin measures how much of your revenue remains after covering the direct costs of delivering your product or service.

It shows how efficiently your startup turns revenue into profit before accounting for operating expenses like salaries, R&D, or marketing.

Formula:

Gross Margin = (Revenue – Cost of Goods Sold) ÷ Revenue

In a startup context, “Cost of Goods Sold” (COGS) doesn’t mean raw materials, it’s the cost directly tied to serving your users. For SaaS and tech companies, that typically includes:

Cloud hosting and server costs

Payment processing fees

Customer support and onboarding

Third-party integrations or API usage

Software licenses directly tied to the product

Example 1 — Early-Stage SaaS Startup

A B2B SaaS startup generates $100,000 in monthly revenue.

Its monthly COGS includes:

$12,000 for AWS hosting

$8,000 for customer support

$5,000 for API and payment fees

Total COGS: $25,000

Gross Margin = (100,000 – 25,000) ÷ 100,000 = 75%

This startup keeps 75 cents of every dollar earned to cover operations, sales, and R&D. For SaaS, that’s a healthy gross margin — it shows scalability without significant incremental costs per user.

Example 2 — Public Tech Company (Shopify)

In 2024, Shopify reported revenues of $8.8B and gross profit of $4.47B - a gross margin of roughly 51%. That means for every $1 in revenue, it retained about $0.51 after covering the cost of payment processing, hosting, and merchant infrastructure.

Shopify’s gross margin is lower than pure SaaS companies because it combines software revenue (high-margin) with payment and logistics revenue (lower-margin). The blended figure reflects its business mix and still indicates strong scalability for a platform that processes billions of transactions annually.

Gross margin isn’t about having the highest possible number. It’s about understanding what drives it. A 70% margin for one business might mean efficiency, while for another it might signal underinvestment in infrastructure or customer experience.

What matters most is knowing how your margin behaves as you grow, whether it expands, stays flat, or compresses, because that’s what reveals the true economics of your model.

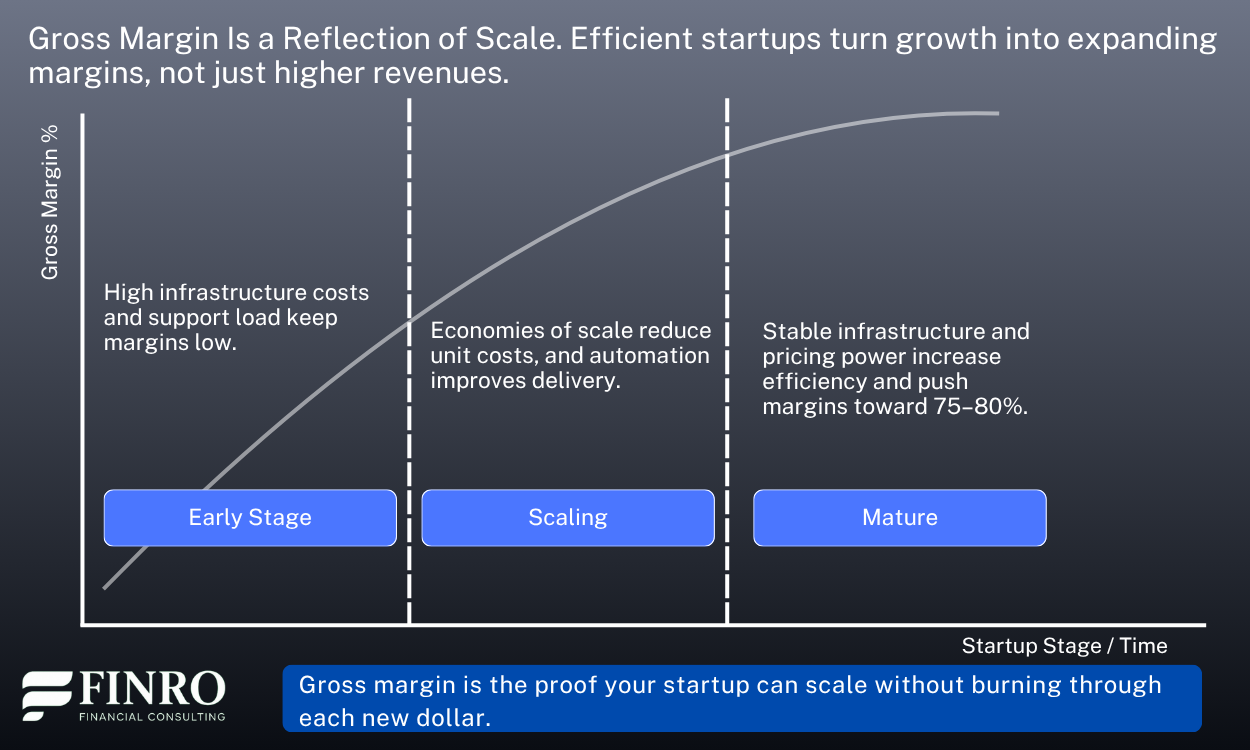

As startups mature, infrastructure costs stabilize, automation takes over manual processes, and pricing power strengthens. The result is a steady rise in gross margins, signaling a model that scales efficiently instead of just growing revenue.

Why Gross Margin Matters More Than You Think

Gross margin isn’t just an accounting ratio. It’s a measure of scalability and resilience. A high margin means your product delivers value efficiently, leaving more cash to reinvest in growth, marketing, and innovation. A low margin, on the other hand, signals structural issues: pricing that’s too low, infrastructure costs that are too high, or an offering that doesn’t scale well.

For AI startups, this difference is especially visible.

Companies that rely heavily on third-party APIs or cloud compute face higher cost of goods sold, which can compress gross margins into the 40–50% range.

In contrast, AI platforms that fine-tune or deploy their own proprietary models often maintain margins of 70% or higher once usage scales, because inference costs decline and each additional user adds minimal variable cost.

Investors use gross margin as a lens into a company’s defensibility.

A Fintech platform that automates onboarding, payments, or compliance at scale can compound profitably even at moderate growth rates. But a startup that relies on manual processing, third-party payment rails, or costly customer support must grow much faster just to maintain profitability.

The same logic applies in cybersecurity. Product-led vendors with automated detection, scalable cloud delivery, and minimal human monitoring sustain margins above 75%.

In contrast, service-heavy security providers that depend on manual threat analysis or 24/7 response teams often see margins drop below 50%. That’s why investors now focus not just on growth but on efficient growth, turning every new dollar of revenue into lasting margin leverage.

How to Improve Gross Margin?

Up to this point, we’ve looked at what gross margin represents, a measure of scalability, efficiency, and product strength, and how it differs across tech verticals like AI, fintech, and cybersecurity.

But understanding why gross margin matters is only half the story. The real challenge is improving it. This is where financial strategy meets operational execution.

Gross margin improvement isn’t about aggressive cost-cutting. It’s about designing a business that compounds efficiency as it grows.

The strongest startups, whether they’re building AI infrastructure, payment rails, or cybersecurity platforms, treat margin improvement as an ongoing process of refinement, optimization, and leverage.

Take AI startups, for example.

Early on, inference and cloud compute dominate costs, often compressing margins below 50%. But as model performance stabilizes and inference becomes cheaper through quantization, caching, or proprietary model training, margins expand dramatically.

This shift turns what was once a cost center into a defensible advantage. Every additional user adds value without adding comparable cost.

In fintech, the path looks different but follows the same principle.

Payment processors and neobanks improve margins not by cutting support or compliance costs, but by automating them.

Stripe and Wise, for instance, use integrated infrastructure and dynamic pricing to improve efficiency with scale. Their margins aren’t protected by lower fees but by operational leverage, the ability to process billions in volume without proportionally increasing cost.

For cybersecurity, product efficiency plays the starring role.

Companies like CrowdStrike or Wiz achieve high gross margins not by selling less or charging more, but by automating what competitors still handle manually. Cloud-based delivery and AI-driven threat detection reduce reliance on human analysts, a fixed cost that doesn’t scale, and convert it into a software-based margin engine.

Across every vertical, the same truth holds: gross margin improves when each dollar of revenue carries less cost to deliver. That doesn’t come from a single decision. It’s the accumulation of better product design, smarter infrastructure, and disciplined pricing.

When founders approach margin as a strategic metric, not an accounting one, it becomes one of the clearest indicators of long-term business quality.

Summary

Gross margin sits at the intersection of growth and discipline. It tells founders whether their business is truly scalable or just growing through spending.

Startups that understand gross margin deeply use it as a feedback loop — a signal of where to double down and where to simplify. It exposes the strength of your pricing model, the efficiency of your operations, and the quality of your product design.

Across tech verticals, the story plays out differently, but the principle stays the same. In AI, it’s the journey from high compute costs to optimized inference. In fintech, it’s the transition from manual compliance to automated infrastructure.

In cybersecurity, there is a shift from human monitoring to product-led detection. Each of these transformations widens the gap between revenue and cost, and every percentage point gained compounds over time.

When gross margin improves, it unlocks more than profit. It gives founders control — the ability to reinvest in growth without depending entirely on capital markets. High-margin startups have flexibility in timing their rounds, leverage in negotiations, and room to pursue innovation without jeopardizing sustainability.

The most resilient companies don’t just measure gross margin; they design their businesses to make it expand naturally with scale.

Key Takeaways

Gross margin measures scalability. It shows how efficiently your business converts revenue into profit.

Low margins reveal structural issues. High costs, weak pricing, or poor automation are often to blame.

Investors track margin trends, not one number. Expanding margins signal pricing power and efficiency.

Each tech niche has different benchmarks. AI and Cyber companies often operate with higher fixed costs but greater long-term leverage.

Gross margin is a flywheel. Efficiency fuels growth, which in turn improves efficiency and drives sustainable profitability.

Answers to the Most Asked Questions

-

Gross margin shows how efficiently a startup delivers its product or service. It measures how much of each revenue dollar is left after direct costs like hosting, support, and delivery.

-

Strong SaaS startups typically have gross margins between 70% and 85%. Early-stage companies may start lower, but margins should improve as automation and scale reduce variable costs.

-

By improving automation, optimizing vendor contracts, and refining product efficiency. High-margin startups invest in scalability — reducing cost per customer as revenue grows.

-

Investors view gross margin as a proxy for scalability and defensibility. Expanding margins show that growth is efficient and the product can generate value without heavy ongoing costs.

-

Gross margin measures profit after direct delivery costs, while net margin includes all expenses — like payroll, marketing, and operations. Gross margin reflects scalability; net margin shows overall profitability.