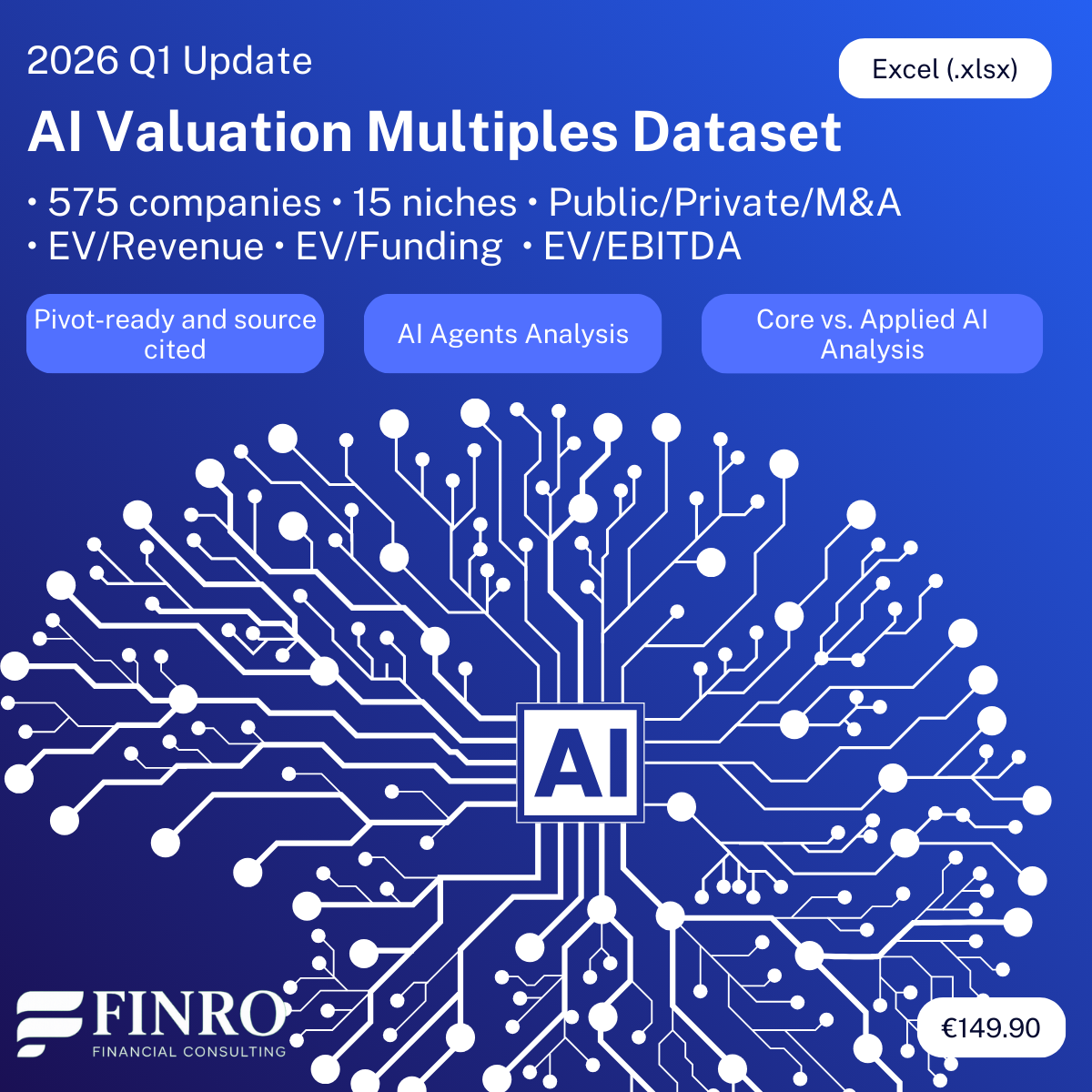

AI Valuation Multiples Database: Q1 2026 Update

AI Valuation Multiples Database: Q1 2026 Update

Public comps, private rounds, and M&A benchmarks across the AI stack, organized by segment and updated for Q1 2026.

AI valuations did not move in one direction in Q1 2026. They separated.

This dataset is built to help founders, investors, and corporate teams benchmark that separation with a consistent reference set, without relying on vague “AI multiples.”

You get a structured view across the market, by segment, and by transaction type, so you can triangulate what is defensible in public comps, what is being priced in private rounds, and what is actually clearing in M&A.

575 companies · 15 niches · Public/Private/M&A · EV/Revenue & EV/Funding

€149.90 • Instant Download (Excel)

What You’ll Get

Investor-grade benchmarks for the AI landscape, Q1 2026. USD-denominated.

Pivot-ready Excel aligned with the methodology used in the companion article.

Charts and summaries you can paste into a deck in minutes.

Source-noted entries and quarterly refreshes on material events.

What’s Inside:

1️⃣ Database of 575 AI Companies

Early- to late-stage startups, public firms, and M&A exits

EV/Revenue, EV/EBITDA, EV/Funding multiples

Valuation, revenue, capital raised, funding stage, and more

Fully tagged by niche and deal type

2️⃣ Segmented by 15 Niches

LLM Vendors

Computer Vision

AI Robotics

Search Engine

Infrastructure

Data Intelligence

Cybersecurity

Health Tech

Fintech

PropTech

Legal Tech

Marketing Tech

HR Tech

Sales & Customer Ops

Productivity Tools

See how multiples shift across different layers of the stack and applied verticals.

3️⃣ Stage-by-Stage Valuation Trends

Compare how Seed, Series A, B, C, and late-stage rounds are priced.

Use real-world benchmarks to pressure test assumptions and refine a target range.

4️⃣ Private vs. M&A vs. Public Comps

Spot where venture pricing diverges from public market anchors.

See how strategic acquisitions typically clear versus private round marks.

Use cross-market triangulation to avoid benchmarking against the wrong lens.

5️⃣ Core vs. Applied AI Segmentation

A clean split across two functional layers.

Core AI covers the rails: models, infrastructure, data systems, and developer tooling.

Applied AI covers outcomes inside workflows: legal, HR, writing, finance ops, and vertical execution.

Use this view to benchmark the right peer set and avoid mixing platform economics with workflow economics.

6️⃣ Agentic AI Zoom-In View

A dedicated cut across agentic companies and specific AI Agents segments.

Built to analyze where agents are clearing premiums versus where pricing compresses.

Useful for founders and investors evaluating “agent” positioning, packaging, and valuation expectations across both Core and Applied layers.

7️⃣ Pre-Built Views and Visuals

Charts, pivot tables, and ready summaries.

Filters for niche, round, and deal type, no formatting required.

Built to support fast comp work, internal memos, and investor materials.

Who This Is For

Startup founders benchmarking valuation for fundraising.

VCs and investors setting expectations or comparing deals.

Corporate development teams evaluating M&A or partnership opportunities.

Consultants and analysts building valuation models with real numbers.

Why It’s Different

No fluff. Clean structure. Source-noted. Built for analysis, not browsing.

It’s not a PDF. It’s a working Excel tool designed to be used.

Format & Price

Format: Microsoft Excel (.xlsx)

Price: €149.90

Delivery: Instant download after purchase — no subscription, no upsells

Add to Your Toolkit

If you’re pricing a round, pitching investors, building a comp set, or analyzing a deal, this dataset gives you the hard numbers to back it up.

This is a non-refundable digital product. The information provided in this document is for informational purposes only and should not be regarded as investment advice or a recommendation regarding any particular security or course of action. Neither, Finro Limited (“Finro”) nor any of its affiliates makes any representation or warranty or guarantee as to the completeness, accuracy, timeliness or suitability of any information contained within any part of the Report nor that it is free from error.

Finro does not accept any liability (whether in contract, tort or otherwise howsoever and whether or not they have been negligent) for any loss or damage (including, without limitation, loss of profit), which may arise directly or indirectly from use of or reliance on such information. Information in this report was obtained from publicly available sources, information obtained from the client or Finro’s internal analysis, projections and estimations.

Please read the full disclaimer in the spreadsheet before using the data.