SAFE Rounds and Valuation Caps Explained: What Founders Need to Know Before Raising

By Lior Ronen | Founder, Finro Financial Consulting

SAFEs have become the most common way early-stage startups raise capital. They are quick to close, straightforward to work with, and allow founders to bring in funding before setting a full valuation.

This flexibility can be a real advantage.

It also creates confusion, especially when it comes to understanding how valuation caps and conversion actually work.

A valuation cap is often misunderstood as the company’s valuation. It is not. The cap simply sets the maximum price at which the investor’s SAFE will convert into equity in the future.

Two companies can both raise at a “$10M cap” and still end up with very different levels of dilution once the next priced round occurs. The details of conversion matter, and many founders only realize the impact when it is too late to renegotiate.

This matters because early fundraising shapes ownership. A few misaligned decisions in the first round can reduce founder control, shift board and voting dynamics, or make future rounds more challenging.

Understanding how SAFEs convert, and how caps influence dilution, allows founders to raise capital from a position of clarity rather than urgency.

In the sections that follow, we explain what a SAFE is, how valuation caps function, what drives cap differences between startups, how to interpret the benchmark data shared in Carta’s recent analyses, and how founders can set terms that support long-term control and momentum.

The goal is not to prescribe a “correct” cap.

The goal is to equip founders to negotiate confidently, understand dilution before signing, and choose terms that support the business they want to build.

Valuation caps don’t define what your startup is worth; they define how much ownership you’ll give away later. Founders who treat caps strategically - understanding dilution, timing, and investor perception - build stronger rounds and retain more control. Finro helps you model the impact before you sign the next SAFE.

- What a SAFE Actually Is?

- How Valuation Caps Actually Work (and Why They’re Not Valuations)?

- What Recent Data Reveals About SAFE Valuation Caps?

- How Founders Should Think About SAFE Caps Strategically?

- Choosing the Right Cap: Balancing Dilution and Narrative

- Summary

- Key Takeaways

- Answers to the Most Asked Questions

What a SAFE Actually Is?

A SAFE (Simple Agreement for Future Equity) is a contract that gives an investor the right to receive equity in the company later, typically when the startup raises its first priced equity round. There is no upfront equity issued and no repayment obligation.

The investor provides cash today, and the SAFE converts into shares in the future.

The core idea is to avoid negotiating a full valuation before the business has enough proof points to justify one.

Early stages move fast. Products change. Markets shift. A SAFE lets founders raise while staying focused on building.

Unlike convertible notes, SAFEs do not accrue interest and do not have a maturity date. There is no countdown clock forcing a future financing event. This removes pressure from the company and avoids debt sitting on the balance sheet.

In practice, SAFEs align both sides around the long-term equity value of the business rather than short-term financial mechanics.

When SAFEs Make Sense

SAFEs are most useful in the earliest phases of a company:

When the product is still being validated.

When growth signals are emerging but not yet consistent.

When founders want to raise quickly without complex negotiations.

In these situations, speed is more valuable than precision. SAFEs allow momentum to continue.

When SAFEs Can Become Misaligned

SAFEs can create challenges if they accumulate without being modeled carefully.

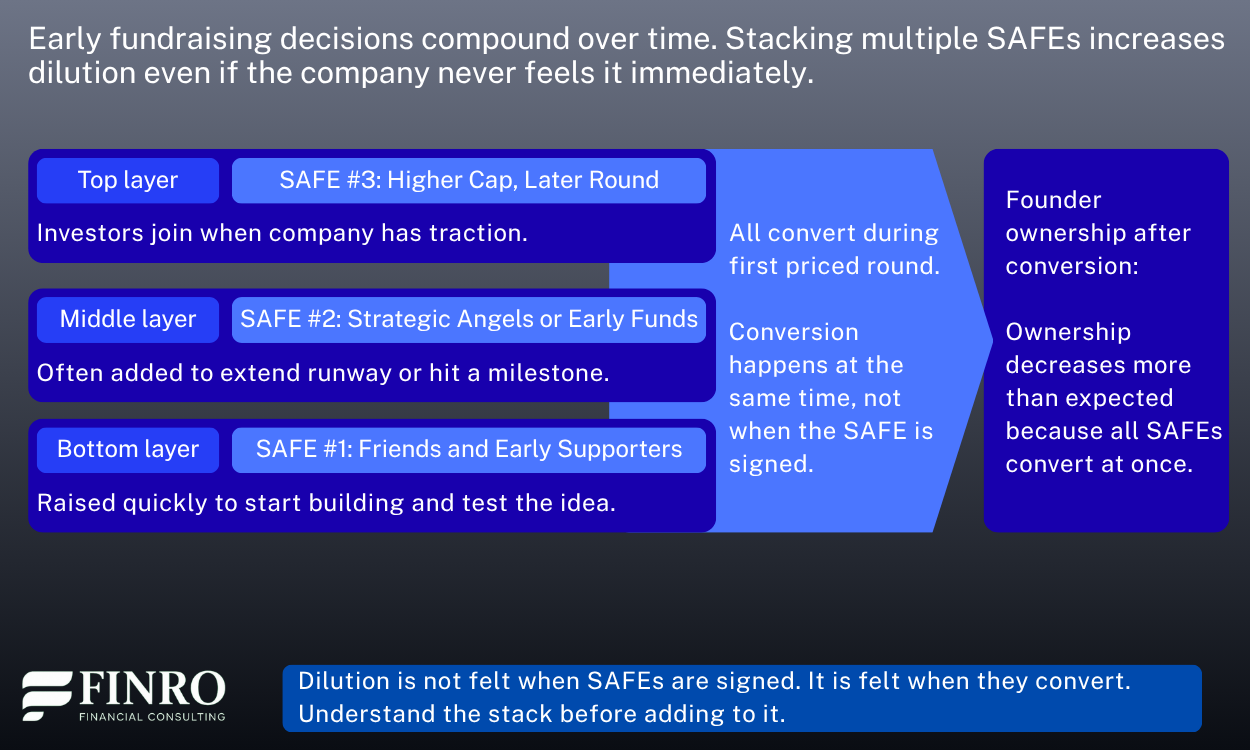

Each SAFE represents a claim on future equity, so multiple rounds of SAFEs can stack and dilute founders more than expected. This becomes visible only at the priced round, when all SAFEs convert simultaneously.

Startups sometimes raise two or three SAFE rounds before their Series Seed or Series A.

If founders do not track conversion impact, they may realize too late that their ownership has dropped below comfortable control levels. This can affect governance, hiring, and long-term incentives.

This is why understanding valuation caps and modeling conversion before raising is essential.

How Valuation Caps Actually Work (and Why They’re Not Valuations)?

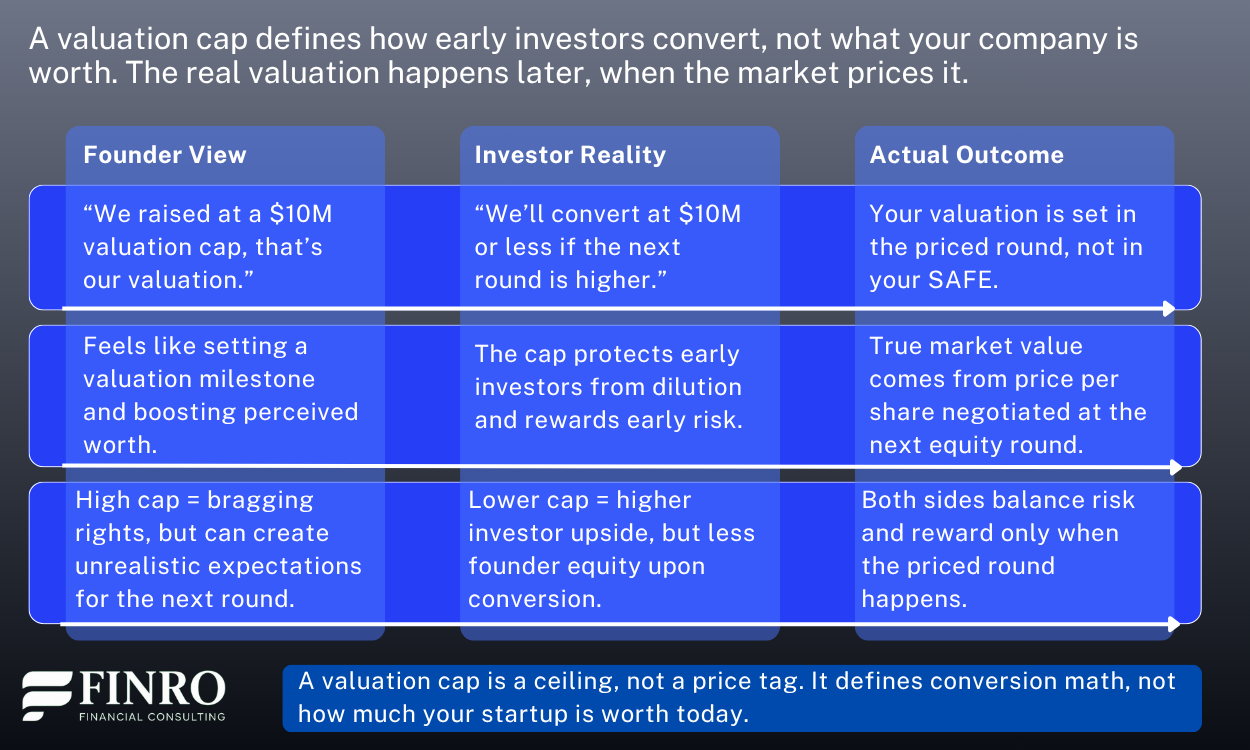

Most founders hear “valuation cap” and assume it defines the company’s valuation. It doesn’t.

A valuation cap is a conversion threshold, not a price tag. It sets the maximum price per share that SAFE investors will pay when their investment converts in the next priced equity round.

Think of it as a protection mechanism for investors — a way to lock in a discount if your company grows quickly between now and the next funding event.

If your Series A is priced higher than the cap, investors convert at the lower (capped) valuation. If your Series A ends up below the cap, they convert at the actual round price.

Here’s an example:

Let’s say you raise $500K on a $10M valuation cap SAFE. Later, your Series A is priced at $15M. The SAFE investors convert as if the company were worth $10M — effectively getting 33% more equity than if they’d waited until the priced round.

That’s why calling a cap “your valuation” is misleading. It’s not what the market decided, it’s the maximum price your early investors will pay once real pricing happens.

In early rounds, these caps can vary widely.

AI or biotech startups with defensible technology and strong founder credentials may close SAFEs at $20–$30M caps. A typical pre-seed SaaS or fintech company may fall closer to $8–$15M. The spread has less to do with revenue and more with narrative, founder background, and investor confidence.

When founders treat a cap like a valuation, they risk two things:

Over-optimizing for optics: chasing a high cap that feels good on paper but creates misalignment later.

Underestimating dilution: because the true impact only shows when multiple SAFEs convert simultaneously (as shown earlier).

The healthiest approach is to view your valuation cap as a bridge between belief and proof. It rewards early risk-takers while keeping the next round clean and credible.

What Recent Data Reveals About SAFE Valuation Caps?

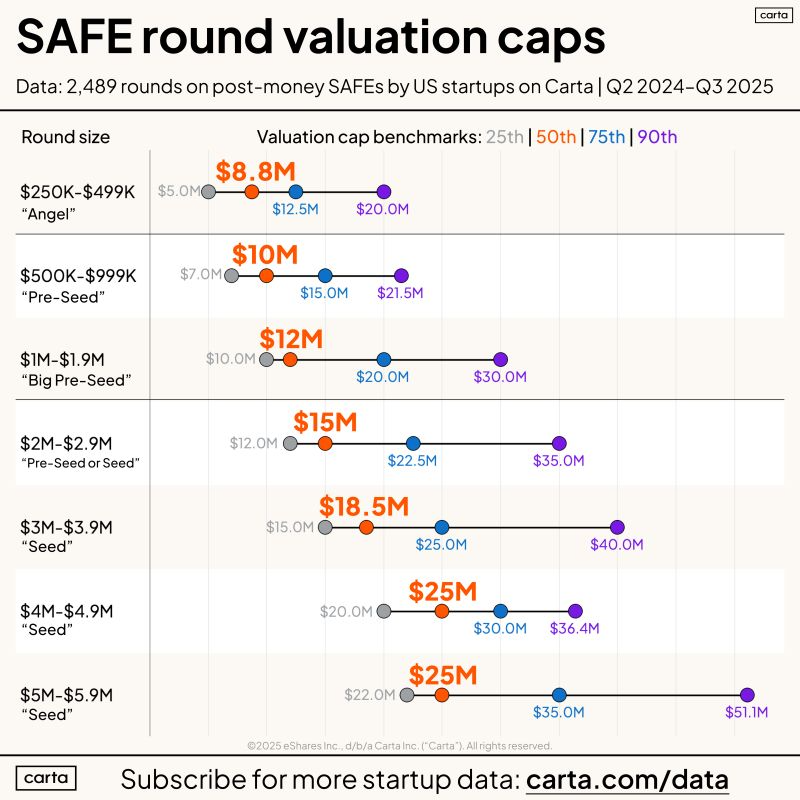

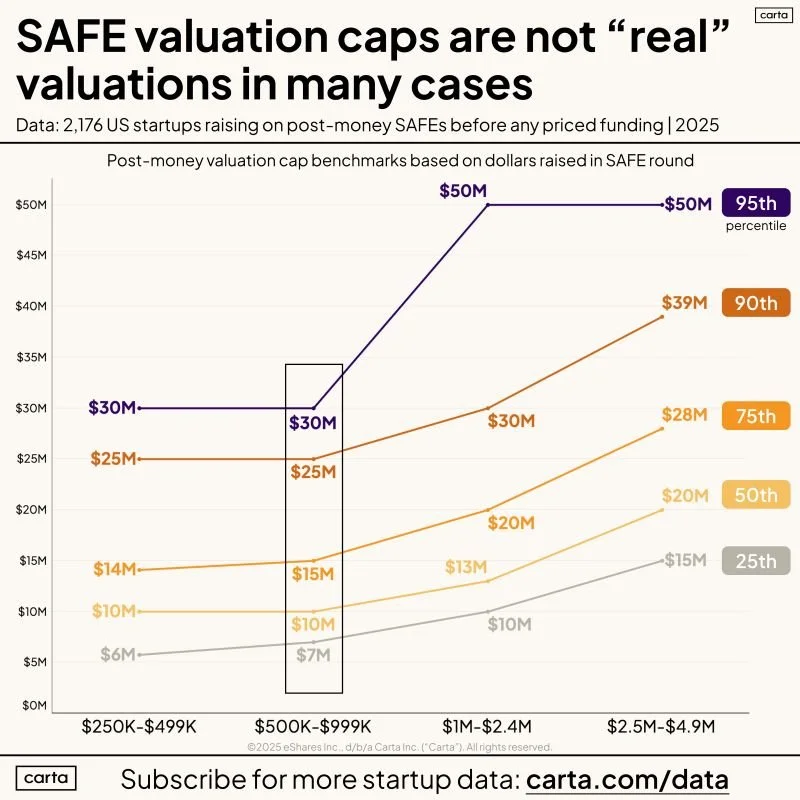

Over the past year, SAFE rounds have become the most common way for early-stage startups to raise their first institutional money. Yet as Carta’s latest data shows, valuation caps vary wildly, not because of financial logic alone, but because of who the founder is and how hot the sector looks at the time.

A founder raising $500K may see caps ranging from $7M to $30M, often with similar traction levels. At this stage, the spread isn’t a reflection of revenue or users; it’s a reflection of narrative, demand, and perceived founder quality. In other words, markets don’t price seed-stage risk evenly — they price confidence.

These valuation caps also scale with the size of the round. Carta data shows that when startups raise more than $2M on SAFEs, the median cap typically moves above $20M, while smaller rounds tend to cluster around $10–12M.

That doesn’t mean your startup is worth $20M, it means investors are betting their SAFE will convert favorably at that ceiling when you raise your first priced round.

In practice, high valuation caps can feel flattering but may complicate your next equity raise. If the priced round’s valuation doesn’t exceed the previous SAFE cap by a healthy margin, you’ll face difficult investor conversations and potential down-round optics.

For most founders, a realistic cap backed by milestones and measurable traction builds stronger long-term credibility than a vanity headline.

How Founders Should Think About SAFE Caps Strategically?

Valuation caps create structure in early fundraising, but they are not valuations.

They’re conversion mechanics.

The difference matters because a cap defines how much ownership investors might receive later, not how much your startup is actually worth today.

Founders often treat a higher cap as validation, but it’s really a promise to deliver growth before the next priced round.

If your metrics don’t rise to match that cap, your next negotiation starts under pressure. Investors will benchmark your progress against the cap, not the story you told when you set it.

On the flip side, a slightly lower cap can serve as a signal of alignment. It rewards early risk-takers, strengthens relationships, and often leads to more supportive investors during tougher fundraising cycles.

The goal isn’t to maximize your paper valuation, it’s to design a financing path that compounds, rather than compresses, your ownership.

The data also shows why two founders raising the same amount can end up with very different caps.

Experience, network, and perceived credibility shape investor comfort more than short-term traction.

For better or worse, early fundraising still blends narrative with numbers.

Choosing the Right Cap: Balancing Dilution and Narrative

Setting a valuation cap is both a financial and strategic decision.

It defines how much ownership you trade for early capital and how credible your next round will look in the eyes of future investors.

A cap that’s too low can leave founders over-diluted before the company truly starts scaling. But pushing it too high can backfire. The next round will demand results that justify that higher number — and if you miss the mark, it can trigger down-round dynamics, awkward renegotiations, or a loss of investor confidence.

The right cap balances today’s traction with tomorrow’s story. Founders who anchor their caps in clear milestones — product usage, early revenue, or signed pilots — tend to raise faster and face less friction later. It also signals maturity: you’re not just selling potential, you’re pricing progress.

The key is understanding how all your early instruments stack.

Multiple SAFEs or convertible notes can quietly compound dilution until they all convert at once in a priced round. Running proper conversion modeling before signing a new SAFE helps founders protect ownership and align investor expectations.

Finro helps founders model these dynamics with precision.

From SAFE conversion and dilution scenarios to equity waterfall analysis and round pricing simulations, we build models that reveal how every financing decision compounds. Before you set your next cap, make sure you understand what it means for the round after that.

Summary

SAFE notes remain one of the simplest tools for early-stage fundraising — but their simplicity can be deceptive. Each round shapes the next, and valuation caps often send stronger signals than founders realize. Setting the right cap isn’t about maximizing a headline number; it’s about protecting long-term ownership and ensuring each financing step compounds toward your next milestone.

Founders who understand conversion math, dilution timing, and investor psychology build stronger negotiating positions. Whether it’s balancing a $10M versus $15M cap, deciding when to stack SAFEs, or modeling post-conversion ownership, precision matters more than momentum.

That’s where Finro steps in. We help startups quantify every fundraising scenario — from SAFE conversion modeling and equity structure analysis to full investor-grade valuation models — so you can raise confidently and preserve the value you’re building.

Key Takeaways

A valuation cap isn’t your valuation. It only sets a ceiling for how investors convert, not what your startup is worth today.

Multiple SAFEs compound dilution. Ownership drops when all convert simultaneously in your first priced round.

High caps aren’t always better. They raise expectations and can hurt future round credibility if progress lags.

Data shows huge cap variation. Founder background and investor perception often outweigh early traction.

Model before you sign. Conversion and dilution simulations clarify how today’s SAFE affects tomorrow’s equity

Answers to the Most Asked Questions

-

A SAFE (Simple Agreement for Future Equity) lets investors fund startups now and receive shares later, usually at a discount or capped valuation.

-

A valuation is the company’s agreed market value. A valuation cap only limits the price investors pay when converting their SAFE into equity.

-

Yes. Stacking SAFEs can cause more dilution than expected when they all convert together in the first priced round.

-

It should balance traction, milestones, and investor confidence. Too high creates future pressure; too low causes early over-dilution.

-

Finro models conversion scenarios, SAFE stacking, and ownership outcomes, helping founders raise smartly and protect long-term control.