Core vs. Applied AI: The Valuation Split That Matters in Q1 2026

By Lior Ronen | Founder, Finro Financial Consulting

“Core vs. applied” explains more of Q1 2026 AI valuation dispersion than almost any other label.

In Q1 2026, the market did not reprice “AI” in one move.

It repriced underwriting certainty.

Where a company sits in the stack, and how directly revenue translates into durable economics, now matters more than headline growth.

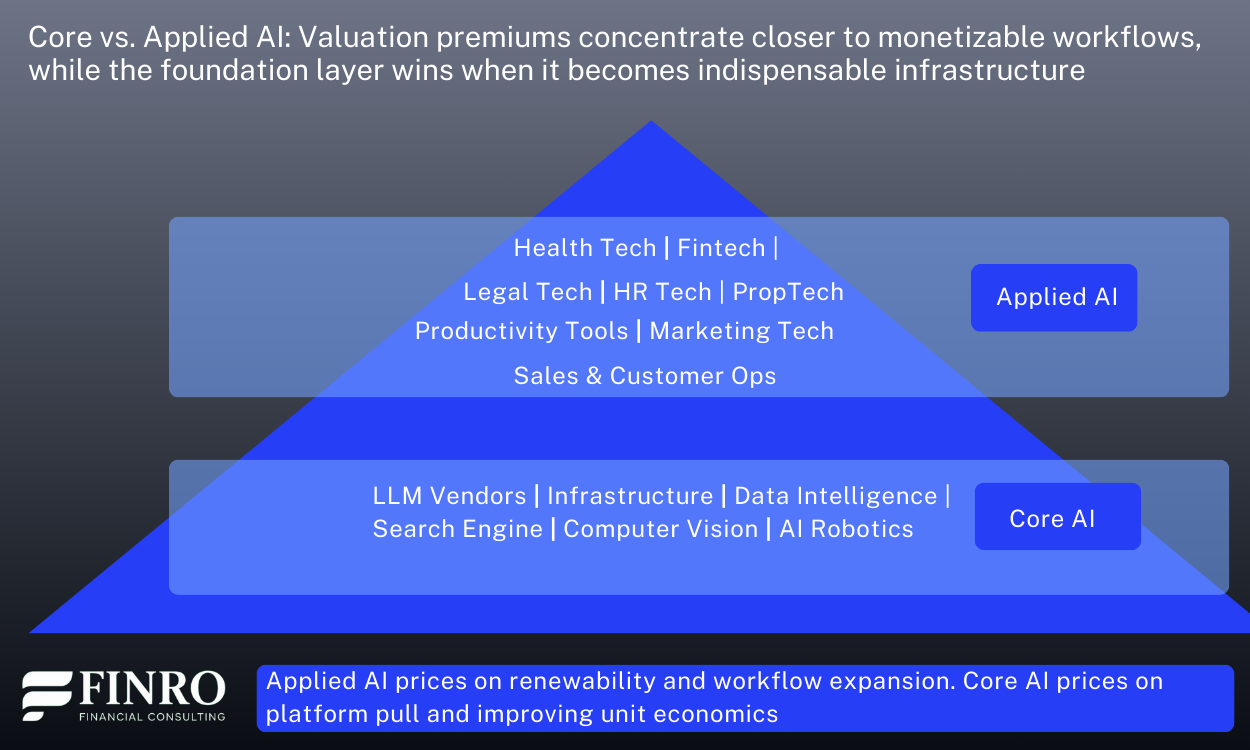

Core AI is the foundation layer. It sells the rails: models, infrastructure, orchestration, developer tooling, and data systems others build on.

Core can earn premiums when it becomes hard to replace or sits on a critical path, but it also faces faster diffusion, pricing pressure, and higher compute sensitivity.

Applied AI sits on top. It sells outcomes inside workflows, legal, HR, writing, finance ops, support, and vertical execution.

Applied tends to price better when the product ties to budgets, renews predictably, and expands across adjacent workflows, and it compresses when it is easy to bundle or replace.

This article uses that split to explain where premiums are still clearing in Q1 2026, where they are compressing, and why similar stories land at very different valuation outcomes.

AI multiples in Q1 2026 split harder as investors repriced underwriting certainty over headline growth. Public comps anchored what is defensible, private rounds priced scarcity-driven upside, and M&A enforced ROI and integration reality. Core AI earns premiums only when it becomes indispensable infrastructure with an improving cost curve; otherwise it compresses fast. Applied AI holds up when it sells a renewable workflow with clear budget ownership, repeatable rollout, and expansion, and compresses when it is replaceable or services-heavy.

- Why this split is showing up now

- Why Applied AI tends to price more consistently than Core AI?

- Core AI: where premiums survive and where they don’t?

- Applied AI: where premiums survive and where they don’t?

- The dataset behind the Core vs. Applied view

- Summary

- Key Takeaways

- Answers to The Most Asked Questions

Why this split is showing up now

The Core vs. Applied distinction has existed for years. What changed in Q1 2026 is that investors started using it as a shortcut for one question: where does underwriting risk actually sit.

Core AI carries structural uncertainty that is hard to hand-wave away. Capability diffuses quickly, open alternatives keep improving, and price competition tends to show up faster than teams expect.

Even when a Core company is genuinely ahead, buyers often treat performance as a moving target and push for better economics each renewal cycle. That makes Core outcomes increasingly hinge on defensible distribution, a clear billable unit, and proof that margins improve as usage scales.

Applied AI has its own risks, but they are easier to diligence. Buyers can point to a workflow, a budget line, and measurable impact.

When an Applied product is embedded in a recurring process, renewals become operational rather than discretionary. That reduces the number of “ifs” in the story, which is exactly what the market has been repricing.

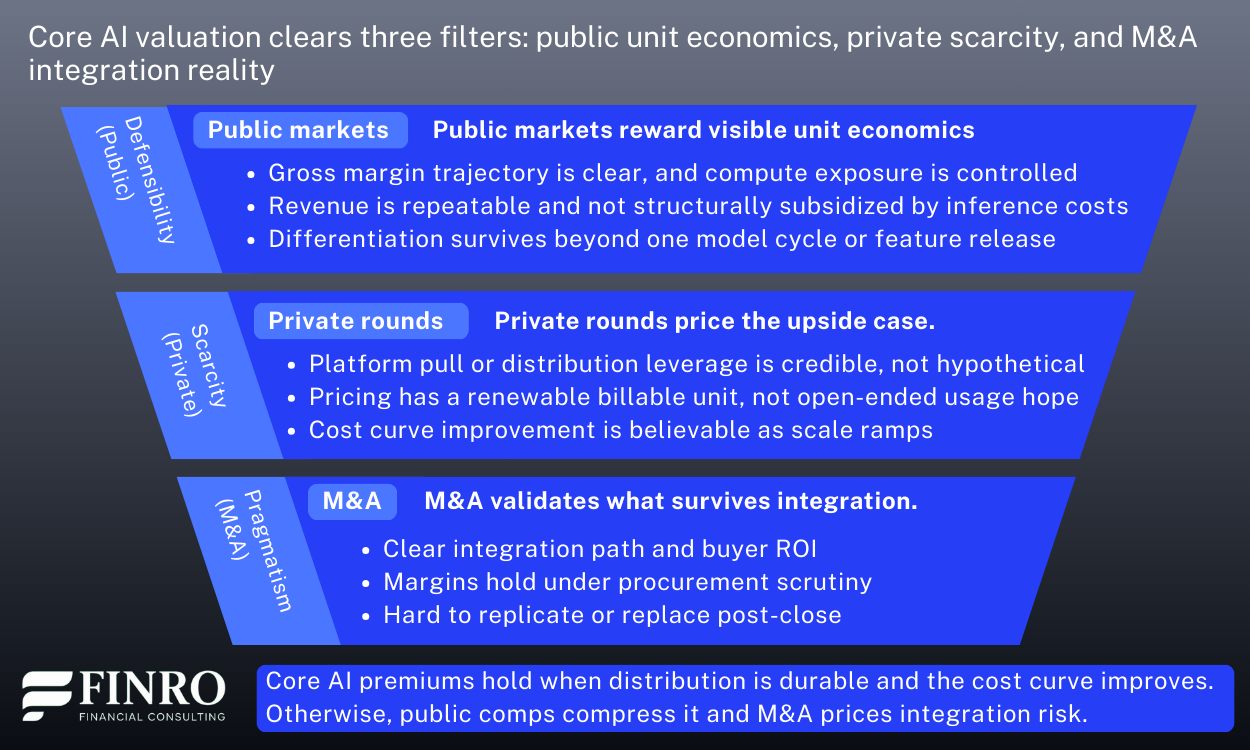

This is also where the public, private, and M&A lenses start to align. Public comps tend to punish weak gross margin trajectory and unclear unit economics. Private rounds can still pay for upside, but only when scarcity and category leadership feel credible.

M&A is the strictest filter because it has to clear a buyer’s ROI model and integration reality, which is why acquisition pricing tends to be more grounded. When you map companies to Core or Applied, you can usually predict which of these filters they will clear most easily.

The practical takeaway is that “Core vs. Applied” is not a tech taxonomy. It is an underwriting taxonomy. It explains why two companies can both be “AI companies,” both be growing quickly, and still see very different valuation outcomes.

What’s Driving the Valuation Gap in AI?

The most important AI valuation signal right now is not the average multiple. It is how aggressively the market separates the same story into very different outcomes.

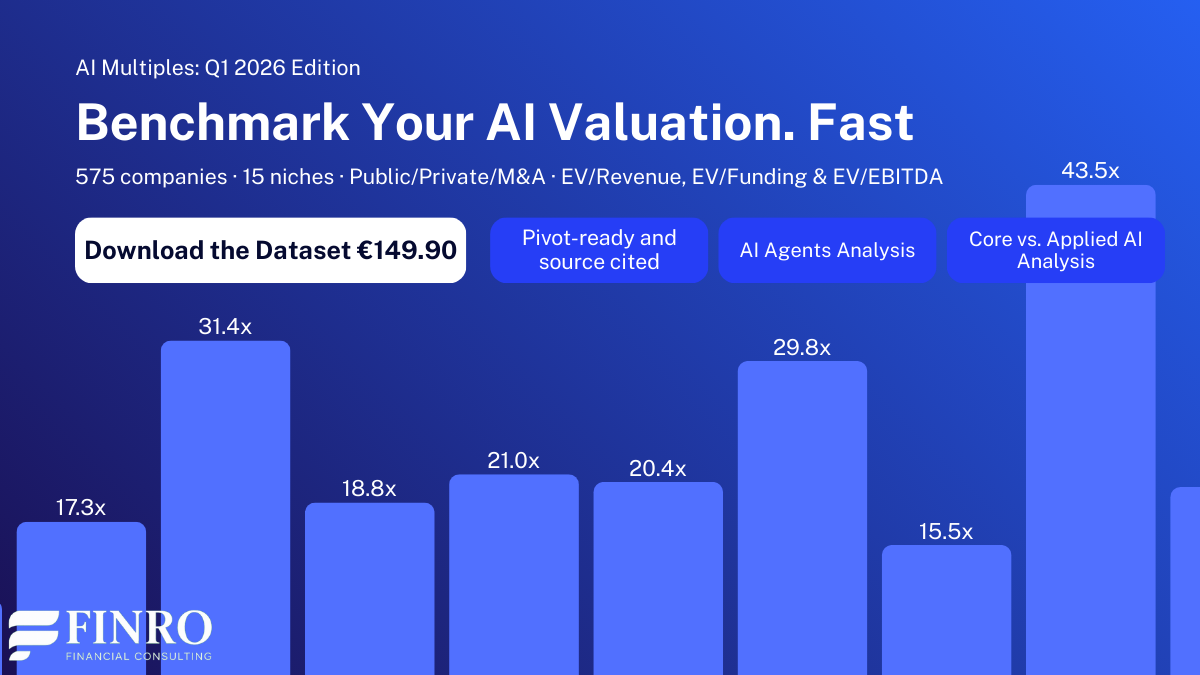

Based on an analysis of ~580 AI companies across public comps, private rounds, and M&A, three valuation signals show up clearly. Public comps define the reference range for AI exposure, running roughly 2.0x to 41.0x EV/Revenue, and that sets the bar for what a premium needs to earn.

Private rounds express the upside case when investors believe an asset is scarce and can compound into category leadership, which is why private pricing concentrates higher at roughly 10.5x to 37.3x. M&A is the most pragmatic filter because it has to clear a buyer’s ROI model and integration reality, so deals tend to land in a more grounded 2.3x to 26.8x range.

Taken together, those ranges explain the market signal better than any single “AI multiple.” Public markets anchor what is defensible, private markets pay for scarcity-driven upside, and M&A enforces what is actually monetizable.

What determines which range a company tends to clear is not the word “AI.” It is where the company sits in the stack. In practice, most of the separation becomes legible once you split the market into two functional layers: core and applied.

Core AI sells the rails, meaning models, infrastructure, and developer tooling. Applied AI sells outcomes inside workflows, such as legal, HR, writing, finance ops, and vertical execution.

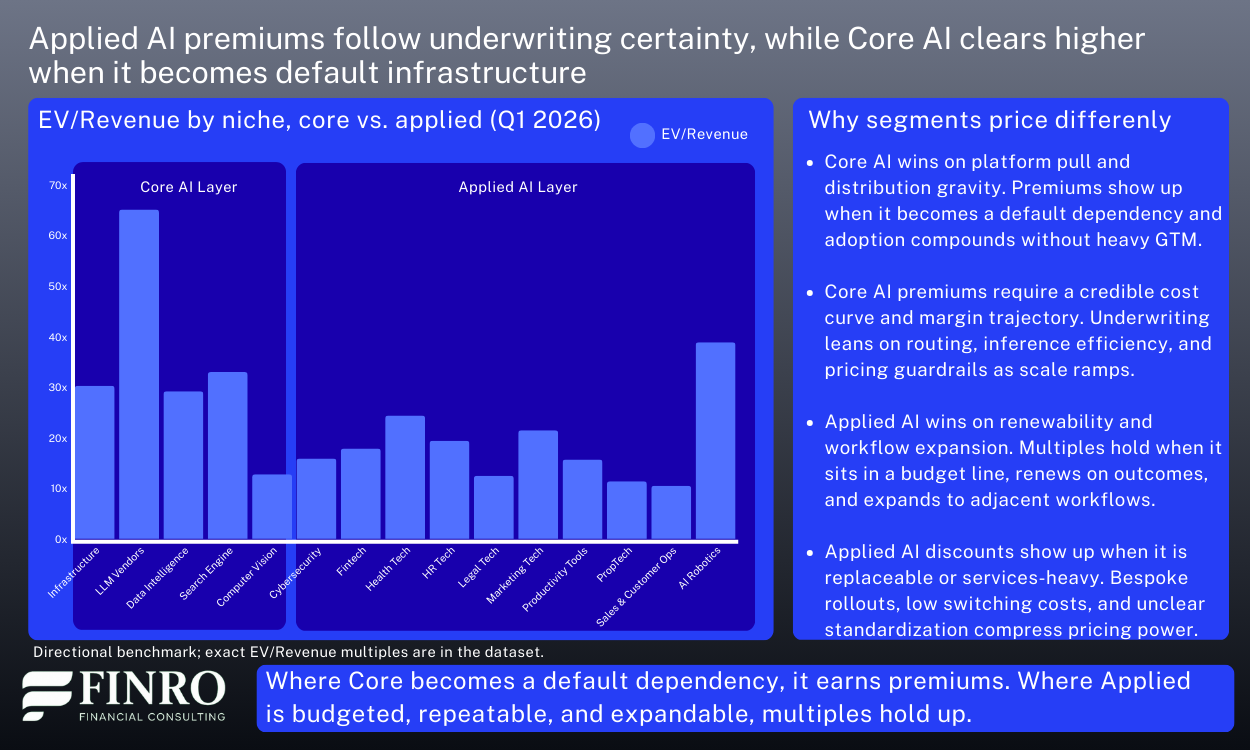

That split explains most of the dispersion. Core AI can command premium pricing when it becomes picks-and-shovels infrastructure other companies must build on. When an infrastructure asset becomes a workflow primitive with expansion pull, private pricing can clear premium territory even before margins fully mature, because underwriting is about platform leverage and durability, not near-term profitability.

Applied AI is where multiples separate into clearer tiers. Enterprise workflow leaders still earn strong pricing power when the product ties to a budget line, renews predictably, and expands across adjacent workflows. The long tail prices very differently when the product is easier to replace, harder to standardize, or effectively sold as a feature.

Net, “AI multiples” are not one benchmark. Valuations are being set by where the company sits in the stack, how scarce that position is, and how clearly revenue translates into durable economics.

Core AI: where premiums survive and where they don’t?

The earlier sections set the lens. Core AI is where repricing is most unforgiving, because the product sits closer to compute economics, fast capability diffusion, and procurement pressure.

Premiums still clear in Q1 2026, but only when a company passes three tests at once: defensibility in public markets, scarcity-driven upside in private rounds, and pragmatism in M&A.

Public markets reward visible unit economics. In Core AI, “better models” is not the value proposition investors pay for. What holds up is margin trajectory, controlled compute exposure, and revenue that is repeatable rather than structurally subsidized.

Private rounds still pay for scarcity, but it has to look structural. That is why LLM Vendors sit at the top of the Core layer in Q1 2026, with private EV/Revenue averaging ~79.7x and an overall category average of ~65.2x. The premium is underwriting platform pull and distribution leverage, not current profitability.

M&A is the reality check. Buyers still pay for strategic Core assets, but pricing has to clear integration and ROI constraints. You see that gap in LLM Vendors, where M&A averages ~54.8x versus private ~79.7x, and in Infrastructure, where pricing is strong but more grounded (~33.2x private, ~26.4x M&A, ~30.3x overall). Segments that are easier to bundle or replicate compress faster; for example, Computer Vision clears at ~12.8x overall in Q1 2026 (~10.1x public, ~11.9x M&A).

Net, Core AI premiums survive when the product becomes a dependency, and the cost curve is credibly improving. They compress when differentiation relies on the next release cycle, switching costs are low, or compute economics remain the hidden subsidy.

Applied AI: where premiums survive and where they don’t?

Up to here, the pattern is clear. “Core vs. applied” is not a taxonomy exercise, it is the fastest way to explain why some valuation outcomes stay intact while others get marked down. With that lens in place, Applied AI is the part of the stack where pricing looks more explainable, but also more ruthless about what is actually selling.

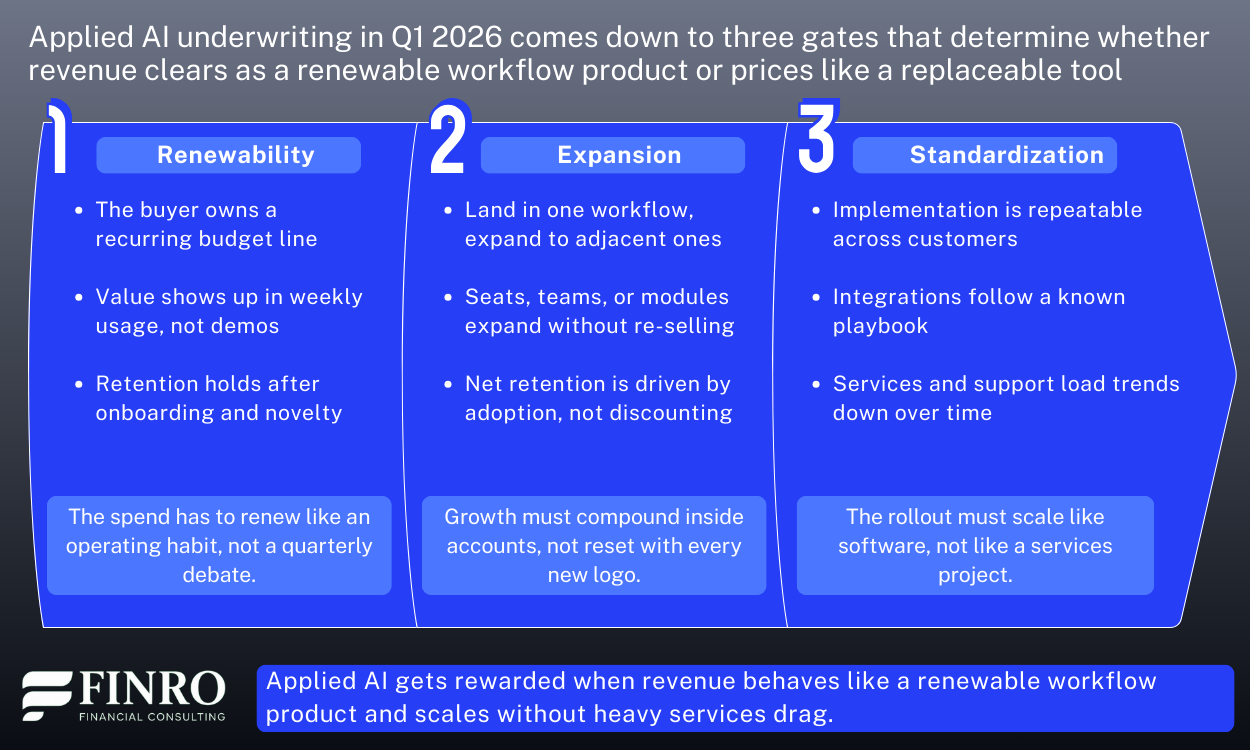

In Q1 2026, Applied AI does not earn a premium for being impressive. It earns a premium for being renewable. The market is rewarding products that show up as a line item, get used inside a recurring process, and expand without turning every deployment into a services project.

Public comps tend to keep Applied pricing honest. When an offering looks like a feature that can be bundled into an existing suite, or when revenue quality depends on heavy implementation, public multiples compress quickly. When the product behaves like software that renews on habit and expands on usage, the floor is materially higher.

Private rounds are where Applied leaders still clear strong outcomes. The premium shows up most consistently in enterprise workflows where ROI can be defended, procurement is repeatable, and expansion has a clear path. That is why Legal and HR leaders can still carry premium marks, with examples like Harvey around ~80x and Rippling around ~30x, while many “AI-enabled” point solutions cluster much closer to the market’s baseline.

M&A is where the market draws the hardest boundary. Strategic buyers will pay for Applied assets that already own workflow adoption and can be integrated cleanly, but they discount anything that looks like it will be hard to standardize post-close. Even within Legal, you see more grounded outcomes for mature platforms like Icertis at ~14x and Ironclad around ~23x, reflecting how quickly pricing snaps back to integration reality.

Net, Applied AI premiums survive when the product is embedded, renewal is the default, and expansion is mechanical. They compress when the product is easy to swap, easy to bundle, or still relies on bespoke delivery to make the numbers work.

The dataset behind the Core vs. Applied view

If the Core vs. Applied split feels sharper in Q1 2026, it is because the market is no longer rewarding “AI exposure” in the abstract. It is rewarding where value accrues and how reliably it compounds. The practical challenge is that most comps sets do not let you see that separation cleanly across transaction types and segments.

Finro’s Q1 2026 AI Valuation Multiples dataset is built to make the split benchmarkable. It covers public comps, private rounds, and M&A across the AI stack, fully tagged by segment so you can compare Core versus Applied on a like-for-like basis and understand which signals are anchoring outcomes.

You can use it to triangulate three things quickly. What the public market treats as defensible. What private rounds are still willing to pay for when scarcity looks real. And what pricing actually clears when a buyer has to underwrite ROI and integration.

The file includes 575 companies across 15 AI segments, with multiples such as EV/Revenue and EV/Funding, plus summary views by segment and transaction type, and dedicated cuts for Core vs. Applied and agentic exposure. It is designed to be pivot-ready so you can build a comps view, pressure test a valuation range, or sanity check a round narrative in minutes.

A link to the dataset is included below for anyone who wants the full reference set behind the benchmarks discussed here.

Summary

Core vs. Applied is not a semantic distinction in Q1 2026. It is the cleanest way to explain why similar “AI” stories land at very different valuation outcomes.

Core AI can still clear premium revenue multiples, but the bar is structural. Premiums hold when the product becomes a dependency in the stack, distribution is durable, and the cost curve is credibly improving. Where differentiation relies on the next release cycle, switching costs are low, or compute remains the hidden subsidy, public comps compress quickly and M&A prices the asset through integration and ROI risk.

Applied AI behaves differently because underwriting is closer to the budget. Multiples hold when revenue renews like an operating habit, expands inside accounts without constant re-selling, and the rollout scales like software rather than services.

When value is harder to standardize, deployments stay bespoke, or the product is easy to bundle, pricing compresses into the “replaceable tool” tier even if the product looks impressive.

Taken together, the takeaway is practical. In Q1 2026, valuation outcomes are being set less by the label “AI” and more by where the company sits in the stack and how predictably revenue converts into durable economics.

If the business reads as a dependency with an improving cost curve, the market pays up. If it reads as a feature with fragile margins or fragile renewals, the market reprices it fast.

Key Takeaways

Q1 2026 repriced underwriting certainty, not “AI.” Revenue quality, margin trajectory, and renewability drive outcomes more than growth.

Public markets set defensible ranges, private rounds price scarcity-driven upside, and M&A anchors valuations to integration and ROI reality.

Core AI premiums survive when distribution is durable and compute economics improve; otherwise, differentiation diffuses, and multiples compress quickly.

Applied AI prices best when tied to budgeted workflows with predictable renewals and expansion; feature-like tools face faster commoditization discounts.

“AI multiples” are not one benchmark; valuation is set by stack position, replaceability, and how cleanly revenue converts into durable economics.

Answers to The Most Asked Questions

-

They vary widely by segment and deal type. Public comps set defensible ranges, private rounds price scarcity upside, and M&A anchors what clears real ROI.

-

They reflect different filters. Public markets demand visible economics, private investors underwrite upside, and acquirers price integration risk and near-term payback.

-

Core AI sells the rails like models, infrastructure, orchestration, and tooling. Applied AI sells outcomes inside workflows like legal, HR, finance ops, and support.

-

Premiums follow durability. Clear monetization, improving margins, renewability, and distribution advantage support higher pricing. Replaceable products with unclear unit economics get repriced.

-

Benchmark by stack position and transaction type. Compare to the closest segment peers, then triangulate public defensibility, private scarcity premium, and M&A realism.