Startup Financial Forecasting: The 9 Most Costly Mistakes (and How to Fix Them)

Most founders build financial forecasts to show big numbers and impress investors.

Investors build them to evaluate risk, judgment, and founder thinking.

This is why the majority of startup forecasts fail. The math is often fine, but the underlying logic is unrealistic. Founders overestimate adoption, underestimate churn, apply generic growth curves, treat all costs the same, or ignore cash flow entirely.

The result is a forecast that looks good in a slide deck but collapses under basic investor scrutiny.

A credible forecast is not about predicting the future perfectly.

It is about proving that you understand how your business works and how it will scale.

In this guide, we break down the 9 most costly forecasting mistakes startups make, why investors spot them instantly, and how to fix each one with smarter, more realistic modeling.

Let us start with the most common and most dangerous mistake founders make when building revenue.

TL;DR

A strong startup forecast is not a spreadsheet full of guesses but a strategic model that explains how growth actually happens, connects revenue to real drivers, builds in unit economics and retention, forecasts costs based on how the business scales, models cash flow and runway, prepares for upside and downside scenarios, aligns capital with milestones, and turns financial planning into a decision-making system that earns investor trust and guides the company toward sustainable, compounding growth.Topics covered in this article

- Mistake #1: Top-Down or “Spreadsheet Magic” Revenue

- Mistake #2: Overestimating Early Adoption and Speed to Scale (Years 1–3)

- Mistake #3: Unrealistic Long-Term Growth Curves.

- Mistake #4: Ignoring Unit Economics

- Mistake #5: Treating All Costs as Linear or % of Revenue.

- Mistake #6: No Scenario Planning / No Stress Testing?

- Mistake #7: Underestimating Retention (The Silent Growth Killer)

- Mistake #8: Confusing Profit with Cash

- Mistake #9: Forecasting Without Milestones or Capital Strategy

- Models as Strategy: How Great Founders Use Financial Models

- Why the Best Founders Choose Finro to Build Their Financial Models?

- Summary: Financial Forecasting Is Not About Guessing the Future. It Is About Building It.

- Key Takeaways

- Answers to The Most Asked Questions

Mistake #1: Top-Down or “Spreadsheet Magic” Revenue

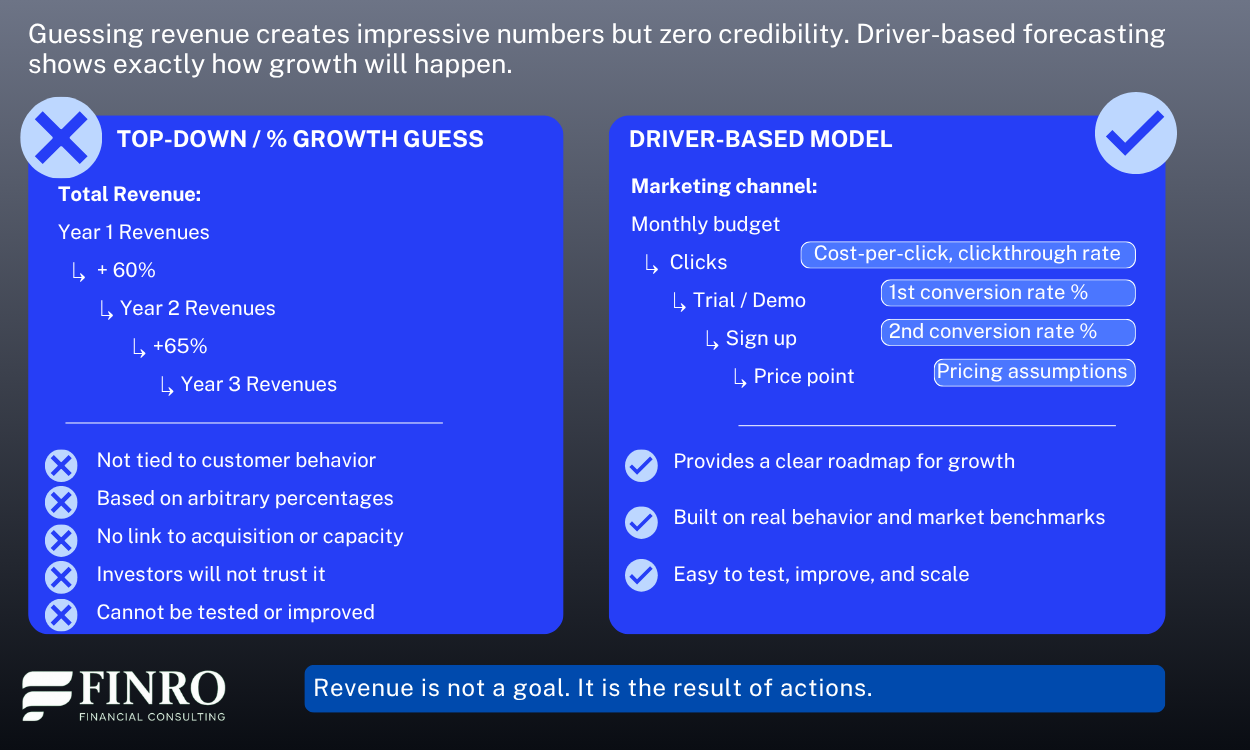

Many founders start forecasting revenue by picking a large market size and then guessing a percentage they will capture. Others set an annual revenue target and divide it evenly across months with a growth formula. These approaches create impressive numbers but no credible path to achieving them.

Why investors reject it:

Top-down forecasts have no connection to real customer behavior, go-to-market motion, pricing, retention, or capacity. If you cannot explain exactly how each dollar of revenue is created, investors assume you do not understand your own business model.

What great forecasts do instead:

They build revenue bottom-up using drivers and assumptions that mirror reality:

How many leads or signups per month

Conversion rates at each stage

Pricing and packaging

Usage or transaction volume

Retention and expansion over time

Sales capacity or channel limits

When revenue is tied to clear mechanics, investors can test assumptions, adjust scenarios, and trust your logic even if the final number changes.

Driver-based revenue is not just more accurate. It proves that you understand how growth is actually created.

Next, let us look at the second mistake, which often ruins forecasts even when the revenue logic looks sound.

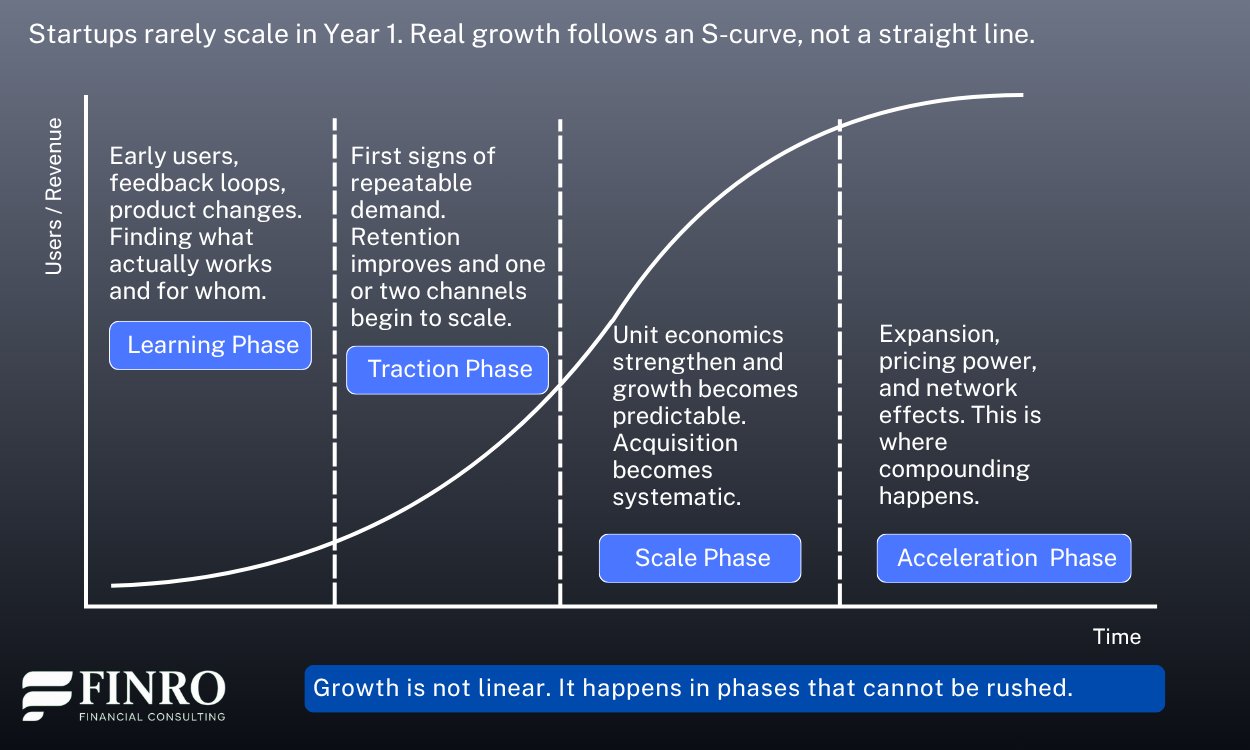

Mistake #2: Overestimating Early Adoption and Speed to Scale (Years 1–3)

Many founders assume that once the product is launched, users or customers will adopt it quickly and growth will accelerate smoothly. In reality, the path from launch to scalable traction is slow, uneven, and full of iteration.

It often takes one to three years to find true product-market fit, build repeatable acquisition channels, establish trust, and create a growth engine that compounds.

Why investors reject it:

When a forecast shows rapid adoption in Year 1 with no historical traction, investors do not see ambition. They see inexperience. They know early growth is messy, retention is fragile, and confidence must be earned through tested assumptions, not optimistic curves.

What great forecasts do instead:

They model adoption in realistic phases:

Learning phase: slow adoption, feedback loops, product iteration

Traction phase: early channel effectiveness, improved retention

Scale phase: repeatable growth, stronger unit economics

Acceleration phase (only if earned): expansion, pricing power, network effects

Growth is not a straight line. It is an S-curve. Great forecasts respect the time it takes to build momentum and show investors that scale will be based on proof, not hope.

Next, let us look at how unrealistic long-term growth curves create even bigger problems as the forecast expands over multiple years.

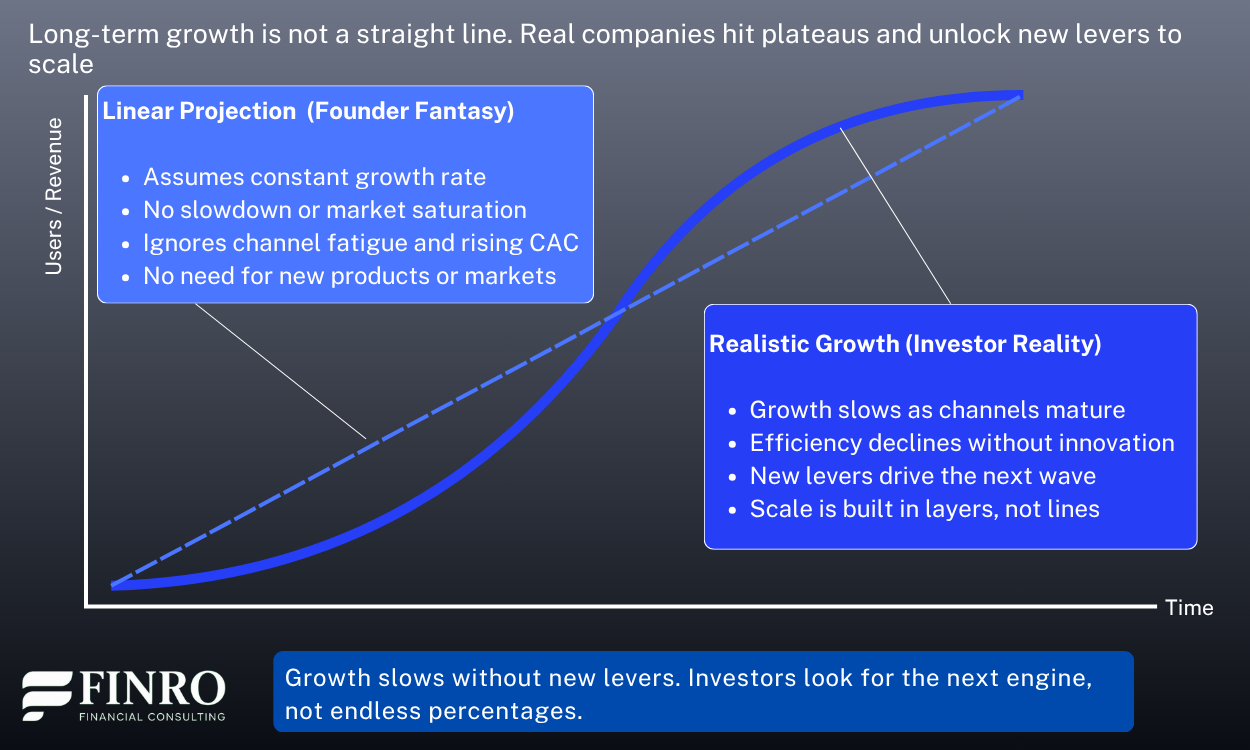

Mistake #3: Unrealistic Long-Term Growth Curves.

After overestimating early adoption, many founders make the opposite mistake in later years. They assume growth will continue at the same rate indefinitely, often projecting smooth, linear increases or aggressive percentage jumps every year. The model shows perfect scalability with no friction, no saturation, and no diminishing returns.

Why investors reject it:

Experienced investors know that growth gets harder over time. Markets segment, acquisition costs rise, conversion rates flatten, and competition responds.

Even great companies experience plateaus or must unlock new channels, markets, or products to maintain momentum. When a forecast shows endless acceleration, investors see a founder who has not thought through scale.

What great forecasts do instead:

They shape the future using realistic growth patterns:

Slower growth after market saturation

Diminishing returns on existing channels

The need for new markets or products

Expansion into enterprise or international segments

Strategic inflection points instead of smooth lines

Great forecasts are not about showing constant growth. They are about showing how growth evolves and what levers will drive each stage. This proves to investors that you understand scaling is not automatic. It must be engineered.

Next, let us look at the mistake that destroys growth even faster than bad assumptions: ignoring unit economics.

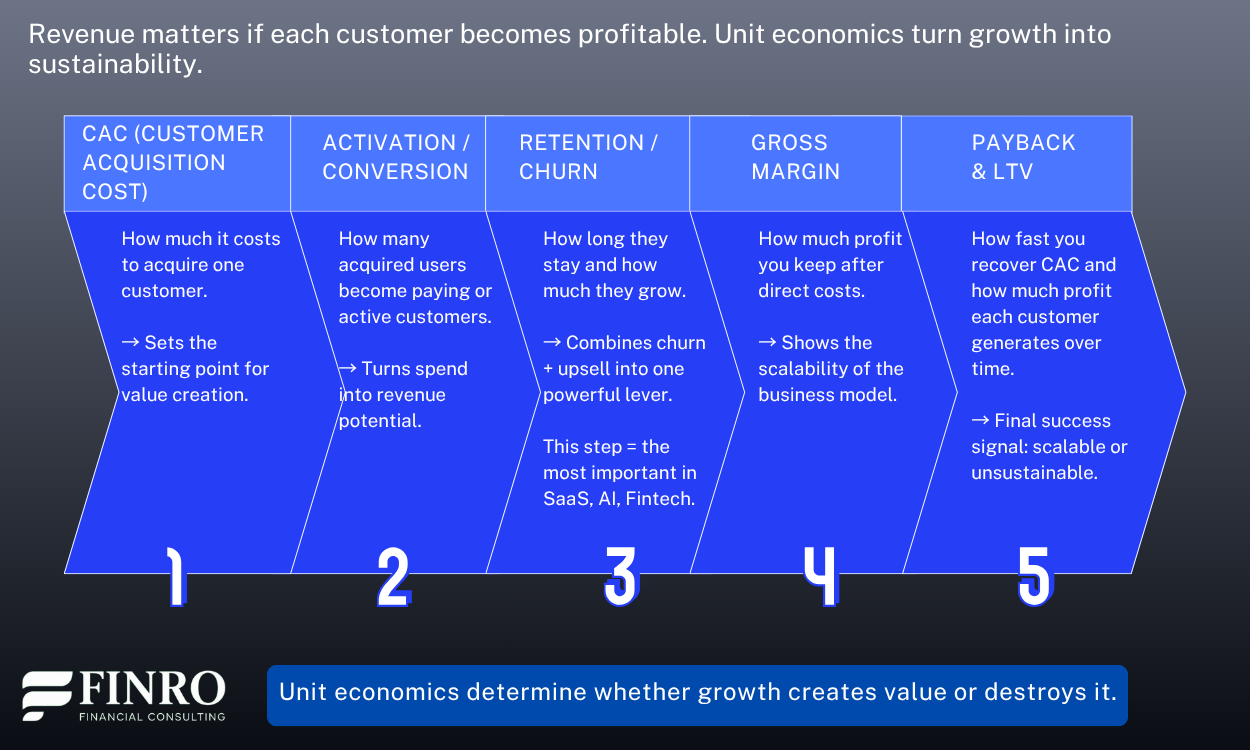

Mistake #4: Ignoring Unit Economics

Many founders build forecasts that show revenue growth but completely skip the mechanics of how profitable each customer or transaction actually is.

They model top-line numbers while leaving out core metrics like CAC, LTV, gross margin, churn, or payback period. On paper, the business grows. In reality, it may lose money faster with every new customer.

Why investors reject it:

Revenue without unit economics is meaningless. Investors care far more about the efficiency and sustainability of growth than the size of the top line. If every dollar of revenue costs more than it makes or takes years to pay back, the model is not scalable.

A forecast that ignores churn, pricing, and margin improvement tells investors the founder does not understand the business engine.

What great forecasts do instead:

They build revenue and cost assumptions directly from unit-level logic:

CAC based on channels or sales motion

LTV driven by retention and expansion

Gross margin by product type or plan

Payback period to validate efficiency

Unit economics improvement as the company scales

Great founders do not just project revenue. They show how each customer becomes profitable and how profitability improves over time. This proves that growth will compound instead of collapse.

Next, let us look at the cost side of the model and the mistake that makes expenses just as dangerous as weak revenue assumptions.

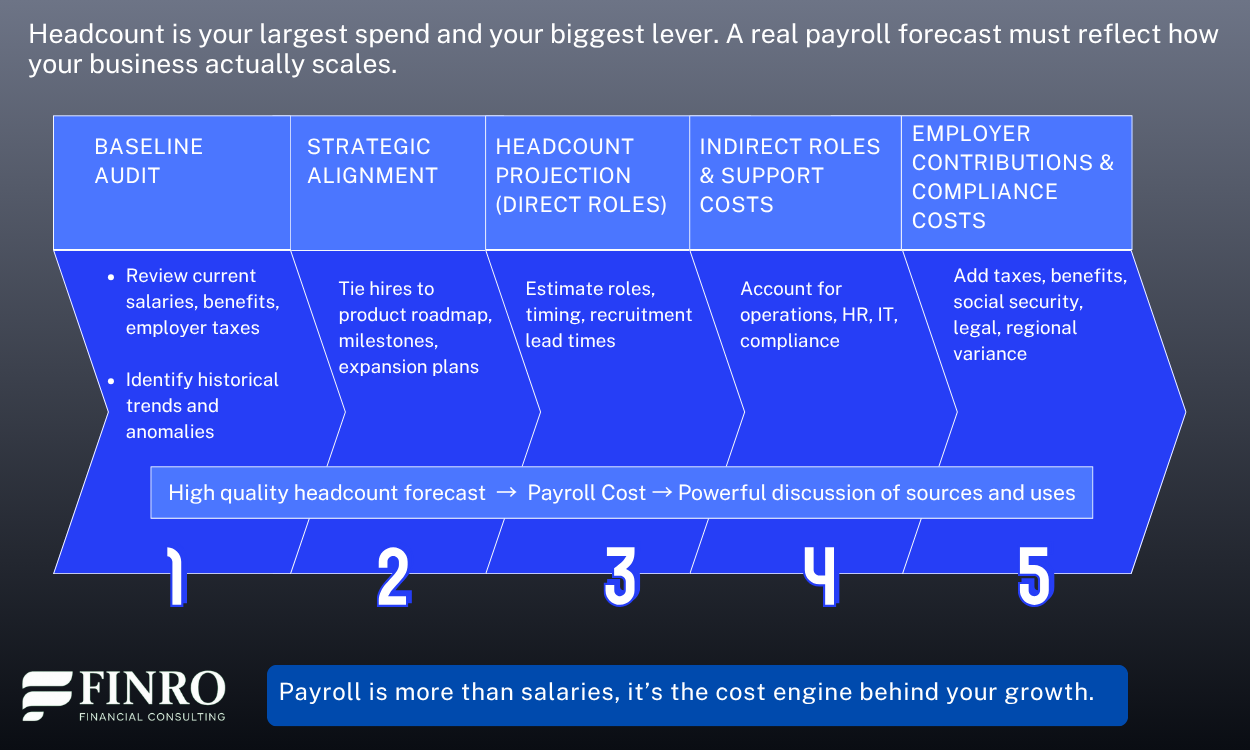

Mistake #5: Treating All Costs as Linear or % of Revenue.

Many founders forecast expenses by applying a flat percentage of revenue or increasing every cost at the same rate.

This approach looks clean in a spreadsheet but ignores how costs behave in a real startup. Some costs scale with users, others with headcount, others jump in steps, and some do not scale at all.

Why investors reject it:

Costs do not grow smoothly. Salaries increase in chunks when new teams are added. Infrastructure spending can spike when usage scales. Marketing spend must rise to access harder segments.

If the model treats all expenses as linear, investors know the forecast is disconnected from operational reality and hides the true burn profile.

What great forecasts do instead:

They model costs based on how the business actually operates:

Headcount added by role and timing

Sales and marketing tied to channels and CAC

Infrastructure and tooling based on usage or customers

Step-change costs when hitting new scale thresholds

Efficiency gains as the company matures

Great founders do not just predict “how much” they will spend. They show “why” and “when” each cost is needed. This proves they understand both growth mechanics and capital allocation.

Next, let us look at the forecasting mistake that exposes every model under pressure: the absence of scenario planning.

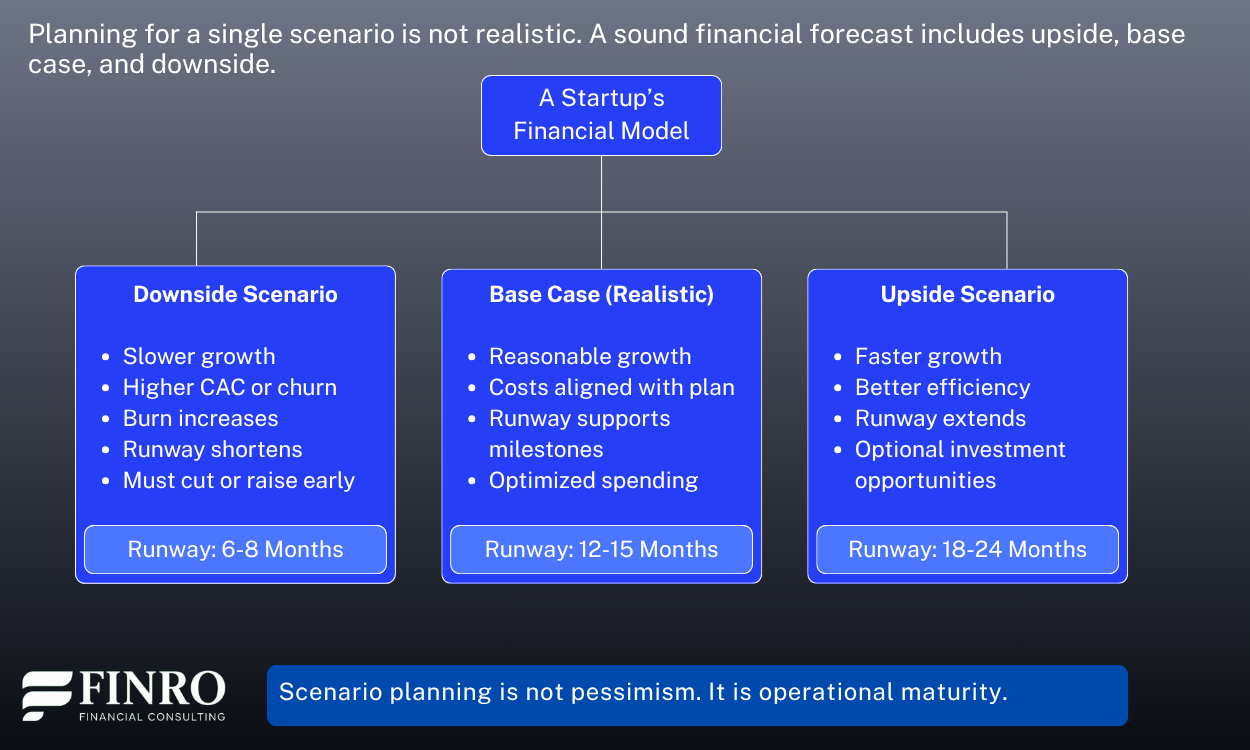

Mistake #6: No Scenario Planning / No Stress Testing?

Many founders build a single forecast and treat it as the truth. They model “the plan” with perfect execution, stable pricing, on-time hiring, and smooth growth.

But real startups face delays, pricing pressure, churn spikes, hiring gaps, and unexpected costs. Without scenarios, the model becomes a wish, not a tool for decision-making.

Why investors reject it:

Investors know the plan will not go exactly as forecasted. What they want to see is how the business performs under different conditions: slower growth, higher costs, lower conversion, delayed funding. If the model only works in the best case, it is not credible. Founders who cannot answer “what if?” are not ready to manage risk.

What great forecasts do instead:

They build a flexible model that can be stress tested and adapted.

They show:

Base case: Most realistic scenario

Upside case: Faster growth with stronger efficiency

Downside case: Slower traction or higher burn

Cash runway in each scenario

Trigger points and decisions if things change

Great founders do not try to be perfect. They show investors they are prepared. A forecast that can handle volatility earns more trust than a forecast that pretends volatility does not exist.

Next, let us look at the mistake that compounds all of the above: ignoring retention and lifetime value, which silently destroys even the strongest top-line growth.

Mistake #7: Underestimating Retention (The Silent Growth Killer)

Many founders obsess over acquiring new users but ignore whether those users stay, use the product, or expand over time.

Their forecasts show strong top-line growth, yet churn, downgrade, and inactivity quietly erode revenue every month. A model that assumes customers stay forever will always look great on paper—and collapse in real life.

Why investors reject it:

Retention is the strongest indicator of product-market fit and long-term value. If customers do not stick around or spend more over time, growth is a treadmill. You are constantly replacing lost customers just to stay flat.

High churn signals weak product value and broken economics. Investors know that poor retention destroys even the best acquisition strategy.

What great forecasts do instead:

They model retention just as carefully as acquisition:

Track churn by cohort or segment

Model revenue decay over time

Include expansion or upsell to boost LTV

Forecast net revenue retention, not just gross revenue

Show how retention improves as the product matures

Great founders understand that growth is not just about getting customers in the door. It is about keeping them and increasing their value over time. Retention turns growth from a sprint into compounding momentum.

Next, let us look at another common mistake: treating milestones and fundraising as calendar events instead of performance-driven triggers.

| Acquisition-Only Model | Retention-Driven Model | |

|---|---|---|

| Growth Source | New customers only | New and existing customers |

| Churn Impact | Revenue leaks every month | Revenue compounds over time |

| LTV | Low | High and increasing |

| CAC Efficiency | Declines as growth slows | Improves as retention rises |

| Net Revenue Retention | Under 100% | Over 100% |

| Outcome | Growth stalls | Growth accelerates |

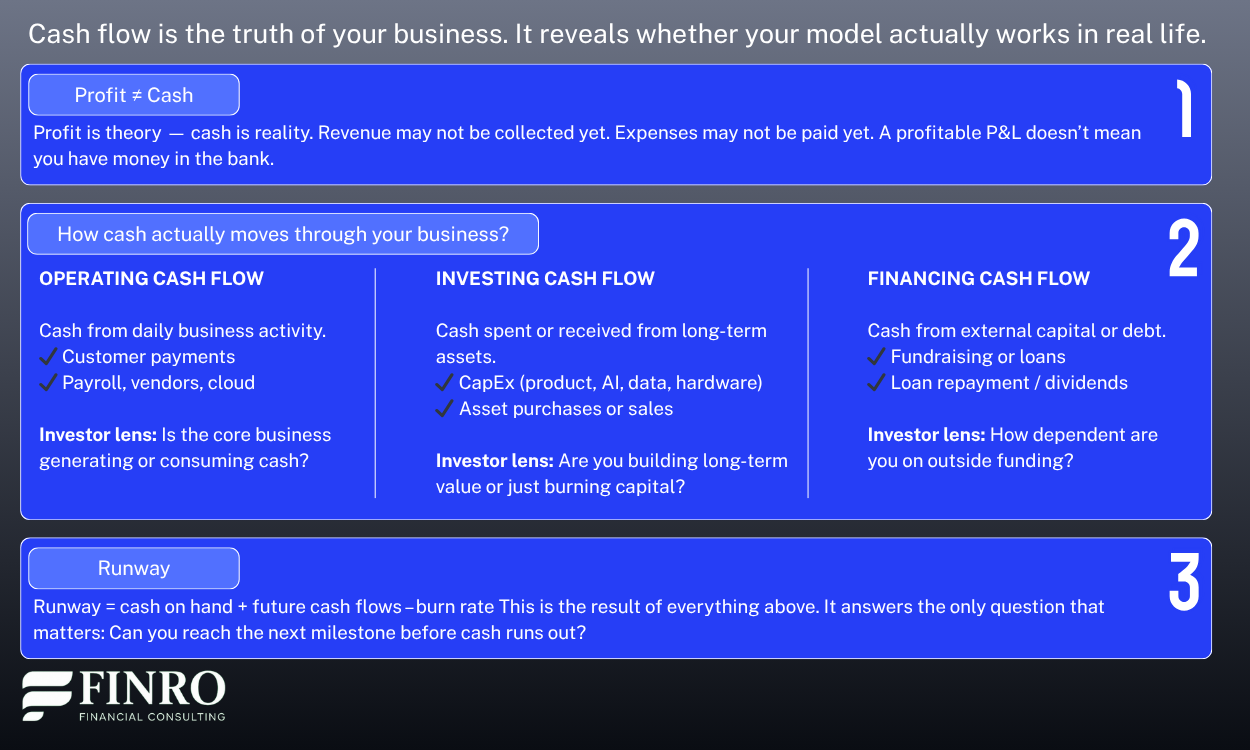

Mistake #8: Confusing Profit with Cash

Many founders assume that if the income statement shows profit, the business is financially healthy. But profit is an accounting outcome, not actual money in the bank. Revenue can be recorded before cash is collected. Expenses can be recognized after cash is spent.

Capital expenditures, loan payments, and working capital swings do not appear on the profit and loss statement at all. A startup can show profit and still run out of cash.

Why investors reject it:

Cash flow determines survival and runway. Profit does not pay salaries, vendors, or cloud bills—cash does. When a model ignores cash timing, investors know the forecast could collapse under real operating conditions. If a founder cannot explain how profit turns into cash (or why it does not), investors see a major risk in financial judgment.

What great forecasts do instead:

They connect profit to cash using realistic assumptions and timing:

Revenue collection lag or billing cycles

Payment terms to vendors and contractors

Capital expenditures that reduce cash but not profit

Loan repayments and interest costs

Working capital changes (AR, AP, inventory)

Cash runway in every scenario

Great founders know that profit is optional in the early stages, but cash is not. Cash flow is the truth of the business. It reveals whether the model survives long enough to reach the next milestone.

Next, let us look at the final and most strategic mistake: forecasting without milestones or a capital strategy, which leaves investors wondering why the model even exists.

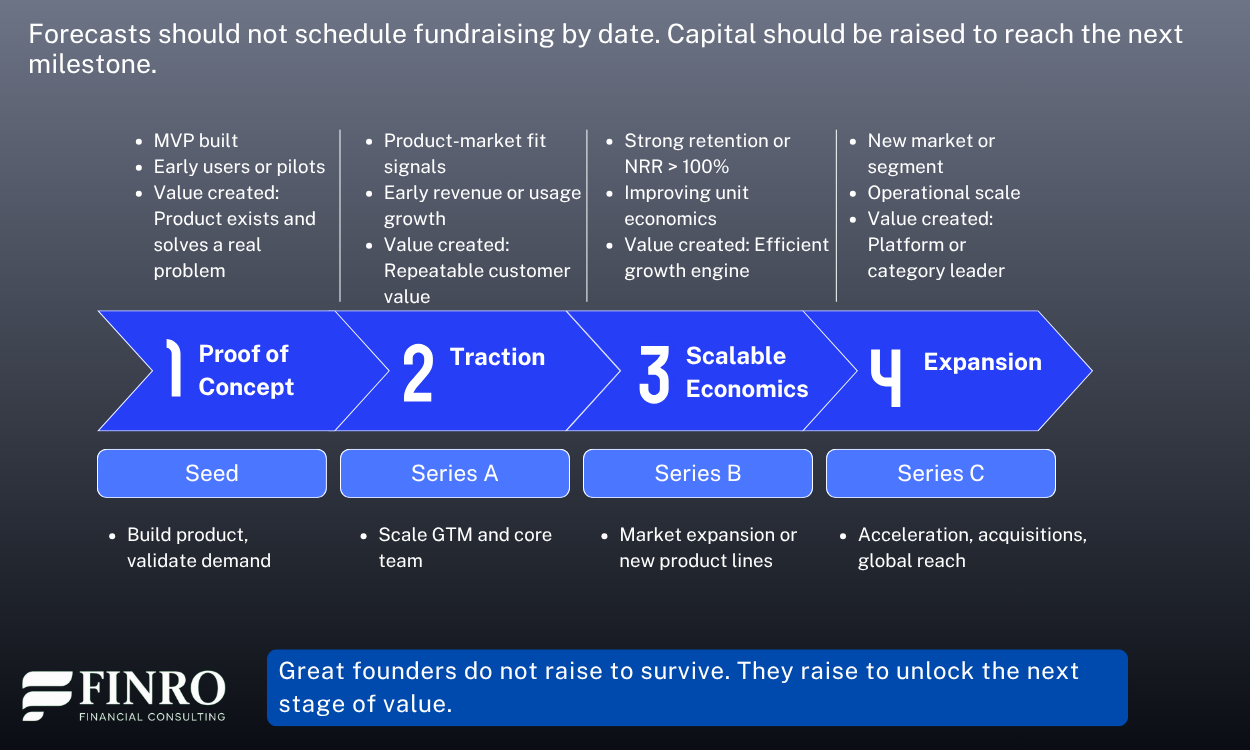

Mistake #9: Forecasting Without Milestones or Capital Strategy

Many founders build forecasts as if growth happens on a calendar. They pick dates for new hires, product launches, and fundraising rounds simply because time has passed. But investors do not fund time. They fund progress. Without clear milestones, the model becomes a collection of numbers instead of a map for value creation.

Why investors reject it:

If the model does not show what each stage of spending achieves, investors cannot see how capital turns into traction, revenue, and valuation. A forecast that says “raise in 12 months” without explaining what will be accomplished before then signals weak planning. Investors want to know what you will prove, not just when you will need more money.

What great forecasts do instead:

They anchor the financial model around milestones and capital decisions:

Product milestones tied to development costs

GTM milestones tied to headcount and marketing spend

Revenue or retention targets tied to fundraising rounds

Runway aligned with specific achievements, not dates

Capital raises sized to reach the next value inflection point

Great founders do not raise money to survive. They raise to unlock the next stage of growth. A forecast that links capital to milestones shows investors that the founder understands sequencing, risk, and value creation.

Now that we have covered the most costly mistakes, let us look at how to build forecasts that earn investor trust from day one.

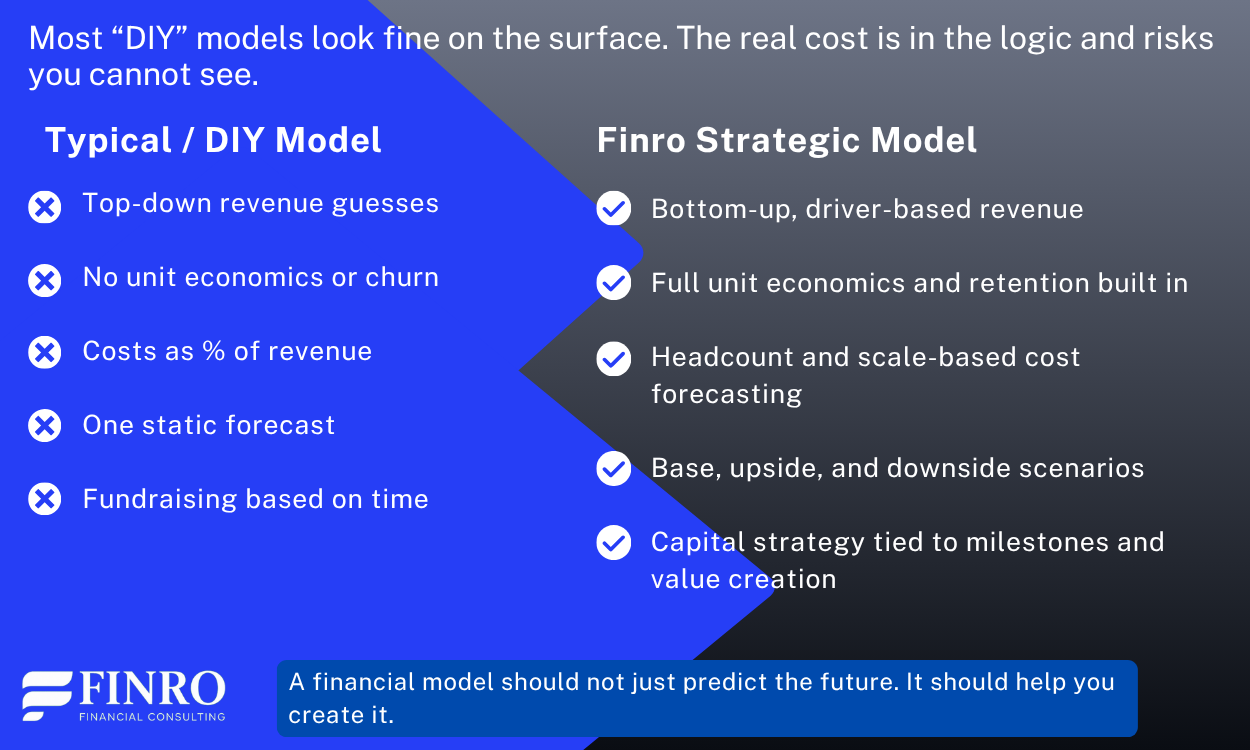

Models as Strategy: How Great Founders Use Financial Models

Most founders treat financial models as a fundraising requirement. They build them because investors ask for them or because a pitch deck needs projections. But the best founders use financial models very differently. They use them to think, to plan, and to build leverage.

A strategic financial model is not just numbers. It is a decision-making system that helps you choose the right markets, sequence your hires, design pricing, test scenarios, and determine exactly how and when to raise capital. It connects product, go-to-market, operations, cash flow, and milestones into one clear narrative of how the company will grow.

A great model answers the most important questions in your business:

What will it take to reach the next stage of value?

What assumptions must be proven or improved?

Where are the risks, and how do we prepare for them?

How much capital do we really need—and what will it create?

How do we turn growth into profitability and long-term scale?

Great founders do not use models to predict the future.

They use models to design it.

In the next section, we will show how Finro builds these kinds of models, and why investors trust the founders who use them.

Why the Best Founders Choose Finro to Build Their Financial Models?

Most firms build spreadsheets.

Finro builds strategic engines.

We do not just plug in numbers. We help you design the logic of your business—how you acquire customers, how your product scales, how your margins improve, and how each round of capital unlocks the next stage of value.

This is why top founders work with us:

We build driver-based revenue models investors trust

We model unit economics, pricing, and retention with precision

We forecast headcount and costs the way startups actually scale

We build scenarios and stress tests so you are never caught off guard

We tie the model to milestones and capital strategy so you know exactly when to raise, how much to raise, and what you must prove

A Finro financial model is not just for fundraising.

It becomes your operating system, used in board meetings, capital planning, hiring decisions, and growth strategy.

Investors know when a founder understands their numbers.

Finro makes sure you are that founder.

Ready to build a model that earns investor trust?

Let’s build the model that scales your company, and proves you are the one to lead it.

Summary: Financial Forecasting Is Not About Guessing the Future. It Is About Building It.

The most common forecasting mistakes are not math errors. They are strategic blind spots. Founders overestimate growth, ignore retention, simplify costs, assume profit equals cash, skip scenarios, and raise capital based on time instead of progress.

These issues do not just make a model inaccurate. They make it unreliable in the real world and unconvincing to investors.

The best founders use financial models as strategic tools. Their forecasts connect assumptions to outcomes, growth to unit economics, spending to milestones, and capital to value creation.

They prepare for upside and downside, understand runway and cash flow, and build models that inform decisions. Not just impress with a pitch deck.

A great financial model does not live in Excel. It lives at the center of how the company plans, operates, and scales.

If you are ready to build a model that investors trust and your team can run on, let’s talk.

Lior was exceptionally professional, knowledgeable, and responsive from day one. He quickly understood the complexity of the WAAS ecosystem and translated our B2B4C rental model (hardware, software, and services) into a clear, scalable financial framework.

The result is a robust, investor-proof model that truly reflects how our business operates and grows. I appreciated how engaged and solution-oriented he was throughout the process.

Thank you, Lior and the Finro team, for your collaboration and valuable contribution to our next stage of growth.

Key Takeaways

1. Accurate forecasts are built on driver-based revenue, realistic adoption pacing, and retention rather than optimistic top-down percentage assumptions.

2. Unit economics, including CAC, LTV, churn, margin, and payback, determine whether growth creates value or accelerates burn.

3. Costs must be modeled by headcount, infrastructure, and step-changes, not as flat percentages that ignore how startups actually scale.

4. Scenario planning with upside, base, and downside cases strengthens decision-making, reveals risk, and builds investor confidence.

5. Capital should be raised to reach milestones and unlock value, not based on timelines or runway guesses disconnected from progress.

Answers to The Most Asked Questions

-

An investor-ready model uses driver-based assumptions, realistic growth, unit economics, scenario planning, and clear milestones that show how capital turns into traction and value.

-

Accurate revenue forecasts start bottom-up using acquisition channels, conversion rates, retention, pricing, and expansion—not arbitrary percentages or top-down market assumptions.

-

Retention increases LTV, improves unit economics, compounds revenue, and lowers CAC over time, making growth more sustainable and far more attractive to investors.

-

Relying on optimistic assumptions without modeling unit economics, cash flow, or scenarios—leading to forecasts that look good on paper but fail in reality.

-

Instead of raising by date, align fundraising with milestones that prove traction, improve valuation, and unlock the next stage of growth.