CAC for Startups: Definition, Formula, and Why It Matters

By Lior Ronen | Founder, Finro Financial Consulting

Customer Acquisition Cost (CAC) is one of the first metrics investors look at and one of the last that many founders truly understand. It seems simple on the surface: how much you spend to win a customer.

But in reality, CAC affects pricing, fundraising, cash flow, growth strategy, and whether your business model can scale at all.

A startup can grow revenue, raise capital, and even look successful externally while a broken CAC quietly erodes margins and shortens runway.

When CAC is too high or calculated poorly, every new customer makes the business weaker, not stronger. When CAC is understood and managed well, each customer becomes an asset that compounds over time.

In this article, we will break down what CAC really is, how to calculate it correctly, why it matters far beyond marketing efficiency, and how great founders use it to drive strategy and build investor-ready financial models.

CAC determines whether growth creates value or burns cash. When calculated accurately and tracked over time, it shapes revenue, unit economics, headcount, runway, and fundraising strategy. High revenue with weak CAC destroys businesses, while efficient CAC compounds growth, improves valuation, and attracts investors. Founders who master CAC build scalable, capital-efficient companie

What Is CAC (Customer Acquisition Cost)?

CAC measures how much it costs to acquire one paying customer. The formula is straightforward:

CAC = Total acquisition spend ÷ New customers acquired

For example, if you spend $50,000 on marketing and sales in a month and gain 100 new customers, your CAC is $500.

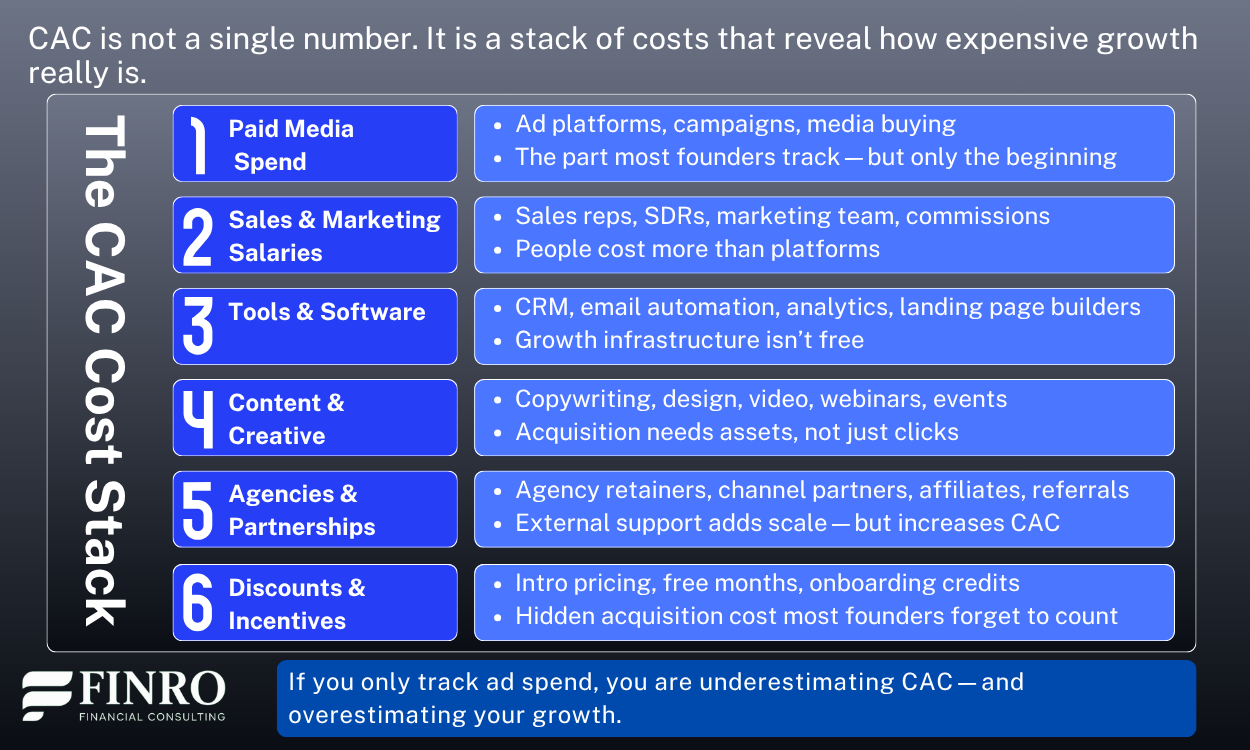

To calculate CAC accurately, you must include all costs involved in winning a customer, not just ad spend. This includes sales salaries, commissions, marketing tools, content production, agencies, events, and any incentives or discounts used to convert leads. CAC reflects the true cost of growth and shows how much you must invest to add revenue.

Here’s a real-life example for an AI startup in 2025.

An AI SaaS startup spends the following in one month to acquire users:

$20,000 on paid ads

$25,000 on sales and marketing salaries

$4,000 on tools (HubSpot, Apollo, Webflow, analytics)

$3,000 on content, webinars, and demos

Total acquisition spend: $52,000

New paying customers: 80

CAC = $52,000 ÷ 80 = $650 per customer

The founder originally thought CAC was just the $20,000 in ad spend ($250 per user). But once salaries, tools, and content were included, the real CAC was more than double.

This is why most founders underestimate CAC and why their models collapse when they try to scale.

Why CAC Matters?

In the previous section, we looked at what CAC is and how to calculate it correctly.

But understanding the number is only the first step. CAC is one of the most important metrics in a startup’s financial model because it determines how fast you can grow, how much capital you need, and whether each new customer strengthens or weakens the business.

If CAC is too high or increasing over time, growth becomes expensive and unprofitable. You burn more cash with every new customer and shorten your runway. If CAC is healthy and improving, each customer generates more value than it costs to acquire them. Growth becomes scalable, efficient, and attractive to investors.

CAC also sits at the center of unit economics, pricing, retention, payback period, and capital strategy. Investors look at CAC to judge the quality of growth, not just the size of it. Two startups can have the same revenue, but the one with better CAC will always be more valuable.

Here are two real startup scenarios that show why CAC matters:

Example 1: Good Revenue, Bad CAC = Growth That Kills the Business

An AI startup grows monthly revenue from $50K to $200K in one year. On the surface, this looks impressive. But as they scale, ads become more expensive and the sales team doubles in size.

CAC rises from $300 to $1,200

LTV is still only $1,000

Each new customer loses $200

Outcome: The faster they grow, the faster they burn cash. Even though revenue is rising, the business becomes weaker. Investors walk away because growth is not sustainable.

Example 2: Slower Revenue, Great CAC = Investor Magnet

Another AI startup grows more slowly, from $50K to $120K per month. Instead of spending aggressively on ads, they improve onboarding, increase conversion, and launch a referral program.

CAC drops from $500 to $250

LTV grows from $1,000 to $1,500

Payback improves from 6 months to 2 months

Net revenue retention hits 115%

Outcome: Each customer becomes more profitable over time. The business needs less capital, has more runway, and investors compete to fund them because the growth is efficient and scalable.

CAC is not just a marketing metric. It is a reflection of how well your entire go-to-market engine works. When you understand CAC deeply and improve it over time, every part of the business becomes stronger.

CAC Over Time: Why the Trend Matters More Than the Number?

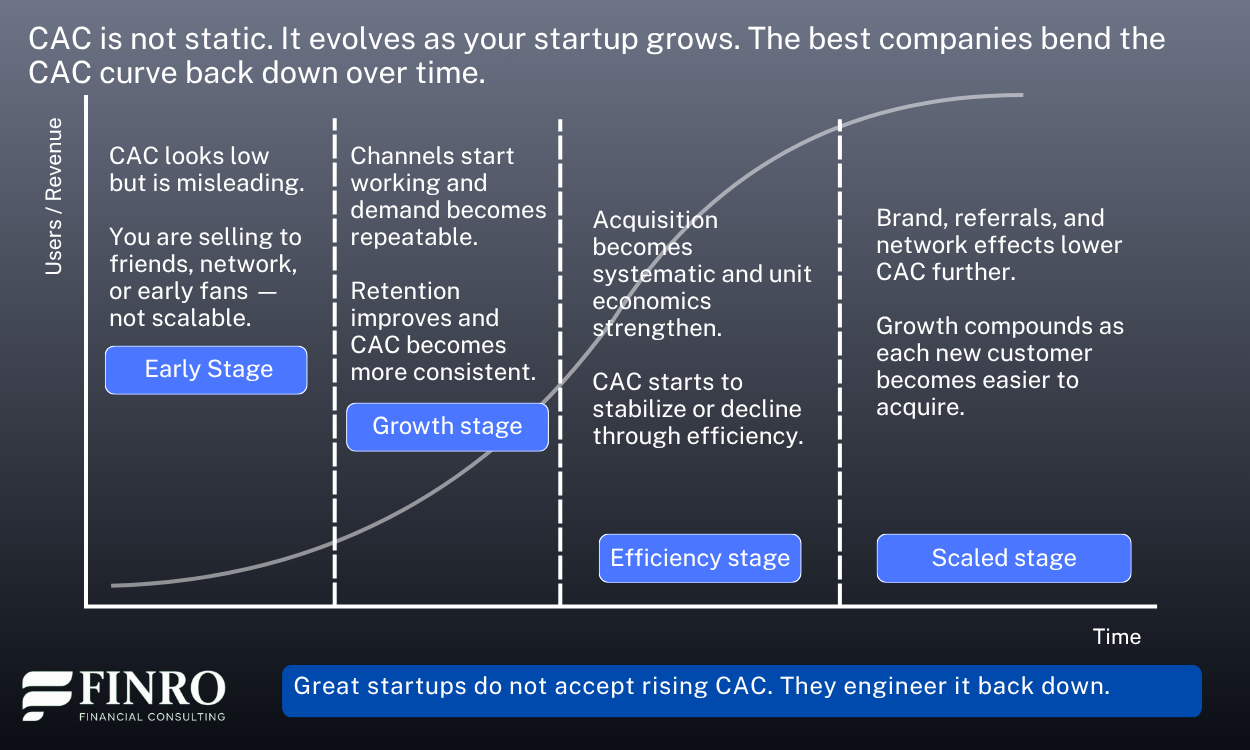

CAC is not a fixed metric. It changes as your startup grows, your channels mature, and the market becomes more competitive. In the early stage, CAC may start low because you are selling to your network or benefiting from early curiosity.

As you scale, CAC often rises when you exhaust the easy leads, hire a sales team, increase paid spend, or enter new segments.

The best companies do not accept rising CAC as inevitable. They build systems that make CAC more efficient over time through better targeting, stronger positioning, higher conversion rates, brand recognition, referrals, and product-led growth.

When the product gets better and retention improves, you can spend less to acquire the next customer.

Investors care more about whether CAC is improving or getting worse than the current number itself. Two startups can both have a CAC of $500, but they are not equal:

If CAC fell from $800 to $500, the business is becoming more efficient.

If CAC rose from $200 to $500, the business is losing efficiency.

Direction matters. A rising or falling CAC tells the real story about product-market fit, channel saturation, and your ability to scale without wasting capital.

CAC in Your Financial Model.

CAC is not just a marketing metric. It is one of the core drivers inside a startup’s financial model because it directly shapes revenue, headcount, runway, and capital needs.

Your revenue forecast is only as credible as your CAC. If CAC is understated, revenue will look inflated and growth will appear too easy.

If CAC is overstated, the model becomes overly conservative and you may raise less capital than you actually need. A realistic CAC tells investors exactly how much it costs to acquire each new customer and how scalable your go-to-market engine really is.

CAC also drives hiring. A sales-led model with a $5,000 CAC requires more reps, commissions, and support staff than a product-led model with a $500 CAC.

The financial model must show how CAC influences team size, channel mix, and budget allocation.

CAC determines burn rate and runway. A falling CAC extends runway without cutting costs. A rising CAC can shorten runway even when revenue is growing.

When you run scenarios, CAC sensitivity has one of the biggest impacts on cash flow and funding strategy.

CAC is not a number to plug into a cell. It is a lever that drives growth quality, operational efficiency, and valuation. The best financial models do not just track CAC— they use it to make smarter decisions.

Summary: CAC Is Not Just a Number. It’s a Strategy

CAC reveals how efficiently your startup turns money into customers, and it sits at the center of growth, runway, and valuation. When calculated correctly, it exposes the true cost of scale. When tracked over time, it shows whether your business is getting stronger or weaker.

CAC shapes revenue forecasts, headcount plans, and capital needs inside your financial model—and investors use it to judge the quality of growth, not just the size of it.

Founders who understand and improve CAC build businesses that compound value instead of burning cash.

Key Takeaways

1. CAC reveals how efficiently a startup converts spending into customers and determines whether growth strengthens or weakens the business over time.

2. High revenue with poor CAC destroys value, while efficient CAC creates scalable growth, extends runway, and attracts investor confidence.

3. CAC is not static; tracking its trend shows whether go-to-market performance is improving, declining, or ready to scale.

4. CAC directly impacts revenue forecasts, hiring plans, cash burn, and capital needs inside a startup’s financial model.

5. Founders who understand, monitor, and improve CAC build stronger unit economics, better fundraising strategies, and more durable companies.

Answers to The Most Asked Questions

-

A good CAC depends on your LTV. As a rule, LTV should be at least 3x CAC and payback within 6–12 months.

-

As you scale, cheap early channels get saturated and competition rises. Without efficiency, conversion, or retention improvements, each new customer becomes more expensive to acquire.

-

Improve targeting, activation, and retention, build referral loops, strengthen positioning, and let product and brand do more of the acquisition work.

-

Yes. CAC includes all sales and marketing costs—ads, team salaries, commissions, tools, content, agencies, and incentives—divided by new paying customers.

-

High CAC shortens runway and requires more capital to grow. Improving CAC extends runway, boosts valuation, and makes fundraising easier and less dilutive.