When Should a Startup Build Its First Financial Model?

By Lior Ronen | Founder, Finro Financial Consulting

Most founders wait too long to build their first startup financial model.

It usually happens under pressure, a few days before fundraising begins or right after an investor asks for “something in Excel.”

The model is thrown together quickly, based on rough guesses, and designed more to fill a slide than to reflect how the business actually works.

But a financial model is not something you create to satisfy investors.

It is something you create to understand your business.

A good financial model helps you answer questions that shape your decisions every day:

Can we afford to hire this person

How much should we spend on marketing next quarter

When will we run out of cash

How much should we raise, and what does that allow us to achieve?

When built early and thoughtfully, your financial model becomes your operating guide.

When built late and reactively, it becomes a liability.

If your goal is to build a real company rather than simply prepare for a funding round, your model should not be an afterthought.

It should be one of the first tools you rely on to make decisions with clarity and confidence.

A well-built financial model gives founders leverage. It turns instinct into strategy, plans into numbers, and conversations into confidence. When it’s grounded in real assumptions and flexible enough to evolve, it becomes a tool for better decisions—not just better slides. That’s the difference between guessing and leading.

Why Founders Delay — and When They Shouldn’t

It’s easy to put off building a financial model. You might think you’re too early, you don’t have real numbers yet, or you’ll figure it out once investors ask for it.

But waiting until a model becomes urgent is exactly when it’s hardest to build it right.

Without a model, you’re operating in the dark. You might hire too soon, spend too much on growth, or underestimate how long your cash will last. And when investors finally ask for your numbers, you’ll be scrambling to explain decisions you never actually modeled.

The truth is, you don’t need to be post-revenue to build a financial model. You just need to hit one of these three milestones:

1. You’re about to hire — even just one person

A model helps you understand how long your cash will last with the current team, and what changes when you add headcount.

2. You’re planning a raise in the next 3–6 months

Investors will expect a model that connects growth, hiring, and runway. Building it early gives you time to adjust assumptions before they’re challenged.

3. You’re making pricing or go-to-market decisions

Whether you’re shifting from freemium to paid, testing acquisition channels, or setting new targets, your model should guide those calls, not react to them.

Building a model early gives you flexibility. Waiting too long forces you to explain decisions you can’t support.

If you’re starting to feel pressure around cash, hiring, or fundraising, that’s not a red flag. That’s the signal it’s time to build your model.

What investors want to see?

A messy spreadsheet won’t lose you the round, but a weak model will quietly raise doubts that are hard to recover from.

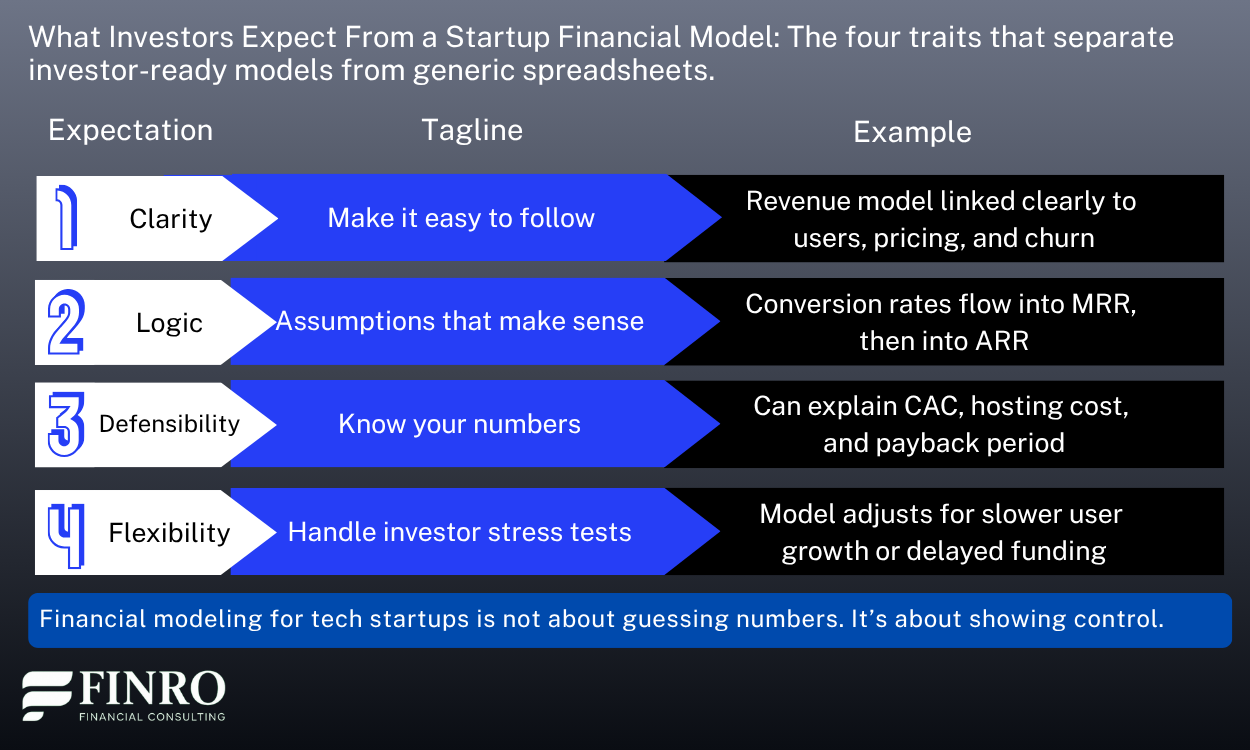

Investors aren’t looking for perfect projections. They know things will change, and they don’t expect you to predict the future. What they’re really looking for is how you think.

Does the model reflect a clear understanding of your business mechanics? Are your assumptions logical, transparent, and grounded in something real? Can the model handle uncertainty and still help you make decisions?

The best financial models tell a story. They make it easy to understand how you plan to grow, what levers you intend to pull, and where the risks sit.

If you expect revenue to triple in 12 months, the model should show how that happens: through users, conversions, pricing, retention, or expansion. If you’re hiring a sales team, the model should show how those hires are expected to perform. The logic should be visible, not buried in formulas or hardcoded numbers.

Sophisticated investors will test your thinking. They’ll ask what happens if churn goes up. Or if CAC increases. Or if you delay that key hire by a quarter.

These aren’t random questions. They’re how investors evaluate your grip on the business and your ability to course-correct under pressure. A good model allows you to explore those scenarios without breaking the structure. A bad one forces you back into guesswork.

And most of all, investors want to know whether you can use capital effectively. Not just how much you want to raise, but what it will buy, how long it will last, and what it helps you achieve. If your model can’t answer those questions clearly and credibly, it weakens your position before the conversation even begins.

At this stage, your model isn’t just a spreadsheet. It’s a lens into your operational mindset. It tells investors whether you’re guessing — or planning.

What a great financial model actually does?

Most founders think of the model as an investor deliverable. But the best models aren’t built for investors — they’re built for the founder.

A great financial model doesn’t just sit in a folder waiting for the next round. It becomes something you use week to week, not just quarter to quarter. It helps you make decisions with more clarity and less guesswork.

Hiring plans, pricing changes, marketing experiments — all of it becomes easier to weigh when you can see the impact on cash, burn, and runway.

It also brings structure to how your team thinks. Instead of debating how much to spend on marketing or when to open a new market, you’re running scenarios.

You’re not chasing a top-down growth goal — you’re figuring out what it actually takes to get there, and whether it’s realistic.

And when investor conversations do come up, your model doesn’t need to be rewritten.

It’s already there. Built on logic. Tied to milestones. Able to flex for upside and downside.

You’re not scrambling to justify a number. You’re already running the business in a way that explains it.

Why founders choose Finro for their financial model?

When you’re building a startup, your financial model is not just a spreadsheet. It’s the foundation that connects your strategy, hiring, pricing, and fundraising into a single, defensible plan.

Founders work with Finro because we specialize in startups. That means no recycled templates and no out-of-context assumptions.

Instead, we build models that reflect your business model, customer journey, pricing mechanics, team growth, and investor milestones. Every model is tailored to your specific stage, sector, and ambition.

Our process is structured and collaborative.

We start by aligning on your go-to-market strategy and revenue levers. Then we build a model that mirrors how your business actually works. We connect spend to growth, headcount to cash flow, and milestones to funding needs.

The result is not just a forecast, but a tool that helps you make smarter decisions.

The models we deliver are clear, fully linked, and built to evolve. As you hire, launch new products, change pricing, or raise a new round, the model adapts.

You are not locked into something static. You are investing in a decision-making engine that grows with your company.

Founders choose Finro because we combine accuracy, speed, and investor credibility. The work we do gets used in boardrooms, diligence calls, and pitch decks. It gives you clarity when the next move feels complex and confidence when investors ask tough questions.

Summary

A financial model is not a checkbox for investors. It’s a decision-making tool that helps you move faster, reduce risk, and operate with clarity. The best founders don’t wait for a raise to start modeling.

They use the model to test assumptions, explore scenarios, and align the team around a strategy that’s actually grounded in the numbers.

From hiring decisions and pricing changes to capital planning and investor conversations, a robust model becomes the bridge between vision and execution.

And when it’s built right, it doesn’t just tell a story—it holds up to scrutiny, scales with the business, and helps unlock real momentum.

If you’re ready to stop guessing and start using your financial model the way serious founders do, Finro can help. We build models that don’t just look good in a deck—they actually help you run the business better.

Key Takeaways

A financial model is a decision-making tool, not just an investor requirement.

DIY models often miss critical logic, leading to blind spots and lost credibility.

Strategic founders use models to test hiring, pricing, and fundraising scenarios in real time.

Investors judge your model for clarity, defensibility, and alignment with your growth story.

Finro builds founder-friendly, investor-ready models tailored to your business—not templates or guesswork.

Answers to The Most Asked Questions

-

It clearly shows how your business works, ties key metrics to growth and spend, and supports your funding ask with credible logic and assumptions.

-

Ideally before you raise capital or make major hiring or pricing decisions. The earlier you model, the better your planning and credibility.

-

Templates often miss what makes your business unique. They save time short term but rarely hold up in serious investor conversations or strategic decisions.

-

They want clarity, defensible assumptions, logical growth drivers, and visibility into runway, milestones, and capital needs—without fluff or Excel tricks.

-

You’ll get a custom-built, fully linked model that’s grounded in your actual business—not a spreadsheet exercise, but a decision-making tool.