What Is Runway and Why It Determines Startup Survival and Leverage

By Lior Ronen | Founder, Finro Financial Consulting

Runway is one of the most important numbers in a startup.

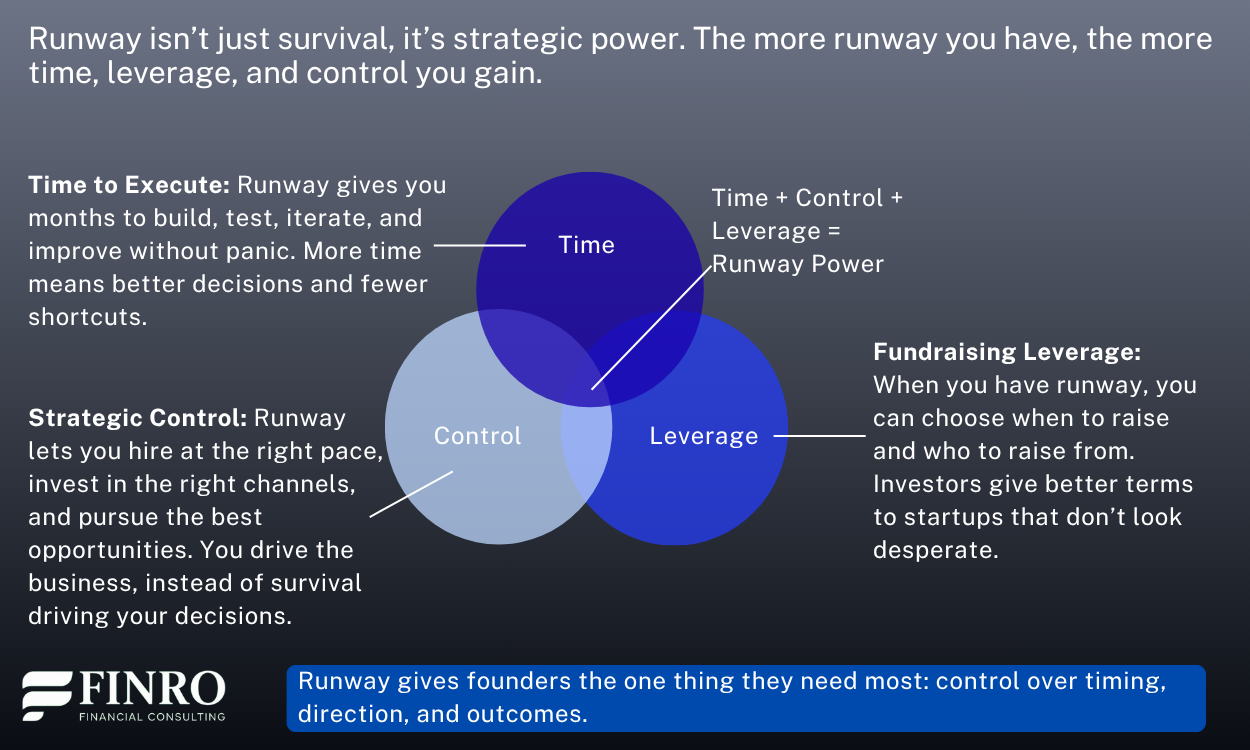

It tells you how much time you have before you run out of cash, which means it quietly controls every decision you make, how fast you hire, how aggressively you grow, when you raise capital, and how much leverage you have with investors.

A long runway gives you freedom, confidence, and negotiating power. A short runway forces desperation, reactive decisions, and weak terms.

Most founders think runway is just “months of cash left,” but it’s much more strategic than that. Runway reflects how efficiently you operate, how well your burn rate is managed, and whether your business model improves over time.

Two startups can have the same revenue and the same cash balance, yet one has 18 months of runway and full control while the other has 5 months and is already in trouble.

In this article, we’ll break down what runway really means, how to calculate it correctly, why it matters more than burn rate alone, and how great founders extend runway without slowing growth. Let’s start with a clear definition.

Runway defines how much time a startup has to execute its plan, but its real value lies in what that time produces. Founders who link cash, burn, and milestones gain control over their growth and fundraising strategy, turning capital into measurable progress. When managed with discipline, runway becomes more than a countdown — it becomes proof of efficiency, foresight, and investor readiness.

What Is Runway?

Runway is the amount of time your startup can continue operating before it runs out of cash.

It is measured in months and determined by how quickly you are burning money. Investors rely on it because it instantly shows how much time you have to execute your plan before you must raise more capital.

Runway Formula:

Runway = Cash on Hand ÷ Net Burn

If you have $1,200,000 in the bank and your net burn is $100,000 per month, you have 12 months of runway. Simple. At least on the surface.

Same Cash, Different Burn, Completely Different Future

| Startup A | Startup B | |

|---|---|---|

| Cash on Hand | $1,000,000 | $1,000,000 |

| Net Burn / Month | $50,000 | $200,000 |

| Runway | 20 months ✅ | 5 months ❌ |

| Investor Leverage | Raise when you want | Forced to raise |

| Strategic Flexibility | Time to improve, test, and grow | Must cut or dilute |

| Valuation Outcome | Stronger terms and higher multiple | Weaker terms and lower multiple |

It’s not how much cash you have, it’s how efficiently you burn it, because runway creates leverage.

Real Market Example (AI SaaS Startup)

An AI SaaS startup has:

Cash on hand: $2,400,000

Monthly operating spend (gross burn): $300,000

Monthly revenue: $80,000

Net burn = $300,000 – $80,000 = $220,000

Runway = $2,400,000 ÷ $220,000 ≈ 10.9 months

The founder originally thought they had 8 months of runway because they assumed burn would increase with new hires.

After improving retention and delaying two non-essential roles, they reduced net burn to $180,000, instantly extending runway to 13+ months without raising capital.

Runway is not just a survival number, it is a strategic one.

A long runway gives you time, control, and leverage. A short runway forces rushed decisions, down rounds, or layoffs. The formula is simple, but the implications drive your entire operating strategy.

Why Runway Needs Milestones (Not Just Months of Cash)?

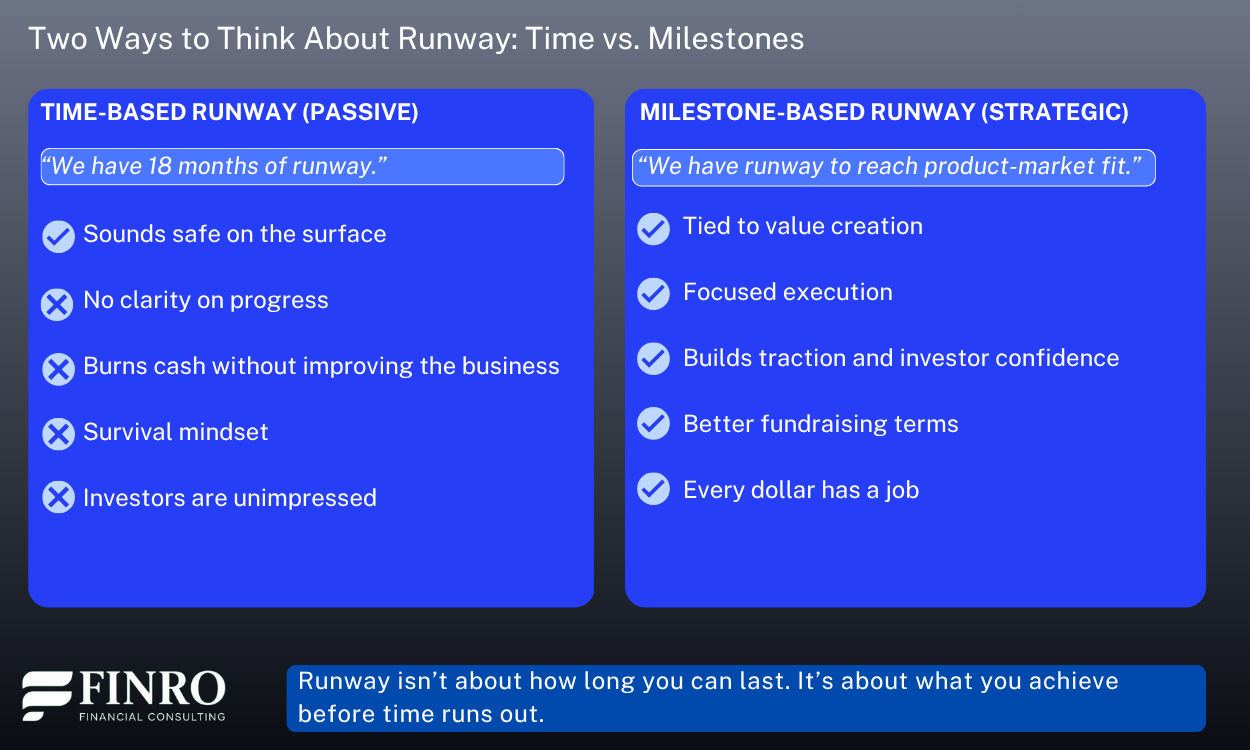

Founders love to say, “We have 18 months of runway.” But 18 months by itself means nothing. What matters is what you achieve before the cash runs out.

Time-based runway only tells you how long you can survive. Milestone-based runway tells you whether you are actually becoming more valuable as you spend.

A startup with 12 months of runway and a clear path to product-market fit is in a far stronger position than a startup with 24 months and no traction.

Investors do not fund time. They fund progress. They want to know: What will you prove? What will you de-risk? What engine of growth or profitability will you build with the capital?

The smartest founders plan runway around value-creating milestones, such as:

MVP in market and early feedback

First paying customers

Repeatable acquisition channel

Net revenue retention above 100%

Positive unit economics

Ready for the next round or profitability

When runway is tied to milestones, every dollar has a purpose. You are not just buying time, you are buying momentum, leverage, and investor confidence. That is the difference between burning cash and building value.

How to Extend Your Runway (Without Slowing Growth)?

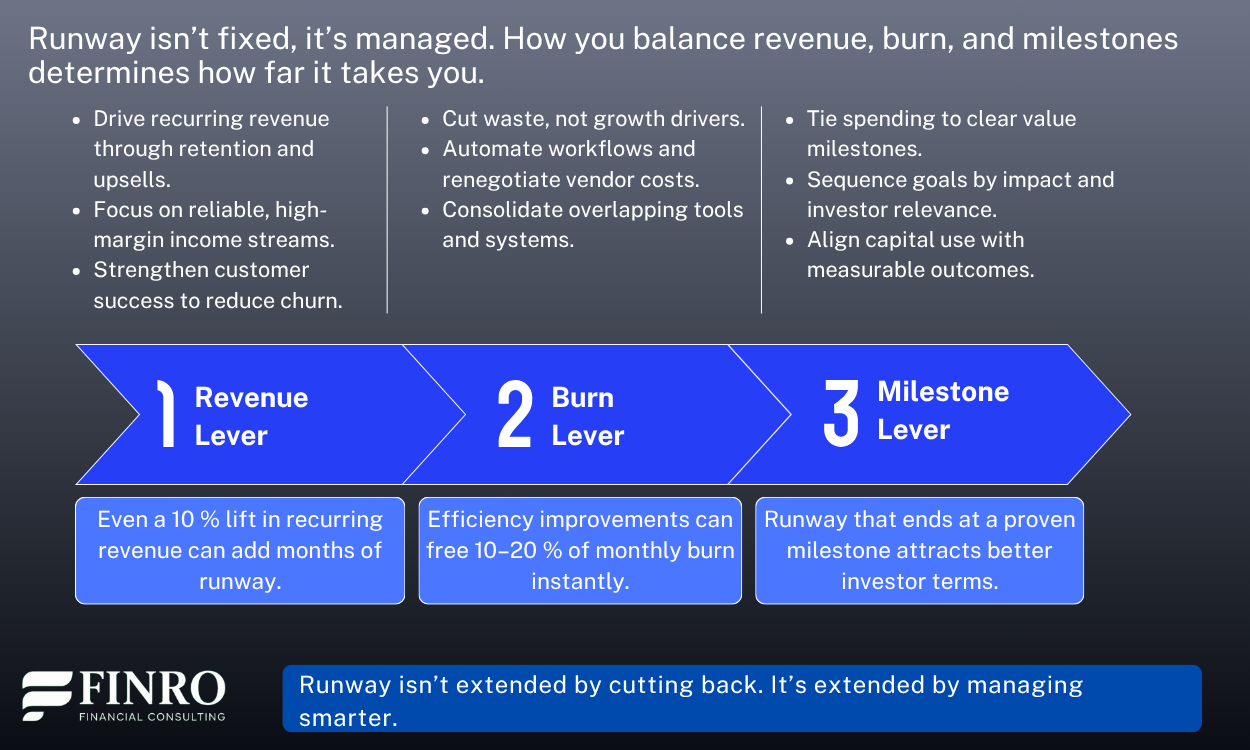

Extending the runway isn’t about slashing costs or freezing hiring.

It’s about creating more time to execute while maintaining growth. Founders who handle this well don’t just spend less — they spend smarter. They understand that every dollar should extend both time and progress.

The first step is prioritizing high-return spending. In early-stage startups, resources are limited, so each expense needs a clear purpose. Investments that directly contribute to revenue growth, retention, or customer satisfaction stay on the table.

Others that don’t create measurable value, like overbuilt infrastructure, expensive branding exercises, or scattered product experiments, can wait. In practice, that means focusing your budget on proven acquisition channels, customer success, or product improvements that drive adoption and expansion.

The second lever is improving operational efficiency. Extending runway doesn’t always mean reducing headcount. Often, it starts with optimizing how the team works. That could mean consolidating overlapping tools, renegotiating vendor contracts, or removing bottlenecks in processes that slow delivery. A more efficient operation lowers the monthly burn rate without hurting output, freeing up cash for activities that move the business forward.

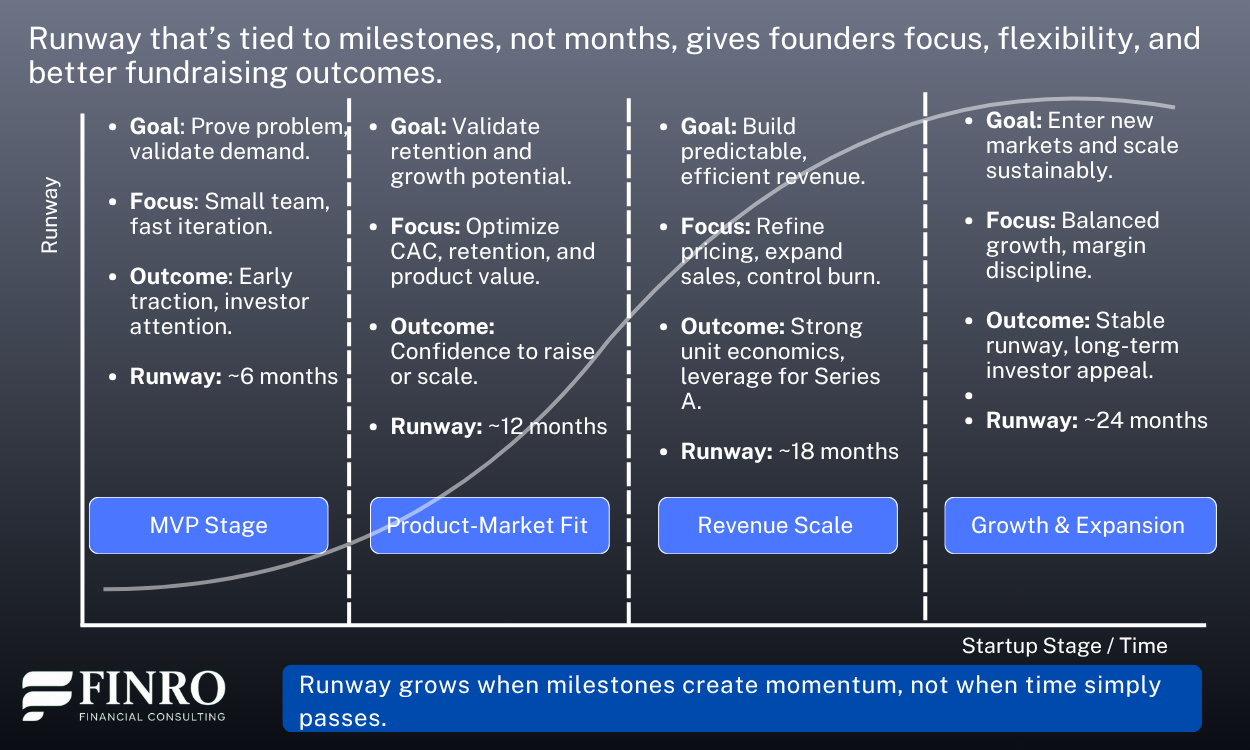

Finally, founders who extend runway successfully focus on sequencing milestones, not timelines. Instead of saying “we have 18 months of runway,” they plan around specific outcomes: like reaching product-market fit, signing 10 enterprise clients, or hitting profitability.

This approach ensures every dollar is spent with intent. It shifts the mindset from survival (“how long can we last?”) to progress (“what can we achieve before the next raise?”).

When managed this way, extending runway becomes a mark of strategic discipline.

It signals to investors that the company isn’t simply managing cash, it’s managing momentum. And that distinction often determines which startups raise on favorable terms and which end up fundraising out of urgency.

How to Model Runway in Your Financial Model?

Runway is one of the simplest yet most critical calculations in your financial model. It starts with your monthly cash balance and your burn rate. In essence, runway tells you how many months your startup can operate before running out of cash — or before the next funding round is required.

To calculate it, take your current cash balance and divide it by your net monthly burn. If you have $600,000 in the bank and a monthly burn of $100,000, your runway is six months. But that’s just the surface-level math. In a financial model, runway should never be treated as a single static number.

A strong model looks at multiple scenarios: base, upside, and downside, because your runway will change dramatically depending on growth rate, hiring speed, and fundraising timing.

A delayed hire or a faster revenue ramp can easily add or remove months of cushion. Modeling these cases gives you flexibility and helps you anticipate risks early, rather than reacting when it’s too late.

Runway also extends beyond expenses. It’s directly impacted by financing events, such as new funding rounds, venture debt, or grant inflows.

Incorporating those events into your model helps you understand not just how long cash will last, but how each capital injection affects dilution, valuation, and future optionality.

The most strategic founders link their runway to milestones, not dates. Instead of saying “we have 12 months of cash,” they plan around goals: reaching product-market fit, hitting a revenue target, or preparing for the next investor conversation.

When runway becomes tied to progress, each dollar spent has purpose — and investors notice that discipline.

Finally, the runway should be tracked and revisited monthly. As burn evolves, assumptions shift, and the business scales, your available runway changes too. Keeping it updated ensures your decisions, whether to hire, raise, or expand, are grounded in reality, not outdated projections.

Runway isn’t about how long your cash lasts. It’s about how far it takes you.

Why Runway Is an Investor Signal?

Runway isn’t just an internal management metric — it’s a signal investors use to gauge risk, timing, and discipline. A startup with a short runway is perceived as under pressure, even if the fundamentals are strong. A company with healthy, well-managed runway projects confidence, control, and optionality.

When investors look at your financial model, they immediately check how much cash you have left, how fast you’re burning it, and what milestones you’ll reach before that money runs out. Runway tells them two key things: how efficient your operations are and how realistic your fundraising strategy is.

Founders often assume longer runway automatically means safety. But investors care less about duration and more about what the runway enables. Twelve months that lead to product-market fit and recurring revenue are far more attractive than twenty-four months that lead nowhere.

Runway also plays directly into negotiation leverage. If your cash balance gives you six months to raise, you’re forced to accept the market’s timing. If you have twelve, you can choose the right moment to raise, build momentum, and negotiate from strength.

Investors don’t fund survival — they fund progress. When your model shows a clear connection between runway and milestones achieved, you’re not just asking for more time. You’re asking for capital to create measurable value, and that’s what gets funded.

Summary

Runway is one of the clearest reflections of a startup’s strategy.

It’s not just a measure of how long you can operate. It’s a measure of how effectively you turn capital into progress. Founders who treat runway as a planning tool, not a countdown, gain control over both their growth and their fundraising.

A well-managed runway tells investors that you understand your numbers, your milestones, and your leverage. It shows discipline, foresight, and confidence — qualities that matter as much as metrics.

Ultimately, the goal isn’t to extend the runway for its own sake. It’s to use it to create value, momentum, and optionality. When your financial model ties runway to outcomes, you’re not managing survival — you’re managing success.

At Finro, we help tech startups turn their financial models into strategic assets that attract investors and drive decisions.

If you’re building or revising your model, we can help you structure your runway, funding strategy, and growth milestones the way investors actually evaluate them.

Key Takeaways

Runway reflects strategy, not time. It shows how effectively a startup converts funding into progress and leverage, not just months of survival.

Milestones define meaningful runway. Runway tied to clear goals builds investor trust and ensures each dollar contributes to tangible business value.

Extending runway requires focus. You lengthen runway by managing smarter — optimizing efficiency, prioritizing outcomes, and reducing wasteful burn.

Financial modeling drives clarity. Scenario modeling reveals how burn, growth, and fundraising shifts affect runway and strategic decision-making.

Runway is an investor signal. Disciplined runway management shows control, foresight, and fundraising readiness — traits investors value in early-stage founders.

Answers to the Most Asked Questions

-

Runway is the number of months your startup can operate before running out of cash, calculated as cash balance divided by monthly net burn.

-

Most early-stage startups aim for 12–18 months of runway — long enough to reach key milestones and prepare for the next funding round.

-

Focus on high-ROI spending, improve operational efficiency, and align expenses with milestone-based goals rather than time-based budgets.

-

Investors see runway as a sign of discipline and execution capability. It signals how well you manage capital and plan for the next round.

-

Model runway dynamically — link it to monthly burn, revenue, and fundraising events, and forecast scenarios (base, upside, downside) to maintain flexibility.