AI Agents Valuation: Revenue Multiples & M&A Benchmarks (2026 Update)

By Lior Ronen | Founder, Finro Financial Consulting

AI agents are no longer being valued as experimental AI products. They are being priced as operational software.

That shift matters. Early agent companies were often valued on technical novelty, autonomy claims, or the promise of replacing human workflows. In 2026, valuation has moved decisively toward a simpler question: does this agent actually run inside a real organization without creating friction?

As a result, revenue multiples across AI agents are diverging sharply.

Agents that plug cleanly into existing stacks, operate with predictable costs, and reduce human intervention are holding up at materially higher multiples. Agents that behave like features, require heavy configuration, or depend on ongoing human oversight are seeing compression, regardless of how advanced the underlying model appears.

This is why AI agent valuation no longer moves as a single market.

Developer-facing agents that integrate directly into engineering workflows are often priced closer to durable SaaS. Data and analytics agents with repeatable usage patterns can still command premium outcomes. By contrast, many business-facing agents in sales, marketing, or operations are being repriced once buyers model implementation effort, services load, and margin normalization.

The same dynamic shows up clearly in M&A. Strategic acquirers are not paying for autonomy narratives. They are paying for assets that can be absorbed quickly, scale inside existing products, and improve unit economics without rewriting internal processes.

In other words, valuation has shifted from “how intelligent is the agent?” to “how reliably does it behave as software?”

That distinction underpins every multiple, funding benchmark, and acquisition outcome discussed in the sections that follow.

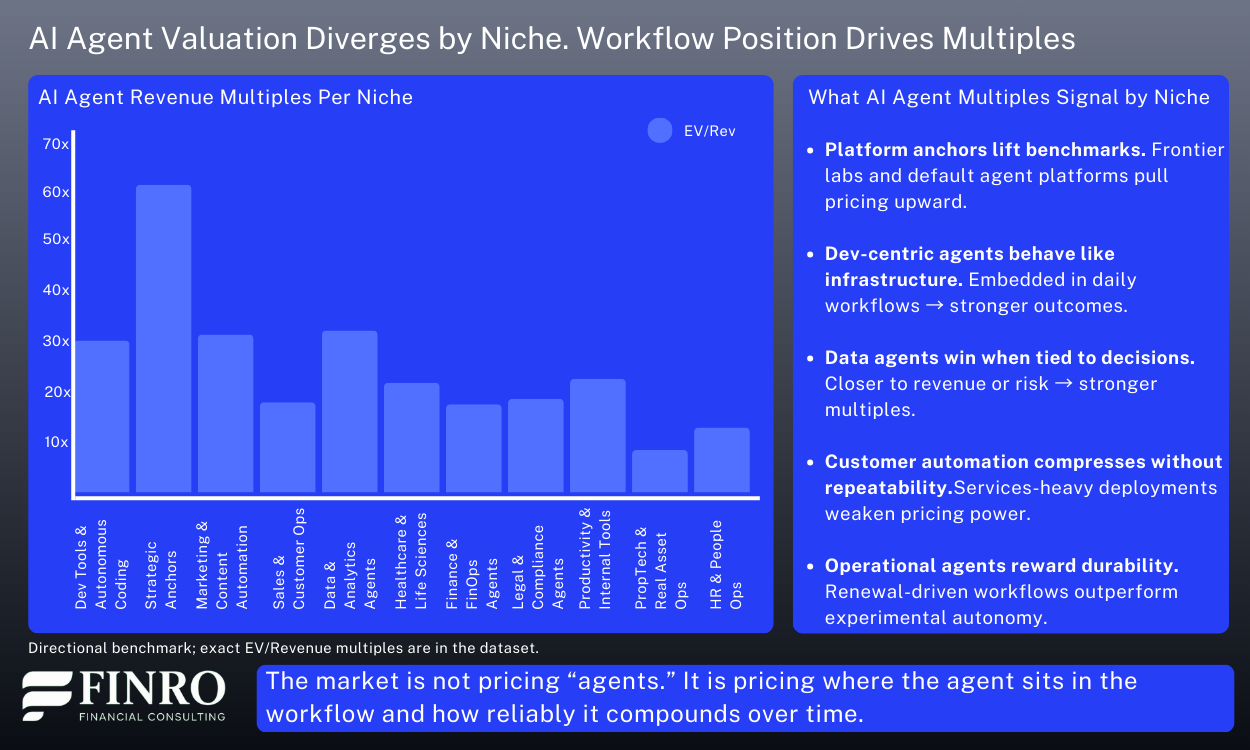

AI agent valuation in 2026 is no longer driven by hype around autonomy. Multiples diverge sharply depending on where the agent sits in the workflow, how defensible its distribution is, and whether deployments scale without heavy services. Platform anchors and dev-centric infrastructure continue to lift benchmarks, while customer automation and internal tools face bundling pressure and margin scrutiny. Across 214 companies and 11 niches, the data shows a clear pattern: investors reward agents that compound inside mission-critical workflows, stabilize cycle over cycle, and behave more like durable software than experimental AI features.

Where AI agent multiples diverge across niches in Q1 2026?

In Q1 2026, our AI Agents dataset covers 214 companies across 11 niches, spanning public companies, private rounds, and M&A deals. The data makes one thing clear: the market is not valuing “AI agents” as a single category.

It is valuing where the agent sits in the workflow, and how defensible its distribution and margins are.

At the aggregate level, the average revenue multiple across the dataset is ~30x. But that headline number hides a wide dispersion by niche.

Strategic Anchors (average ~60x+)

This category operates on a different valuation logic. These companies are priced as platform infrastructure, not as SaaS or workflow tools.

Multiples here reflect compute gravity, ecosystem control, and distribution leverage rather than near-term unit economics. As a result, this niche materially pulls the overall market average upward.

Examples in the dataset include OpenAI, Anthropic, Mistral, and Cohere, where capital intensity and ecosystem positioning drive pricing more than classic SaaS comparability.

Dev Tools & Autonomous Coding (~26x to ~35x)

Developer tools remain one of the clearest “agent as daily workflow” stories, which supports premium multiples. But dispersion inside the niche is extreme.

Examples from the dataset:

H (private): ~$370M EV on ~$22M revenue (~16.7x)

Cursor (private): ~$29.3B EV on ~$1.15B revenue (~25.5x)

Cognition AI (private): ~$10.2B valuation on ~$73M revenue (~139.7x)

Same niche. Very different outcomes. The gap reflects distribution strength and perceived platform positioning, not raw agent capability.

Data & Analytics Agents (average ~32.5x)

This niche holds up because it sits close to decision-making systems, where buyers tolerate higher multiples when agents directly affect revenue, risk, or core analytics.

Examples illustrating the spread:

Hebbia (private): ~$700M on ~$13M revenue (~53.8x)

Relevance AI (private): ~$120M on ~$13M revenue (~9.5x)

Identical category labels. Very different underwriting. The market rewards products that look like durable layers, not features riding on someone else’s data stack.

Marketing & Content Automation (average ~32x)

Marketing agents can earn strong multiples when they tie into activation, pipelines, or revenue operations. Valuations compress when products resemble standalone content tools without durable budget ownership.

Example: Hightouch (private): ~$1.2B on ~$41M revenue (~29.2x)

Sales & Customer Ops (average ~18x)

This is one of the more compressed segments. Adoption can be fast, but multiples suffer when deployments are customization-heavy or require constant tuning.

A clear exception: Cognigy (M&A): ~$955M on ~$37M revenue (~25.8x)

The average remains lower because fewer companies achieve that level of enterprise-grade repeatability.

Legal & Compliance Agents (average ~19x)

Regulated workflows can create defensibility, but only when implementation risk is controlled and the product becomes core infrastructure.

Example: Protect AI (M&A): ~$700M on ~$18M revenue (~38.3x)

Healthcare & Life Sciences (average ~20x+)

Healthcare agents hold up when buyer ROI is clear and adoption embeds into operational workflows. Multiples are still discounted for regulatory and deployment friction.

Example: Hippocratic AI (private): ~$3.5B on ~$78M revenue (~44.9x)

Productivity & Internal Tools (average ~23x)

This is where bundle risk shows up most clearly. Agents that look absorbable by large platforms compress. Those that become default internal layers hold up.

Examples:

Glean (private): ~$7.2B on ~$200M ARR (~36.0x)

Moveworks (M&A): ~$2.85B on ~$200M revenue (~14.3x)

What the spread actually means

Across AI agents, the market is not paying for autonomy.

It is paying for durability:

Does the agent sit in a daily, mission-critical workflow?

Is deployment repeatable without services-heavy overhead?

Can margins improve despite model and compute costs?

Is distribution defensible, or one partnership away from being bundled?

Those answers, more than the word “agent,” explain where multiples land.

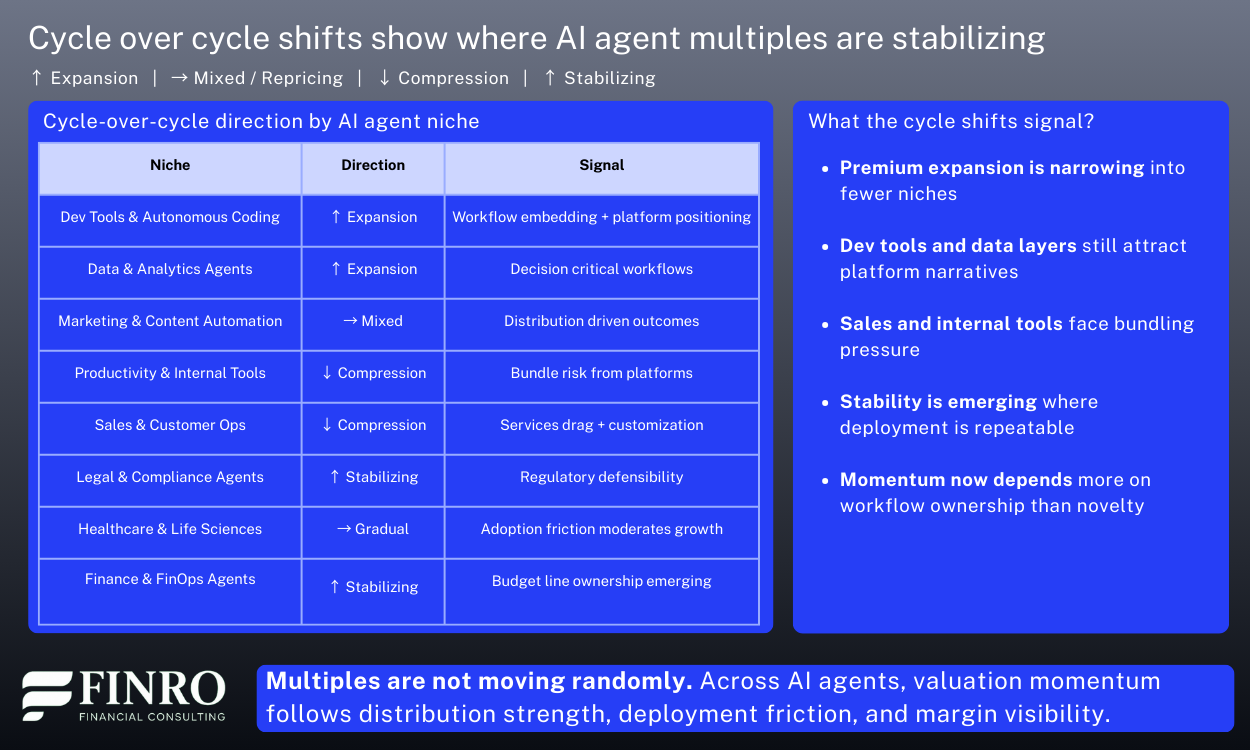

Cycle over cycle shifts show where AI agents are stabilizing

Up to this point, we looked at how AI agent valuation diverges by niche and why workflow position drives multiples. The next step is understanding how those multiples are moving, because direction often matters more than the headline number.

Comparing Q3 2025 to Q1 2026, the overall AI agent market edged higher, with the blended average rising from roughly the mid-20x range to the high-20x range. That lift did not come from every segment. It came from a few niches that are starting to look less experimental and more like durable software.

Dev Tools and Autonomous Coding strengthened meaningfully. Average multiples moved from the mid-20s to roughly the low-30s. This reflects a clear shift toward agents that sit directly inside daily developer workflows. When the product becomes part of the shipping loop, pricing holds up even in mixed markets.

Strategic Anchors pulled benchmarks upward. Frontier platforms and default agent ecosystems expanded the most on a cycle basis, jumping from the mid-20x range to closer to the high-30s. These companies are increasingly priced as infrastructure layers rather than standalone SaaS vendors.

Data and Analytics Agents continued to trend higher.Multiples moved from the high-20s to the low-30s as buyers showed willingness to pay for agents tied directly to decision making, risk analysis, or revenue insights. The closer the agent sits to business outcomes, the stronger the repricing.

At the same time, several niches compressed or stayed flat. Sales and Customer Ops softened, moving from the low-20s toward the high-teens range. Adoption remains strong, but repeatability concerns and customization overhead are clearly being priced in.

Healthcare and Legal agents showed mild compression, reflecting regulatory friction and longer deployment cycles rather than a lack of demand.

Productivity and Internal Tools drifted slightly lower, reinforcing the ongoing bundle risk narrative. When an agent looks like a feature that can be absorbed into a larger platform, multiples stabilize rather than expand.

PropTech agents ticked up from a low base, while HR and People Ops stayed largely flat, suggesting these segments are still waiting for clearer proof of durable distribution.

Taken together, the cycle over cycle movement reinforces a simple pattern. The market is not repricing AI agents uniformly. It is rewarding niches where agents behave like embedded infrastructure and compressing areas where deployment complexity or feature risk remains high.

That directional shift matters more than any single average. It shows where AI agents are transitioning from experimental autonomy into repeatable, margin durable software.

Inside the AI Agents dataset behind this analysis

The insights above come from a structured dataset tracking 214 AI agent companies across 11 niches, covering public benchmarks, private rounds, and M&A outcomes.

While this article focuses on directional signals, the full dataset goes deeper into how the market is actually pricing agents across stages, workflows, and business models.

Instead of treating AI agents as a single category, the dataset breaks the market into operational segments, including Dev Tools & Autonomous Coding, Data & Analytics Agents, Marketing Automation, Legal & Compliance, Finance & FinOps, Healthcare, Productivity Tools, and more. This allows comparisons that reflect how buyers and investors are underwriting real workflow ownership rather than novelty.

Inside the database, readers can explore:

Revenue multiples across public, private, and acquisition benchmarks

Cycle-over-cycle shifts by niche and stage

EV/Revenue and EV/Funding comparisons across the stack

Company-level datapoints used to build the benchmarks referenced throughout this article

Pivot-ready tables designed for research, modeling, and comps analysis

The goal is simple: move beyond headline multiples and understand why certain AI agents clear premium outcomes while others compress.

For founders, operators, and investors tracking the space closely, the full dataset provides a deeper layer of context behind the signals highlighted here.

Download the AI Agents Multiples Database, Q1 2026 Edition (€99.90)

Summary

AI agent valuation is fragmenting. The market is no longer pricing “agents” as a single category. Multiples diverge based on where the agent sits in the workflow, how repeatable deployment is, and whether margins can hold once novelty fades.

Across niches, the strongest outcomes cluster around products that behave like infrastructure inside daily operations. Dev tools, data agents, and platform anchors continue to attract premium positioning because they embed into existing stacks and compound over time. Categories tied to customization, services-heavy deployment, or bundle risk face more compression as buyers and investors focus on durability over experimentation.

Cycle over cycle data shows that expansion is becoming more selective. Momentum is shifting away from broad autonomy narratives toward clear distribution ownership, renewal-driven revenue, and operational fit inside real organizations.

The takeaway is simple: valuation is moving closer to operating reality. The question is not how autonomous an agent looks in isolation, but how reliably it compounds once it becomes part of a workflow.

For readers who want to go deeper, the full Q1 2026 AI Agents dataset breaks down 214 companies across 11 niches with detailed revenue multiples, M&A benchmarks, and cycle-over-cycle trends.

Key takeaways

AI agent valuation multiples vary widely by niche, with workflow ownership and distribution strength driving pricing more than autonomy or model sophistication.

Strategic anchor platforms continue to skew market benchmarks upward, while most applied AI agents trade closer to infrastructure-style SaaS multiples.

Dev tools and data agents hold premium valuations when embedded into daily workflows and tied directly to revenue, risk, or mission-critical decisions.

Sales automation and internal productivity agents face compression when deployments require customization or risk being bundled into larger platforms.

Cycle-over-cycle shifts show investors prioritizing repeatability, margin durability, and defensible positioning rather than rapid experimentation or feature-driven growth.

Most asked questions about AI agent valuation

-

Across public, private, and M&A data, averages hover around the ~30x range, but multiples vary significantly by niche, stage, and workflow positioning.

-

Investors price distribution strength, infrastructure positioning, and repeatable deployment. Agents embedded in daily workflows tend to command stronger multiples.

-

Partially. Many agent companies resemble SaaS in pricing logic, but platform anchors and infrastructure-style tools often trade at higher benchmarks due to ecosystem leverage.

-

Strategic platform anchors, developer tooling, and data-centric agents often lead, especially when tied to mission-critical processes or enterprise adoption.

-

Buyers focus on integration fit, margin visibility, and defensible workflows. Agents that reduce operational friction or become core infrastructure tend to achieve stronger exit pricing.