Burn Rate for Startups: Definition, Formula, and Why It Matters

By Lior Ronen | Founder, Finro Financial Consulting

Burn rate isn’t just how much money you spend each month. It reveals how aggressively you are operating, how efficiently you convert cash into progress, and how long your startup can survive without running out of money.

A healthy burn rate gives you control, confidence, and leverage with investors. A reckless burn rate forces desperation, weakens valuation, and can kill the company even when revenue is growing.

Burn rate reflects strategy, not just expenses. It shows whether your team, product, and go-to-market investments are creating momentum or simply burning cash to stand still. The goal is not to spend less, it’s to burn in a way that extends runway, accelerates growth, and unlocks future funding on better terms.

In this article, we’ll break down what burn rate actually means, how to calculate it correctly, why gross vs net burn matters, and how smart founders design burn rate based on stage, traction, and strategy, not guesswork.

Burn rate reflects the speed at which a startup consumes cash and reveals the efficiency of its strategy, cost structure, and growth decisions. When burn is aligned with milestones, retention, and revenue potential, it fuels momentum and increases leverage with investors. When burn is unmanaged or disconnected from results, it shortens runway, weakens negotiation power, and forces desperation. The strongest startups design burn rate intentionally across each stage, model it accurately, and use it to create control, confidence, and long-term value.

- What Is Burn Rate?

- Gross Burn vs Net Burn (and Why Both Matter)

- Why Burn Rate Matters?

- Burn Rate Over Time (It Should Change by Stage)

- Burn Rate vs Runway (and How They Work Together)

- Burn Rate in Your Financial Model

- Summary: Burn Rate as a Strategic Tool

- Key Takeaways

- Answers to The Most Asked Questions

What Is Burn Rate?

Burn rate measures how much cash your startup is losing each month. It tells you the speed at which your company is spending money and how long you can operate before running out of cash.

Founders often think burn rate is just “monthly expenses,” but there are actually two versions—and both matter.

Gross Burn = Total monthly operating expenses

This includes salaries, tools, rent, marketing, contractors, product costs, and any other cash outflow.

Net Burn = Cash outflow – Cash inflow (revenue)

This is the amount of cash the company actually loses each month after earning revenue. Net burn determines how long your cash will last.

Example:

Operating expenses: $200,000 per month

Revenue: $50,000 per month

Gross Burn = $200,000

Net Burn = $200,000 – $50,000 = $150,000

A founder who only looks at gross burn might think they are spending $200K per month. In reality, they are losing $150K per month and can survive only as long as their cash balance covers that loss. Most mistakes in financial models come from tracking only one version of burn rate instead of both.

Burn rate is not just an accounting number—it reflects how quickly your business consumes cash to operate, grow, and reach key milestones.

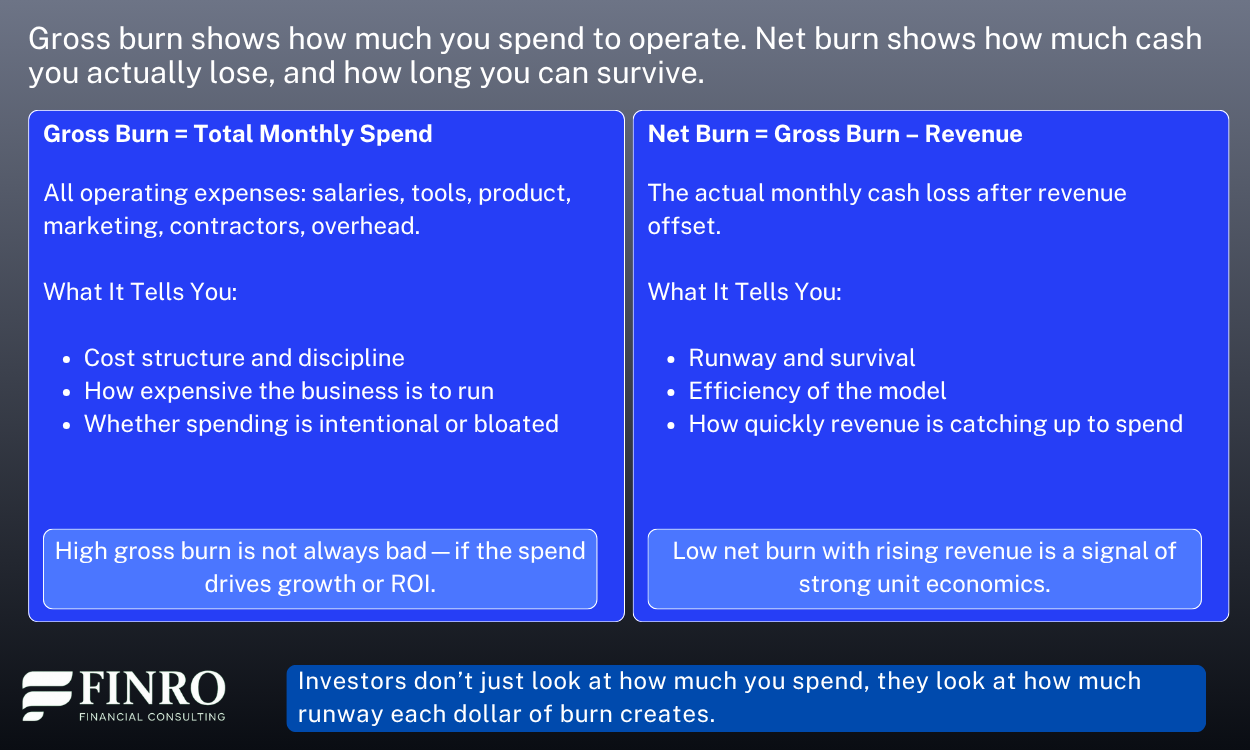

Gross Burn vs Net Burn (and Why Both Matter)

Most founders only track one version of burn rate, but investors evaluate two very different metrics: gross burn and net burn.

Understanding the difference is critical, because they tell completely different stories about your business.

Gross burn is your total monthly operating spend. It shows how expensive your business is to run and whether your cost structure is disciplined or bloated.

High gross burn with no clear ROI is a red flag, even if revenue is growing.

Net burn is how much cash you actually lose each month after revenue. It tells you how long you can survive with your current cash balance and how efficiently your model converts spending into revenue.

A company with high gross burn but low net burn may be aggressive but efficient. A company with low gross burn and high net burn is in trouble, because it means revenue isn’t keeping up.

Real Startup Example

Startup A (Aggressive but efficient)

Gross Burn: $400K

Revenue: $300K

Net Burn: $100K

They are spending heavily, but revenue offsets most of the cost.

They have 12+ months of runway and strong investor confidence.

Startup B (Lean but weak)

Gross Burn: $150K

Revenue: $20K

Net Burn: $130K

They appear “lean,” but revenue is too low to support the business.

They have less runway than Startup A despite spending less.

Insight:

High gross burn with strong revenue can be justified.

Low gross burn with weak revenue is dangerous.

Both metrics matter. Gross burn shows spending quality. Net burn shows financial health.

When gross burn increases strategically and net burn decreases over time, you are scaling the right way. When both rise, the business becomes more fragile as it grows.

Why Burn Rate Matters?

Burn rate determines how long your startup can operate, how fast you can grow, and how much leverage you have with investors. It is one of the first metrics investors analyze because it reveals whether a company is in control of its cash or blindly burning through it. A smart burn rate fuels progress and unlocks better fundraising terms. A reckless burn rate forces desperation and puts the company at risk—even if revenue is rising.

Burn rate influences almost every strategic decision:

Runway: How many months you can survive

Milestones: Whether you can reach the next funding event

Valuation: Efficiency increases multiples

Negotiation power: You raise when you want to, not when you have to

Capital efficiency: Proves you can grow without wasting cash

Two startups can have similar revenue, but their burn rate tells completely different stories:

| Startup A: Strategic Burn | Startup B: Risky Burn | |

|---|---|---|

| Monthly Spend (Gross Burn) | $350K | $80K |

| Monthly Net Burn | $150K | $70K |

| 6-Month Results |

✅ Revenue doubles ✅ Retention improves ✅ Product milestones met ✅ Preparing for Series A |

❌ Flat revenue ❌ No product progress ❌ No traction or milestones ❌ Not fundable |

| Investor View | Burn is buying growth and momentum | Burn is wasting time and runway |

Burn rate is not “good” or “bad” based on the number alone.

It only matters what your burn is buying.

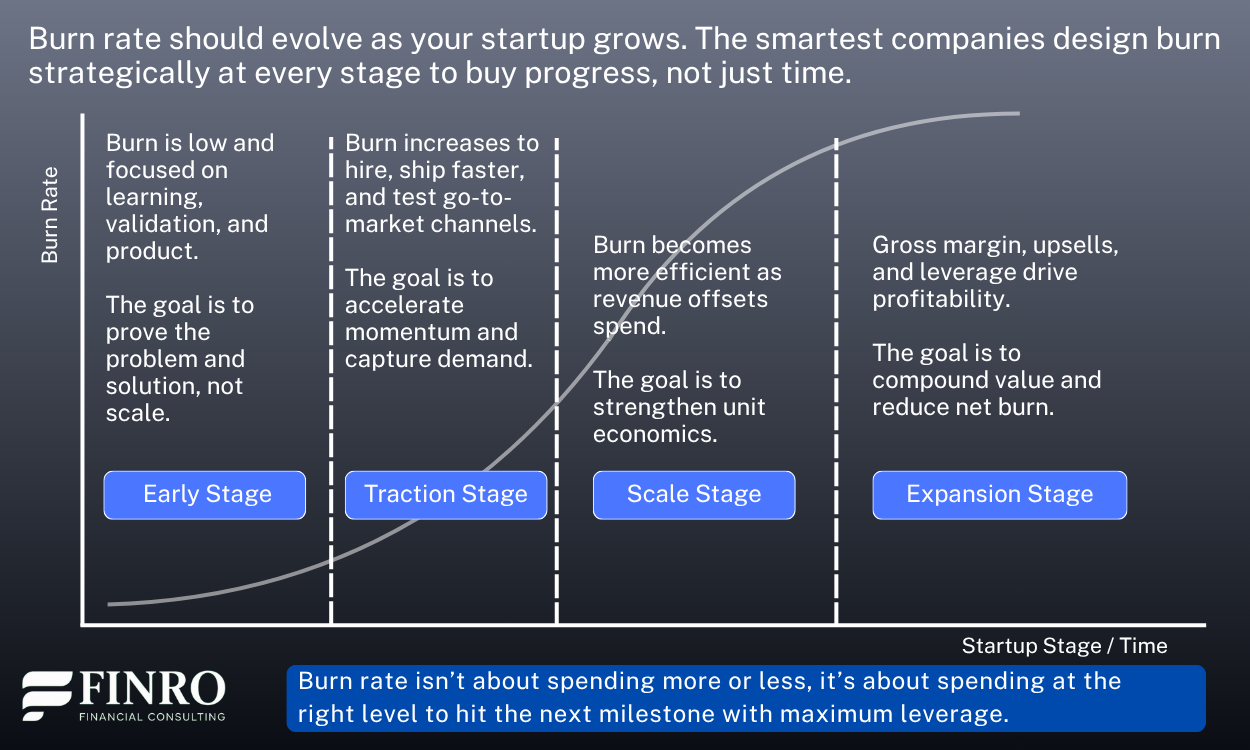

Burn Rate Over Time (It Should Change by Stage)

Burn rate is not meant to stay flat. It should evolve as your startup matures, gains traction, and shifts its priorities.

In the early stage, burn rate should remain lean and focused on product development and validation. At this point, every dollar should go toward learning, testing assumptions, and proving that the problem is worth solving.

A low burn rate gives you time to explore, iterate, and find direction without unnecessary pressure.

Once the business starts to gain traction, burn rate will naturally increase—and this is not a bad thing. As the model shows promise, founders invest more in hiring, product velocity, and go-to-market efforts in order to capture momentum.

Higher burn in this stage is strategic if it buys faster learning, customer adoption, and market positioning. The key is that burn must be tied to acceleration, not vanity spending.

As the company enters the scale stage, burn rate should become more efficient. Revenue begins to offset expenses, CAC improves, and retention strengthens.

Even if total spend grows, burn as a percentage of revenue declines because the business is now converting cash into growth more effectively. This is where strong unit economics start paying off.

In later stages, burn rate should flatten or even turn into positive cash flow. Gross margin, expansion revenue, and operational leverage allow the business to grow without depending on constant capital injections. The healthiest startups don’t try to keep burn low or high.

They design burn intentionally based on stage, ROI, and milestones. The real question is not how much you burn, but how much progress each dollar creates.

Burn Rate vs Runway (and How They Work Together)

Burn rate tells you how fast your startup is losing cash.

Runway tells you how long you can keep operating before you run out of money. They are connected, but they are not the same—and confusing them leads to dangerous decisions.

Burn rate is a speed. Runway is a timeline.

If your net burn is $100K per month and you have $1.2M in the bank, you have 12 months of runway. But if burn rises to $200K, runway instantly drops to 6 months. The faster you burn, the shorter your runway, even if nothing else changes.

This is why investors look at runway before anything else. A startup with $500K in the bank and $50K net burn has 10 months of runway and time to make progress.

A startup with $2M in the bank and $400K net burn has only 5 months of runway and far less leverage, even though it has more cash. The second company will be forced to cut costs or raise on weak terms.

Runway is not just about survival, it’s about control. The longer your runway, the more freedom you have to execute your strategy, hit milestones, and choose when to raise capital. The shorter your runway, the more desperate you become, and investors can feel it.

Burn rate is the input. Runway is the consequence. Smart founders manage burn deliberately to extend runway and create leverage, not just to stay alive.

Same Cash, Different Burn, Completely Different Future

| Startup A | Startup B | |

|---|---|---|

| Cash on Hand | $1,000,000 | $1,000,000 |

| Net Burn / Month | $50,000 | $200,000 |

| Runway | 20 months ✅ | 5 months ❌ |

| Investor Leverage | Raise when you want | Forced to raise |

| Strategic Flexibility | Time to improve, test, and grow | Must cut or dilute |

| Valuation Outcome | Stronger terms and higher multiple | Weaker terms and lower multiple |

It’s not how much cash you have, it’s how efficiently you burn it, because runway creates leverage.

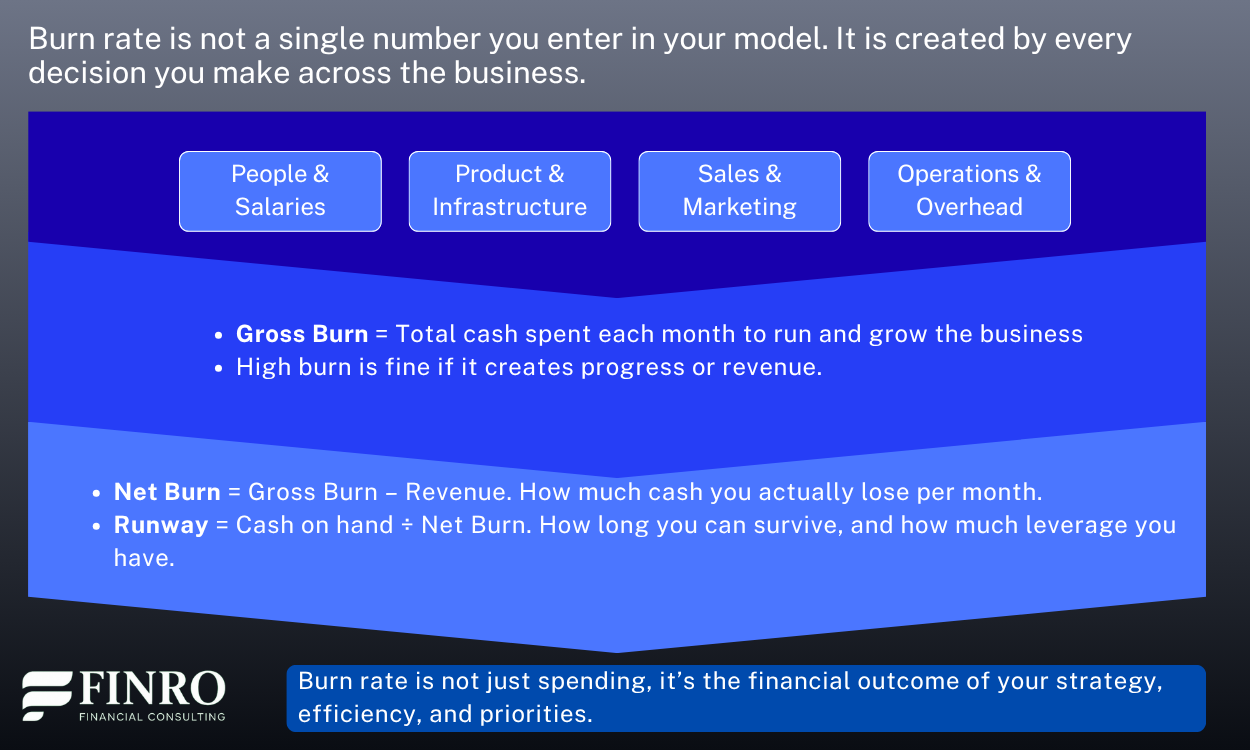

Burn Rate in Your Financial Model

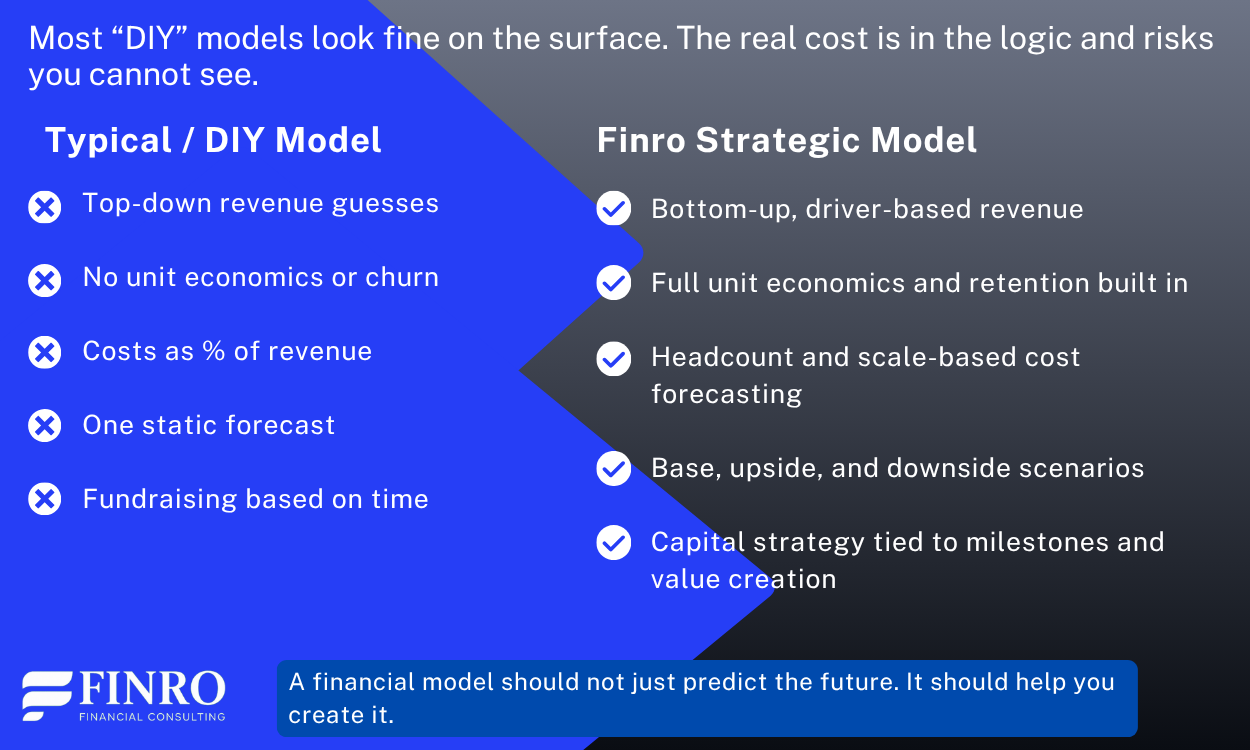

Most founders treat burn rate as a single line in the P&L.

In a real financial model, burn rate is the result of hundreds of decisions across headcount, product investment, customer acquisition, pricing, retention, and operating efficiency. You don’t “enter” burn rate, you create it.

A credible financial model doesn’t just show how much you plan to spend each month.

It explains why you are burning cash, what you expect to get in return, and when that investment creates revenue, retention, or margin. Burn rate must align with milestones, not vanity growth.

Investors look closely at how burn rate changes over time in your model. A smart model shows burn increasing when you are capturing traction, then becoming more efficient as revenue scales, CAC improves, and LTV rises. If burn stays flat forever, you’re not investing. If burn only rises without efficiency, you’re not learning.

The most believable models show a clear path from negative unit economics to breakeven to optional profitability. Burn rate isn’t something you hope goes down, it’s something you intentionally design to buy time, traction, and leverage.

Summary: Burn Rate as a Strategic Tool

Burn rate is not a target to minimize—it’s a metric to design. Every dollar of burn should buy time, progress, or leverage. When tracked correctly, it tells investors your company is disciplined, aware of trade-offs, and capable of scaling responsibly.

Strong startups don’t chase “low burn” or “high burn.” They connect burn to milestones, adjust it as the business matures, and align it with their financial model and runway. The goal isn’t survival. It’s control.

If your model can explain why you burn what you burn, investors will trust the numbers and the story behind them.

At Finro, we help tech founders build investor-ready financial models that make burn rate make sense—strategic, defensible, and growth-aligned.

Contact us to review your current model or start building one that gives you clarity and leverage.

Key Takeaways

Burn rate shows how quickly cash is consumed and whether spending drives growth, retention, and long-term sustainability.

Gross burn reveals total operating spend, while net burn shows actual cash loss and survival risk.

Smart burn increases during traction and becomes more efficient as revenue scales and margins improve.

Runway determines leverage with investors and depends entirely on how efficiently burn is managed over time.

Great founders design burn rate in their financial model to buy milestones, control timing, and protect valuation.

Answers to The Most Asked Questions

-

Burn rate is how much cash your startup spends or loses each month. It shows the pace of spending and financial health.

-

There is no universal number. A “good” burn rate funds milestones, extends runway, and supports growth without creating desperation.

-

Gross burn is total spending. Net burn subtracts revenue and shows true cash loss. Investors analyze both to judge efficiency and runway.

-

Runway = cash on hand ÷ net burn. It tells you how many months you can operate before needing additional funding.

-

Improve gross margin, extend customer LTV, prioritize high-ROI initiatives, delay low-impact hiring, and optimize operations before cutting growth.