Who Should Build Your Startup’s Financial Model? Why Founders Trust Finro.

By Lior Ronen | Founder, Finro Financial Consulting

Every startup needs a financial model, but few founders know who should actually build it.

Should you do it yourself? Hire a freelancer? Bring in a CFO? Or work with a specialist firm?

This article breaks down the real options founders have, why the wrong model can cost you investor trust, and why more and more early-stage startups are turning to Finro to get it right the first time.

Founders often underestimate the importance of a solid financial model — until investors start asking hard questions. A strong model isn’t just about numbers; it reflects how the business actually works, ties key metrics together, and builds trust where it matters most. Finro builds custom, investor-ready models tailored to your go-to-market strategy, pricing, hiring plans, and growth drivers. With built-in scenarios, real benchmarks, and clear outputs, these models go far beyond pitch decks — supporting internal decisions, board meetings, and long-term planning. That’s why founders and investors alike trust Finro when it really counts.

- Who Actually Builds Startup Financial Models?

- Why Founders Shouldn’t DIY Their Financial Model?

- What Investors Actually Want to See in Your Model

- How Finro Builds Models That Scale With You?

- What Founders Say About Working With Finro?

- Final Thoughts: The Model Is the Message

- Key Takeaways

- Answers to The Most Asked Questions

Who Actually Builds Startup Financial Models?

If you’re a founder gearing up for your first round, or finally realizing your Google Sheets aren’t cutting it, the question hits hard:

Who should actually build your financial model?

You’ve got four real options: DIY (founder-built), in-house (CFO / analyst), a general freelancer, or a specialist firm like Finro.

| Option | Pros | Cons |

|---|---|---|

| DIY (founder-built) | Cheapest, fastest to start | Easy to miss critical logic; not investor-grade |

| In-house (CFO / analyst) | Deep understanding of the business | Expensive; not always realistic for early-stage startups |

| General freelancer | Affordable, flexible | Lacks domain expertise; often relies on templates; limited iteration |

| Specialist firm (Finro) | Expert-level modeling, investor-trusted, startup-focused | Requires budget (but pays off quickly in credibility + time) |

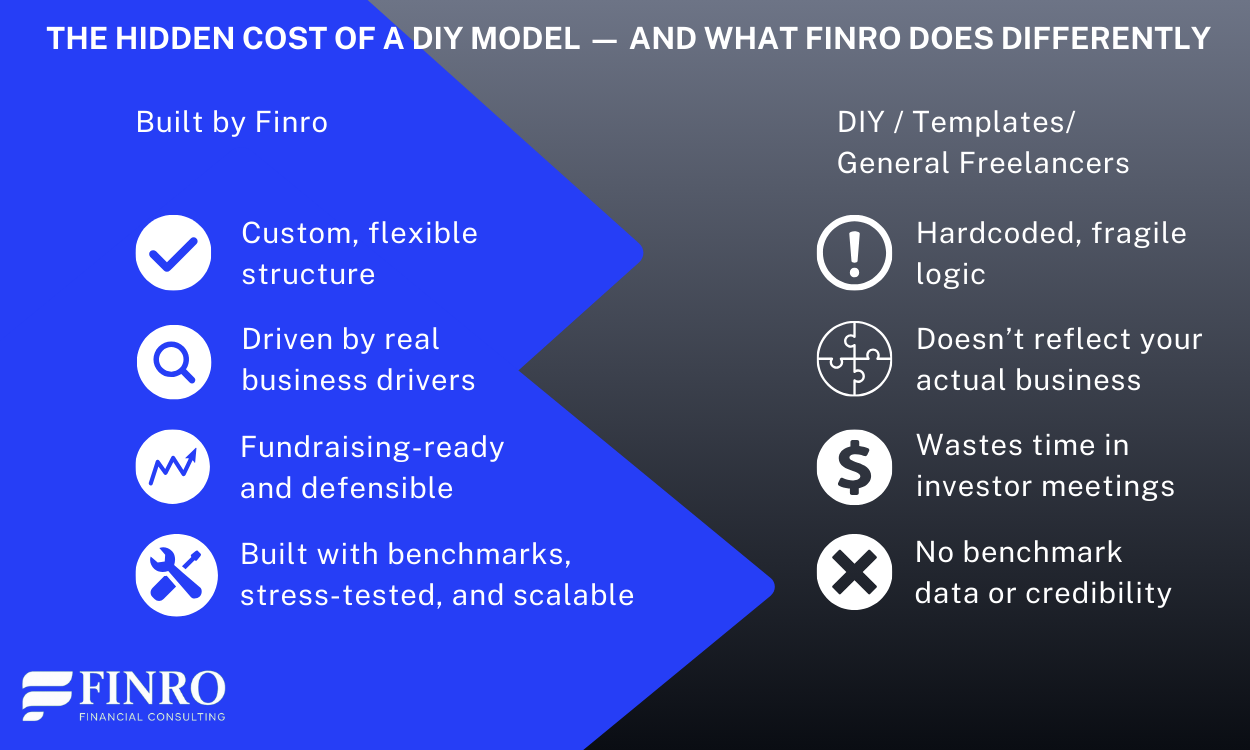

Most founders start with DIY. It feels lean and fast. But unless you’ve built dozens of models before, your spreadsheet will likely include red flags investors spot instantly: hardcoded formulas, unrealistic churn, no link between revenue and cash, or growth projections that don’t match your go-to-market plan.

Hiring a full-time CFO or finance lead is powerful, but it is also expensive and rarely feasible before a Series A funding round. General freelancers can help, but quality varies wildly. You may receive a clean file, or you may receive a template with your logo already pasted on top.

That’s where a specialist firm like Finro comes in:

Focused exclusively on early-stage tech startups

Experience in building hundreds of financial models across SaaS, AI, fintech, marketplaces, and other tech niches.

Designed to scale with you, not just impress investors once

Why Founders Shouldn’t DIY Their Financial Model

Building your own financial model might feel scrappy and lean, but it’s usually a false economy.

Even if you’ve raised a pre-seed round or completed an accelerator, investor expectations rise quickly. By the time you’re preparing for a serious raise, a DIY spreadsheet isn’t just risky — it’s a liability.

Here’s why:

It’s easier to break than to build. Most founder-built models look fine until an investor asks for a change. One tweak, and the whole thing collapses. Why? No clean logic, no structured dependencies, and often — hardcoded chaos.

Templates don’t know your business. Founders often start with free templates. But templates aren’t strategy. They don’t understand your acquisition funnel, product roadmap, or pricing model. You end up editing blindly, with no validation for what “good” looks like.

Critical assumptions are often wrong. DIY models frequently skip over retention, don’t link hiring to growth, or assume perfect CAC that’s never been tested. Investors spot these gaps instantly — and start asking tougher questions.

Cash and revenue aren’t connected. One of the most common mistakes in founder-made models is treating revenue like cash. If your model doesn’t account for billing cycles, payment delays, or runway dynamics, it’s not ready for investor review.

💬 “Most founders underestimate how technical and strategic a financial model really is. And most investors can tell when it’s not done right.”

— Lior Ronen, Finro

The result? Investors either dismiss the model entirely or—worse—lose confidence in your ability to manage capital.

And this isn’t just about impressing VCs. Your financial model should guide real decisions: when to hire, how much to spend on marketing, and what milestones you need to hit before raising again.

What Investors Actually Want to See in Your Model?

Founders often think of the financial model as a fundraising requirement — a formality. But for investors, it’s much more than that.

A great model tells them:

How you think

What you believe will drive growth

Whether you understand what it takes to scale

And how far their money will take you

If your model can’t answer those questions, it raises concerns. Fast.

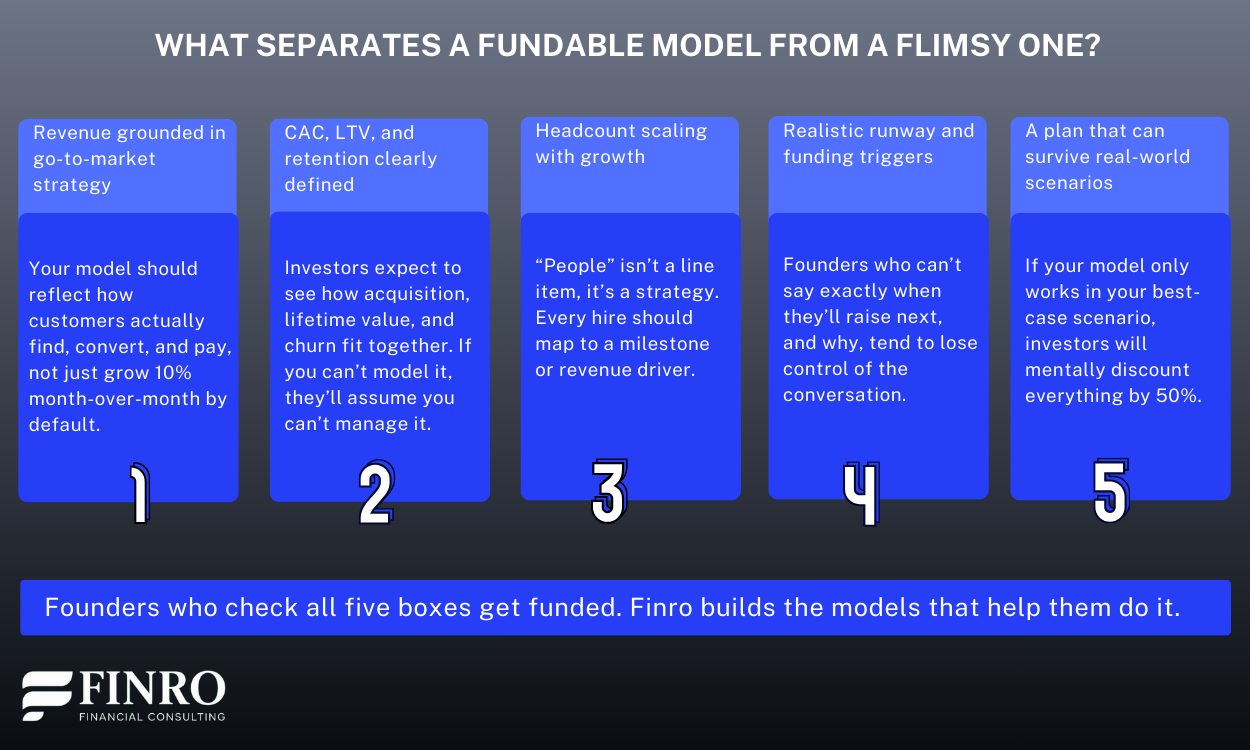

Here’s what experienced investors look for — and where most DIY or generic models fall short:

✅ 1. Revenue logic that matches your GTM strategy

It’s not just about top-line growth. Investors want to see how your acquisition channels, conversion funnels, and pricing model translate into revenue — quarter by quarter.

✅ 2. A clear view of CAC, LTV, and retention

Without a cohort-based approach or at least a defensible churn forecast, investors will assume your model overstates reality. LTV:CAC ratios, gross margin by channel, and retention curves matter — especially post-seed.

✅ 3. Headcount planning tied to growth

You can’t scale revenue without hiring — but how many AEs? How soon do you need a CSM? Your model should show when and why each hire is made, not just dump salaries into one row.

✅ 4. Cash runway and fundraising triggers

The biggest investor question is simple: “How long will this money last?” A strong model shows runway based on forecasted burn, not just guesswork. It also signals when the next round should be raised — and what milestones will support it.

✅ 5. Downside and stress-case scenarios

If you only show a rosy base case, experienced investors will discount it. A good model includes conservative cases, zero-growth stress tests, and at least one view where CAC is higher and conversion is lower — because that’s what happens.

“A strong model doesn’t try to impress — it tries to survive contact with reality. The ones that do get funded.”

— Lior Ronen, Finro

How Finro Builds Models That Scale With You?

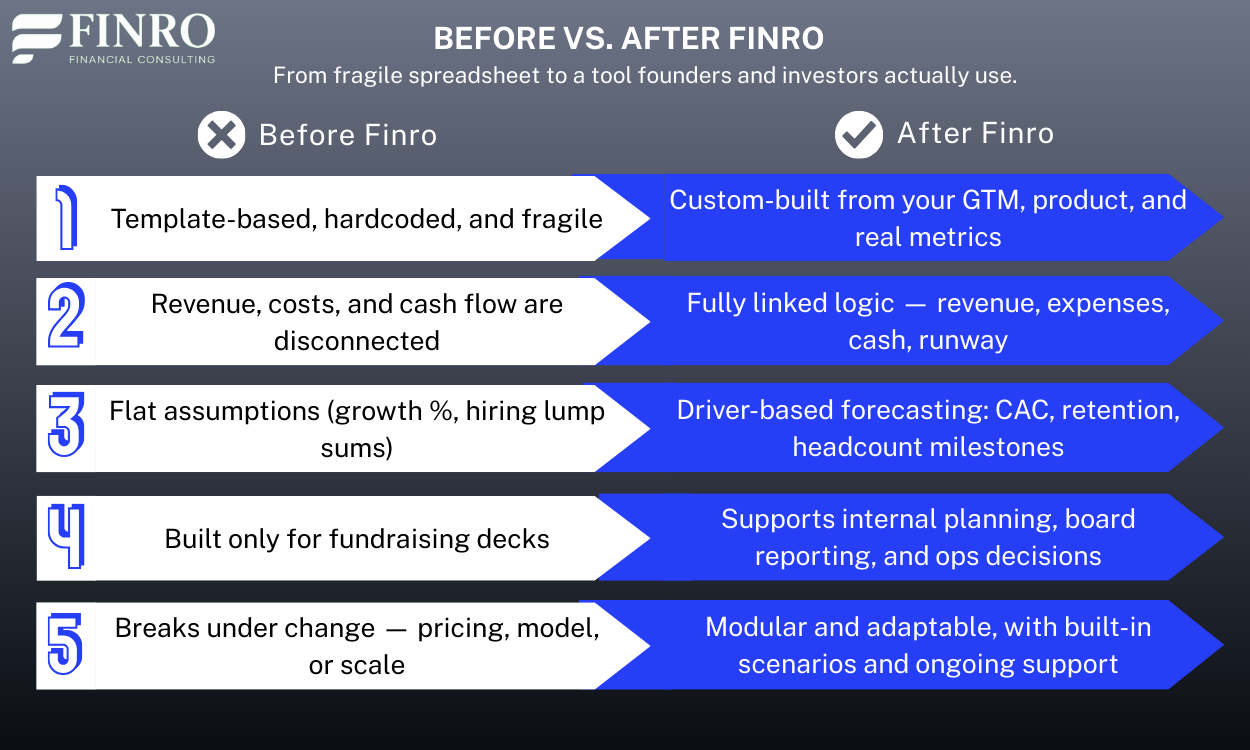

A financial model isn’t a one-time spreadsheet. It’s a living tool, one that should grow and adapt as your startup evolves.

That’s why Finro doesn’t build static models that get thrown out after the next board meeting. We build modular, dynamic, and founder-friendly models that scale with you from pre-seed through Series B (and beyond).

Here’s how:

1. Custom structure, not templates

We don’t start with a template and change the logo. We start with your business model, go-to-market plan, and product roadmap — and build the structure around that. Every line is intentional. Every driver reflects something real.

2. Revenue modeling that evolves with your product

Whether you’re usage-based, SaaS, marketplace, or a hybrid — we map revenue based on how users actually move through your funnel. If your pricing or sales model changes, the structure flexes with it. No need to rebuild from scratch.

3. Headcount and cost modeling tied to growth

We connect hiring plans, contractor costs, and customer support needs to your projected growth. That way, your opex scales with revenue — not guesswork.

4. Built-in scenarios and version control

We deliver models with clearly labeled base, low, and high cases, all driven by real assumptions — not just “multiply everything by 1.3.” You get version control, stress tests, and clear summaries that even non-finance folks can read.

5. Dashboards and investor-ready outputs

Need a 5-year summary, a Q/Q SaaS metrics view, or an investor snapshot? It’s all there — clean, linked, and export-ready. You get a model you can actually use in board meetings, pitch decks, and hiring plans.

What Founders Say About Working With Finro?

You don’t need to take our word for it. Here’s what startup founders, VCs, and GPs say about working with Finro, in their own words:

“Finro provided critical financial due diligence and valuation services for our early-stage tech startup. Lior’s professionalism, financial expertise, and fast turnaround were impressive — the depth of analysis gave our investors confidence.”

— Michale Sperling, CEO & Founder, Spaceling

“We worked with Finro on the valuation of a pre-revenue AI company. Lior delivered in-depth, accurate analysis and identified key comps and pivotal trends. Responsive, thoughtful, and easy to work with — highly recommended.”

— Michael Carolan, General Partner, Princap

“Finro’s work on our financial model made the difference. We didn’t just get a spreadsheet — we got insight, structure, and something we actually used during and after the raise.”

— Confidential client, SaaS founder

“Lior quickly understood our market, challenged our assumptions, and built a model that reflected how we actually operate. This wasn’t just outsourced work — it felt like having a strategic CFO onboard.”

— Early-stage HealthTech founder

Why it matters:

Whether it’s investor-facing materials, scenario planning, or answering tough boardroom questions, Finro models don’t just survive scrutiny — they shape decisions.

Because at this stage, you don’t just need numbers — you need confidence.

Final Thoughts: The Model Is the Message

Investors don’t just look at your financial model for numbers — they look at it for signs of how you think.

Is it realistic or wishful? Is it structured or stitched together? Does it reflect how your business really works, or how you hope it might?

That’s why founders who take fundraising seriously choose Finro. Because when the model is clean, logical, and defensible, it builds trust — with investors, with your team, and with yourself.

You get one chance to make that impression. Make it count.

Key Takeaways

1. Founders shouldn’t DIY their model: Investor-grade models require structure, benchmarks, and logic, not templates or optimistic spreadsheets built under pressure.

2. Investors judge how you think: Your model reflects your strategy, assumptions, and operational plan. It’s not just numbers, it’s your credibility in a spreadsheet.

3. Finro builds models that scale: Custom-built, modular, and defensible models that evolve with your business, from pre-seed planning to Series B boardrooms.

4. One model, many uses: Finro models power fundraising, hiring, cash planning, investor updates, and board decisions, not just a single pitch deck.

5. Trusted by founders and investors: Real founders use Finro to raise rounds. Real investors rely on our work to make decisions. That trust matters.

Answers to The Most Asked Questions

-

If you’re fundraising or scaling, work with a specialist like Finro. DIY and templates often fail under investor scrutiny and miss key logic.

-

Investors want realistic revenue logic, clear CAC/LTV, hiring plans tied to growth, cash runway, and downside scenarios, not just top-line optimism.

-

Templates are a starting point, but rarely fit your GTM or pricing model. Serious investors expect custom, dynamic models grounded in real metrics.

-

It’s defensible, benchmarked, and modular. An investor-ready model connects revenue, cost, and cash with clear logic and supports multiple scenarios.

-

Finro builds custom, scalable models used beyond fundraising, for planning, board reporting, and decision-making. Trusted by both founders and VCs.