Applied vs. Core AI: Why Some Niches Follow SaaS Multiples, Others Don’t

By Lior Ronen | Founder, Finro Financial Consulting

Some AI startups are valued like enterprise SaaS. Others get treated like deep tech moonshots, or like nothing we’ve seen before.

That’s not a bug. It’s a signal.

Over the past year, we’ve tracked 565 AI companies across 15 distinct niches. What we’ve found is a consistent divergence between what we call “Core AI” and “Applied AI” — and how investors value them.

Core AI companies are infrastructure-heavy.

They build models, optimize inference, serve tokens, and sell raw compute. Their cost structures and scaling challenges push them into a different risk bucket and a different valuation logic.

Applied AI companies, on the other hand, look and behave more like traditional SaaS: they wrap AI around workflows, target specific verticals, and often follow proven go-to-market paths.

In this article, we’ll explore why the distinction matters, how it shows up in valuation multiples, and what it means for founders and investors navigating this crowded space.

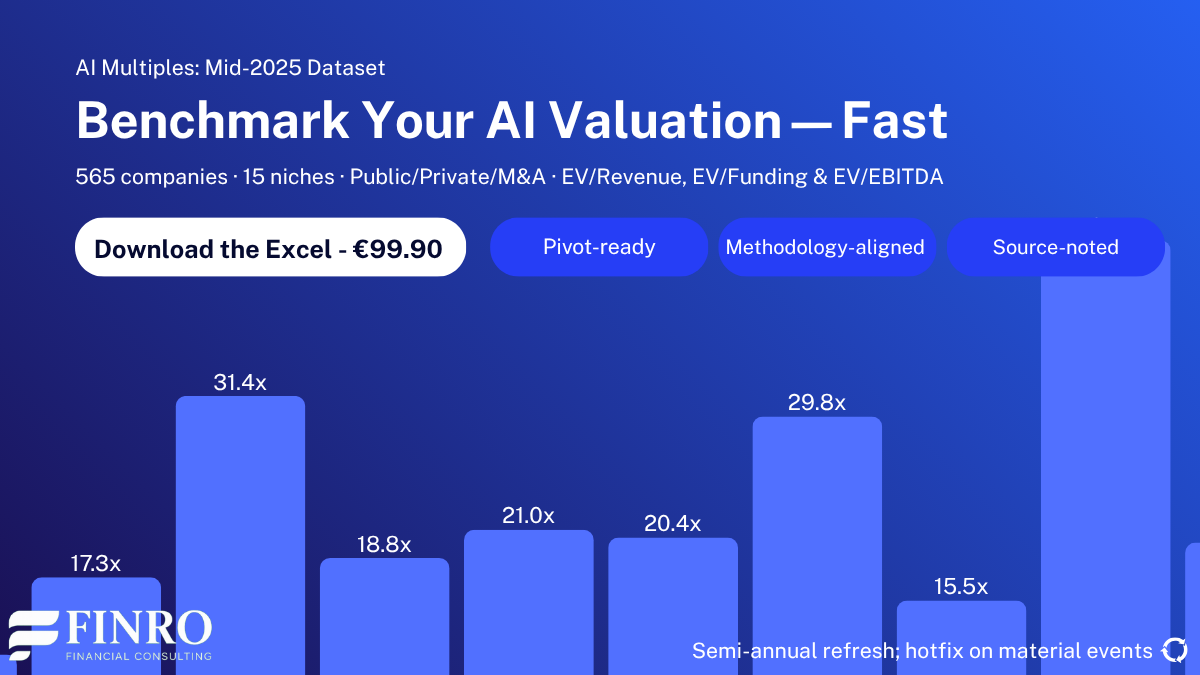

And if you’re looking for real benchmarks, the full database, covering 565 AI companies, including public, private, and M&A deals across 15 AI categories, is available to download for €99.90.

AI startup valuations are diverging. Core AI platforms such as LLMs, infrastructure, and data intelligence tools command higher multiples due to scalability, defensibility, and platform potential. Applied AI startups, like those in health, HR, and legal tech, trade on execution, retention, and clear ROI. The distinction reflects a maturing market where investors price substance over story — valuing efficiency, positioning, and long-term resilience over pure growth.

Core AI vs. Applied AI: Diverging Multiples, Diverging Expectations

When investors look at AI companies, they don’t just see technology. They see layers.

At the top: Core AI, the foundational systems, models, and infrastructure powering the entire ecosystem. These players are few, capital-intensive, and often positioned as category-defining platforms.

Below that: Applied AI, companies leveraging AI to solve specific use cases in sectors like health, fintech, HR, or legal. Their value lies in execution, vertical expertise, and embedding AI into real workflows.

This distinction isn’t just academic; it’s deeply reflected in revenue multiples.

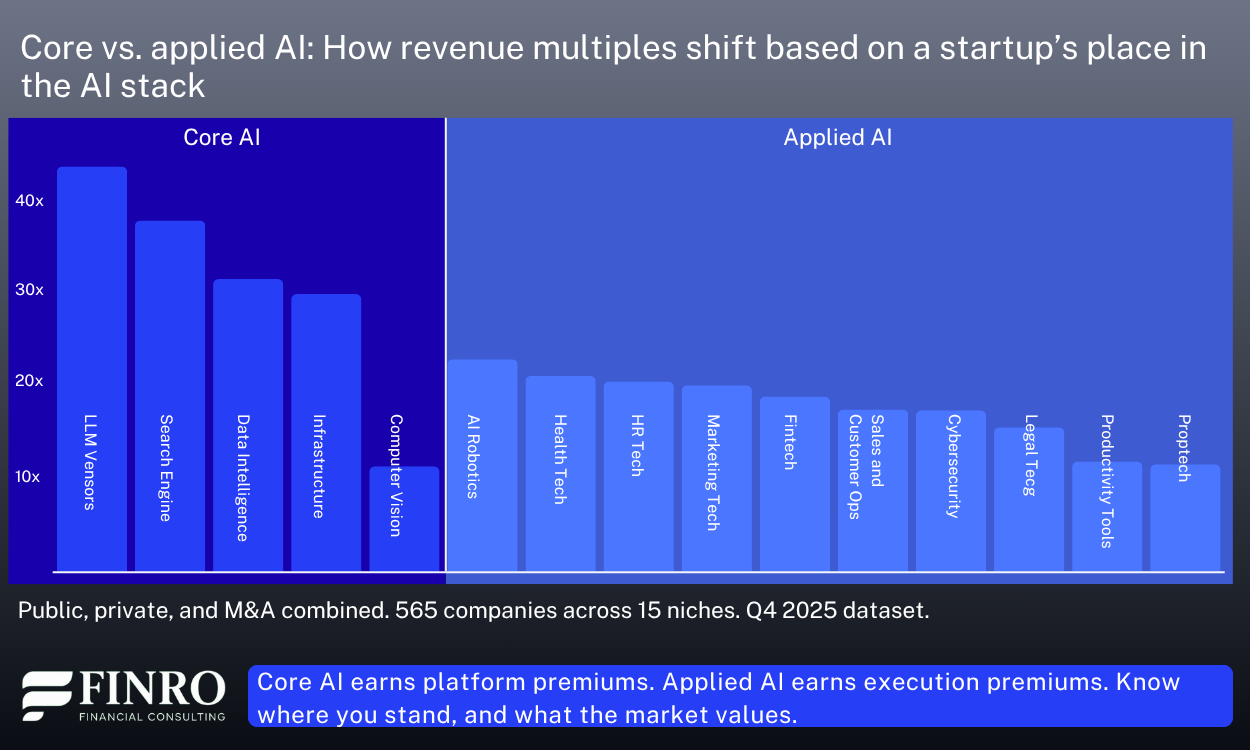

Core AI commands platform-level multiples.

LLM Vendors average a stunning 43.5x revenue multiple. Despite early revenue models, investors price in dominance, optionality, and ecosystem lock-in. You’re not just betting on ARR, you’re betting on the next AWS or Android.

AI Infrastructure companies (training, orchestration, inference) follow closely with 29.8x. Their growth is fueled by demand from both enterprise AI and AI-native startups, making them mission-critical.

Search Engine AI (vector search, embeddings) pulls 37.7x, underscoring the growing importance of retrieval-augmented generation (RAG) and domain-specific LLM tuning.

Data Intelligence tools average 31.4x, as they sit at the intersection of AI and analytics, helping organizations unlock unstructured data.

These companies aren’t just valued for what they earn, but for what they enable.

Applied AI, by contrast, lives in the business layer and prices accordingly.

HealthTech AI averages a strong 21.0x, supported by regulatory tailwinds, clear ROI, and mission-critical use cases.

HR Tech follows at 20.4x, as companies prioritize AI to improve talent acquisition and workforce planning.

AI Fintech startups hold an 18.8x multiple, high, but tempered by regulatory complexity and legacy infrastructure friction.

Legal Tech and Productivity Tools come in at 15.5x and 11.8x, respectively, both solid, but more in line with traditional SaaS benchmarks.

The lower multiples here don’t suggest weak businesses; just more mature expectations.

These companies often have clearer paths to monetization, more predictable revenue, and lower technical risk.

But they don’t benefit from the platform premium that core AI players attract.

Revenue multiples aren’t just a signal of growth. They reflect positioning. Are you powering the stack, or building on top of it? Are you enabling infrastructure, or solving downstream problems?

The market notices and prices accordingly.

Data snapshot: revenue multiples across 15 AI niches

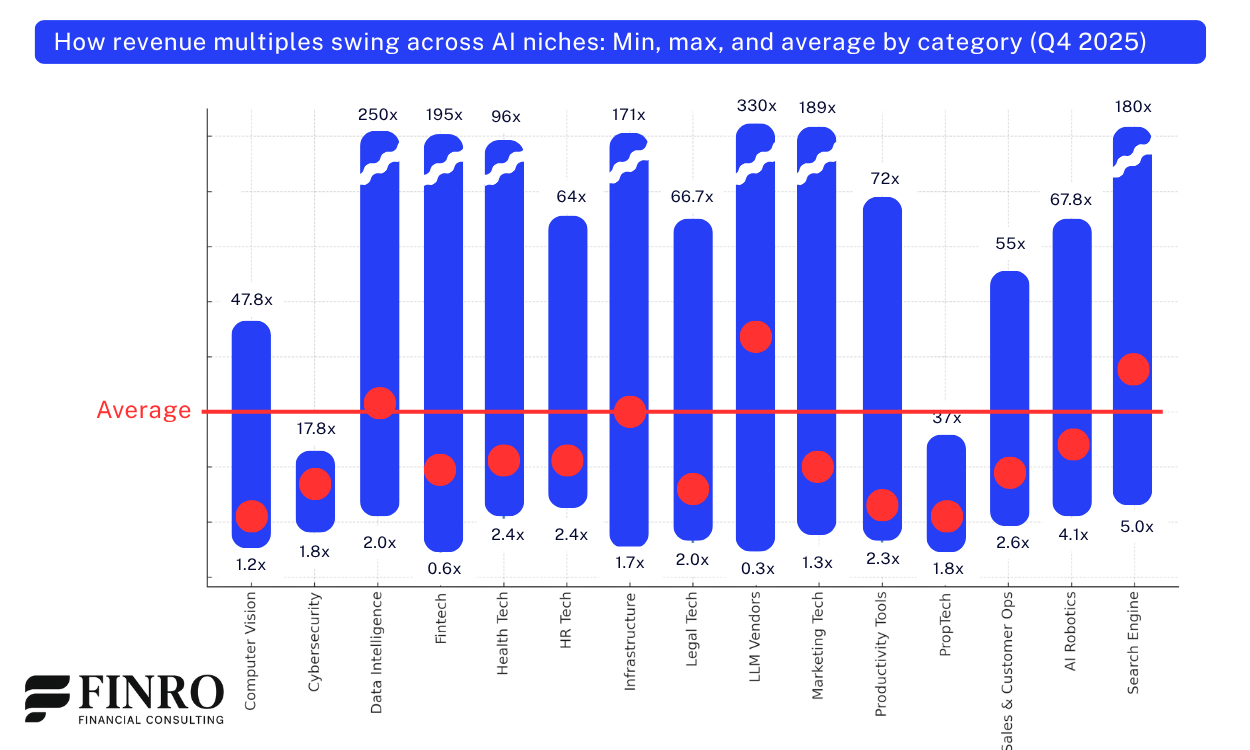

By now, we know AI valuations aren’t uniform, but even within “AI,” the spread is dramatic.

In our Q4 2025 dataset, we tracked 565 companies across 15 distinct niches. That includes public companies, private startups, and M&A deals, all normalized into revenue multiples to allow for comparison across stages.

But the differences between niches aren’t just technical—they reflect how the market perceives opportunity, risk, and defensibility.

Take LLM vendors: they sit at the foundation of the AI stack, and they’re priced accordingly. With a staggering 43.5x revenue multiple on average, this category reflects the kind of premium investors attach to infrastructure plays with massive surface area and lock-in effects.

Even modest traction in this category can drive exponential valuations, because the upside is perceived as nearly uncapped.

Just behind are search engines, data intelligence, and infrastructure — all core building blocks of the AI ecosystem. Their multiples range from 30x to 38x, driven by platform potential, scalability, and defensibility.

These companies often power other AI products, not just end users, which adds to their strategic weight.

Then you have the middle band: Health Tech, HR Tech, Marketing Tech, Fintech, and Cybersecurity. These sectors benefit from the AI wave but are still anchored in operational execution, regulatory complexity, or established competition. Their multiples hover between 17x and 21x, depending on how deeply AI is embedded and how mission-critical the use case is perceived.

And then there’s the tail. Legal Tech, Productivity Tools, Sales & Customer Ops, and PropTech all fall under 16x, with PropTech coming in last at just 11.5x. These companies often struggle with longer adoption cycles, lower switching costs, or unclear AI differentiation.

That doesn’t mean they’re weak. It means the market is pricing them on execution, not just vision.

So what does all this mean?

That valuation isn’t just about revenue — it’s about where that revenue comes from, how strategic it is, and how scalable the underlying tech feels. The market rewards infrastructure and intelligence. It discounts tools and workflows.

And most importantly, it rewards focus. The highest-multiple companies are rarely trying to do everything — they own a clearly defined layer of the stack.

Why these multiples diverge?

The valuation gap between core and applied AI isn’t just a coincidence.

It reflects deeper differences in how these businesses operate, scale, and get perceived by investors.

Core AI companies, like LLM vendors, data infrastructure players, and search engine challengers- often sit at the foundation of the AI stack. Their offerings are platform-like, with massive potential upside if they become default picks across industries.

These businesses usually demand heavy R&D upfront, often operate at lower current revenues, and rely on a “winner-takes-most” thesis. Investors are not just valuing what they see today, but what they believe these platforms could become in the future.

This results in higher revenue multiples, but also more volatility. A single breakthrough, a major partnership, or even a well-timed press cycle can swing valuation narratives quickly. Core AI startups are often priced on vision and velocity, not just metrics.

Applied AI companies, on the other hand, build in known verticals - healthcare, HR, PropTech, legal, etc. - and offer solutions that are easier to benchmark against SaaS comparables.

Their value proposition is often clearer: improve workflow X by Y%. And their go-to-market motions tend to resemble traditional enterprise software, with pricing models tied to usage, seats, or performance.

This makes their multiples more grounded- investors can compare them to existing vertical SaaS players, apply standard frameworks, and lean on historical outcomes to price risk. While this often leads to more modest valuations, it also means these companies are generally easier to fund and explain.

In short, the divergence we’re seeing is less about hype and more about fundamentals: where in the stack a company sits, how it grows, and how it communicates its potential.

Summary: One Market, Two Realities

AI is often treated as one unified category.

But when you dig into the data, the picture is more nuanced.

The valuation landscape splits into two distinct tracks: core AI infrastructure and platform players, and applied AI startups building in specific verticals.

Core AI startups, such as LLM vendors, infrastructure tools, and next-generation search engines, attract significantly higher revenue multiples. Investors in this space are betting on future platform dominance, not just current traction. The risk is higher, but so is the perceived upside.

Applied AI startups, by contrast, behave more like vertical SaaS. They solve clear problems in HR, legal, health, real estate, and other industries. Their business models are easier to model, compare, and explain - and so are their valuations. Revenue multiples here are lower, but more stable.

The takeaway? Founders, investors, and operators should stop treating “AI” as a single valuation category.

Whether you’re pricing a round, planning a go-to-market strategy, or benchmarking a comp, it pays to know which side of the stack you’re on — and what the market expects in return.

Key Takeaways

1. AI is not a single market: Valuation multiples vary significantly between core infrastructure startups and applied, vertical-focused AI companies.

2. Core AI earns higher revenue multiples: LLM vendors and infrastructure tools command premium valuations due to high investor expectations and platform potential.

3. Applied AI mirrors SaaS benchmarks: Health, HR, Legal, and PropTech AI startups tend to cluster around 5–8x revenue multiples, predictable, grounded, and benchmarkable.

4. Outliers skew the averages: A handful of high-growth or hype-driven players inflate the top-end of each niche’s multiple range, especially in Core AI.

5. Context matters more than category: Founders should use niche-level data, not market-level generalizations, to validate valuations and prepare for investor scrutiny.

Answers to The Most Asked Questions

-

It depends on the niche. Core AI startups often trade at 10x–20x, while applied AI companies typically range from 5x–8x revenue.

-

Because investor expectations differ. Infrastructure and LLM vendors offer platform potential, while applied AI follows more predictable SaaS-like growth patterns.

-

By using revenue multiples, funding benchmarks, and comps. Most early-stage AI startups are valued between 4x–10x forward revenue, depending on niche and traction.

-

Core AI builds foundational models or infrastructure. Applied AI uses those tools to solve vertical problems — in health, real estate, HR, and more.